Volatility is beautiful, isn’t it? Well, sort of, if you know what you are doing you can be very profitable in volatile times. One of the most volatile markets in the last week was China’s stock market. We said our 2020 outlook on China was great. Similarly our emerging markets 2020 outlook is promising. Timing any trend is obviously the key success factor. If China breaks out it will be ultra-bullish, period. If this happens in February of 2020 or in October of 2020 is the million dollar question. We have another 11 months to go in 2020, and it looks like things are lined up for a very profitable mid term position which we will play in our Momentum Investing portfolio.

Two things stood out this week in China.

First, China’s New Year started. That’s a reason to celebrate for the people over there.

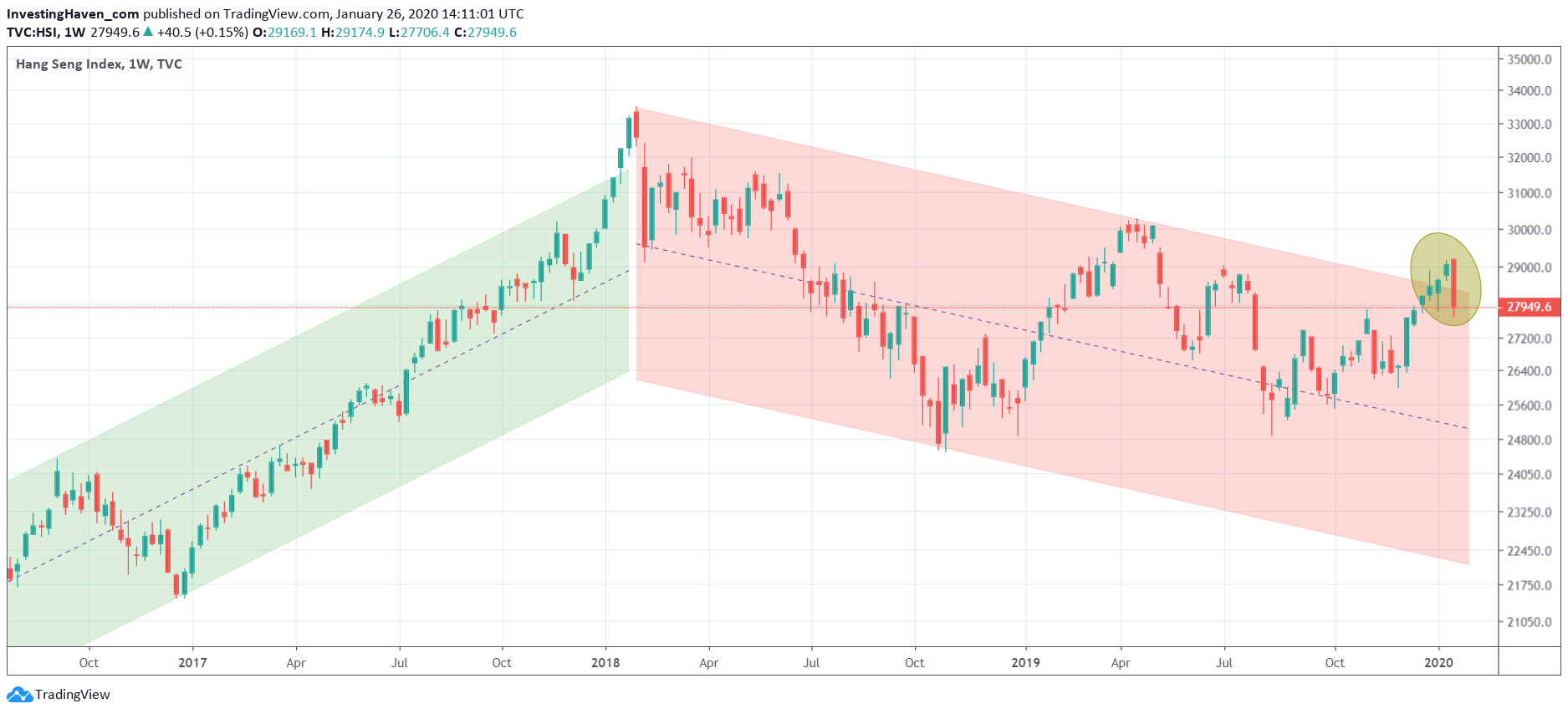

Second, one of the key stock indices (the Hang Seng Index) invalidated its breakout. Less reason to celebrate for long term China bulls, certainly no reason to celebrate for mid term oriented investors. Full disclosure: we sold our TAL position in our Momentum Investing portfolio with a quick 8% profit in less than 2 weeks. This is the type of returns we want to see the compound effect kick in.

Depending on your timeframe China’s market is offering plenty of opportunities to grow your capital. You must have the timeframes right though. Short term oriented trades can be very profitable, and we start seeing the first signs of positive returns with our bearish emerging markets position in our short term trades.

The volatility in China and emerging markets, largely triggered by Hang Seng’s sell off this week, offers plenty of opportunities for those who are able to play short and long term trends. Volatility is not for the faint-hearted though, so know what you are doing if you want to play China and emerging markets.

For now let’s celebrate Chinese New Year until late next week trading resumes.