In 2023, Coinbase Stock (COIN) had an impressive +430% gain. The stock has not only outperformed Bitcoin (+175%) and Ethereum (+100%) but also left behind the Tech giants like Tesla (+397%), Microsoft (+75%), and Nvidia (+274%).

Can $COIN keep their momentum going as investors pile back into crypto?

See also: 5 Cryptocurrency Predictions for 2024

COIN Stock Surges on Spot Bitcoin ETF Enthusiasm

The bullish momentum of 8 consecutive weeks has helped $COIN stock with these whooping gains at the end of this year.

It has also improved the COIN price prediction. This uptrend was triggered after the craze around Bitcoin Spot ETF started in the market.

Many big institutions, including Fidelity, Ark Investment, and BlackRock, have applied for a spot in Bitcoin ETF.

However, none of them has received approval from the SEC as of yet.

But markets are expecting a positive outcome on January 10th 2024, which will not only strengthen the crypto market but also help stocks related to the crypto industry.

As one of the most widely used cryptocurrency exchanges, Coinbase is witnessing increased strength in its stock.

This surge is driven by the prevailing excitement and speculation surrounding the potential approval of a Bitcoin spot ETF by the SEC.

COIN Price Prediction 2024 – Technical Indicators Point to +77% Gain, Propelling $COIN Towards $297

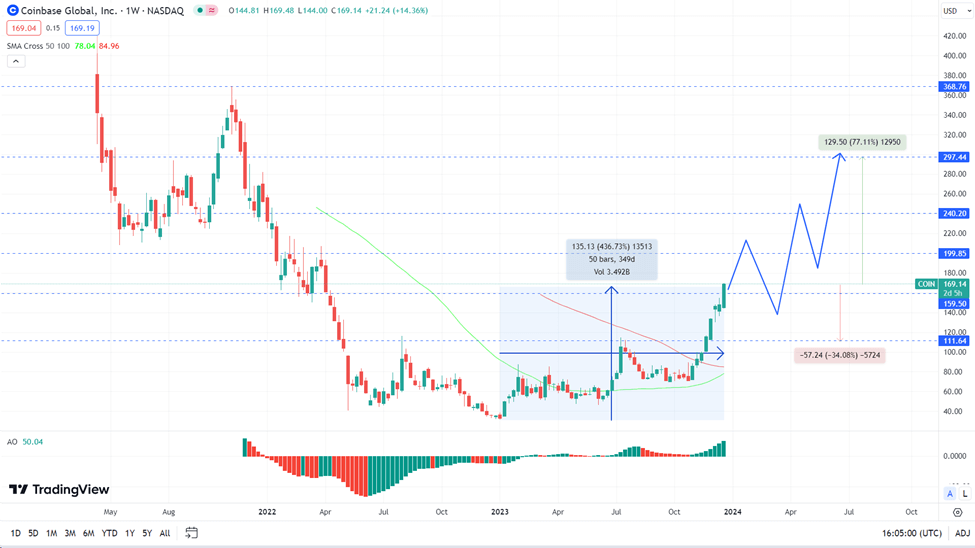

In the weekly analysis of COIN stock, notable gains of +436% have been observed throughout the year.

The current market outlook suggests the potential for continued upward momentum.

The $COIN price recently surpassed the 38% Fibonacci Retracement level of $159 and reached $169.

Although some initial resistance may be encountered, the prevailing bullish market trend is anticipated to support a recovery.

It could propel prices towards the 50% Fibonacci Retracement level of $199, which is 25% higher than the current value.

A decisive break and subsequent candle closure above this level would mark the confirmation of an uptrend. It will further push the prices to the 61% Fibonacci Retracement level of $240 in the coming weeks.

This $240 level is important for COIN stock, as a failure to breach it may result in a retracement.

However, current indicators are signaling a potential 77% price increase from the current level over the next year.

This is a target of level $297—a milestone last recorded in November 2021. Remember when CNBC’s Jim Cramer’s infamous $COIN tweet?

We like Coinbase to $475

— Jim Cramer (@jimcramer) April 14, 2021

While we are not as bullish as Cramer once was on $COIN, the technical analysis points in a positive direction.

Positive technical indicators, including the Awesome Oscillator and the SMA Cross, support our optimistic COIN price prediction.

The presence of green histograms with heightened volume above the zero line signifies a robust bullish trend.

Additionally, the close proximity of the 50 SMA (green) and 100 SMA (red) indicates an impending SMA cross.

Upon realization, this event is expected to affirm the overall bullish market scenario. It will provide additional support towards the $297 target in 2024.

On the flip side

Potential selling pressure stemming from profit-taking or market correction could introduce downside risks for $COIN.

A break and closure below the $159 level may signal a trend reversal in the short term.

This will potentially retrace the prices towards $111—a notable 34% reduction from the current valuation.

Subsequent closure below $111 could trigger support at $85, which aligns with the projected SMA cross.

We view $COIN as a similar investment to crypto in general. If you’re bullish on crypto: this may be an interesting stock for you. If you’re bearish on most cryptos, this would be a stock to avoid.

Summary

Our technical analysis for $COIN stock looks strong for 2024.

However, Coinbase stock is coupled with the rise and fall in crypto.

If Bitcoin, Ethereum and other top cryptos lose their momentum, so too will $COIN stock.

Our premium Crypto research newsletter dives into overall market trends and predictions, and we will notify any users of potential crypto downturns.