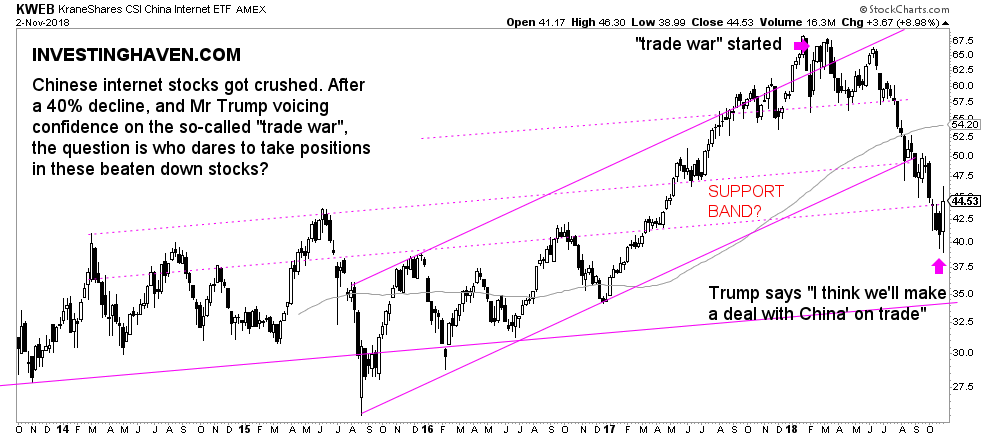

Chinese internet stocks got crushed, literally. The KWEB ETF (KWEB) fell from 68 in March of this year to 39 points last week, a decline of 44% in 6 months. Nobody believes this sector will ever recover again, for sure after the so-called “trade war” that is all over the place in media as well as the aggressive stock market crash of 2018. Still, there are lonely voices like the one from InvestingHaven that believe this is a massive buy opportunity. Yes, it may be true that Chinese internet stocks started a recovery!

Reuters writes yesterday that Trump says ‘I think we’ll make a deal with China’ on trade

U.S. President Donald Trump said on Friday that he will likely make a deal with China on trade, adding that a lot of progress had been made to resolve the two countries’ differences but warning that he still may impose more tariffs on Chinese goods.

“China very much wants to make a deal,” Trump told reporters in Washington just hours after his top economic adviser expressed caution about talk of a possible U.S.-China trade agreement.

“We’ve had a very good discussions with China, we’re getting much closer to doing something,” Trump said.

“I spoke with President Xi (Jinping) yesterday. They very much want to make a deal,” Trump said.

“I think we’ll make a deal with China, and I think it will be a very fair deal for everybody, but it will be a good deal for the United States.”

So far the tactics by the White House. First, beat your enemy with mental and emotional weapons. Then, once you start getting hurt yourself, look for a deal (one that you could have worked out from the get-go).

It is a tactical and mental game, diplomatic or political may be a better word.

In the meantime, China’s stock market (SSEC) got sold off, and Chinese internet stocks got crushed.

As seen on below chart we highlighted the lowest band as the ultimate ‘support band’. This may be coming true now. As of Friday’s closing the KWEB ETF trades right at support of its ‘support band’. As long as it continues to trade above 44 points it will be a great buy opportunity. A retest of the lows in the 40ies may be in the cards, but we don’t want to see weekly closings below 44 points for 3 consecutive weeks in order to qualify as a buy opportunity.

The recovery will not go ultra fast, but mid to long term this may be a massive buy opportunity.