One important investing principle in forecasting markets is looking at trends that confirm each other vs. the ones that show divergences. The major divergence in markets right now is in inflationary indicators. There is a major disconnect between the inflation indicator and inflation expectations. This is a hugely important attention point as it might help us understand whether our gold forecast (GOLD) and silver forecast (SILVER) will materialize any time soon… or whether we have to wait longer.

Let’s jump right away into the 2 data points, and look at the charts.

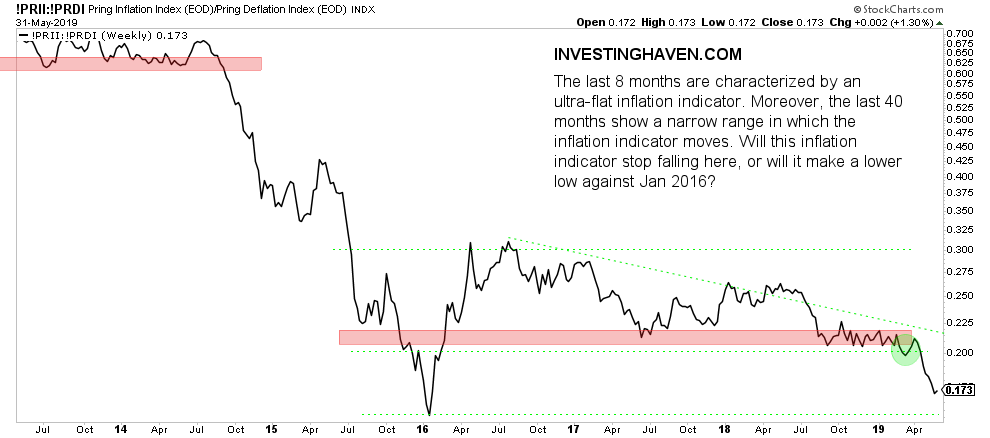

The first chart is the inflation indicator by Martin Pring: the Pring Inflation and Deflation Indexes. We look at the medium to long term with the weekly timeframe.

This chart is pretty concerning. after a major bottom in Jan of 2016, and a major bounce, it looked like the worst was behind us. However, in April of 2019 this indicator broke down (green circle). It is now falling back to the Jan 2016 lows.

This is deflationary, and it might pick up power if and when it falls below the Jan 2016 lows. Pretty tough to forecast if this will happen or not.

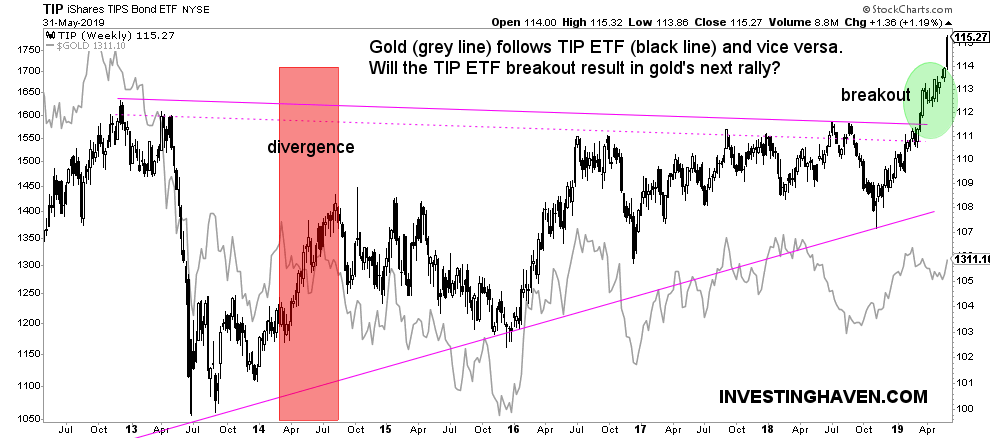

Interestingly, inflation expectations show a totally different picture.

Talking about a major disconnect!

Inflation expectations represented by TIP ETF did break out in April of 2019, see green circle. This means that investors anticipate inflation to pick up.

How is this possible to happen at the same time as the chart above?

The point is this: interest rates have fallen strongly in recent weeks, while deflationary forces were week. Consequently, real rates have risen.

Why this is important is because gold and inflation expectations are strongly correlated. Only once in the last 7 years did they diverge, that was in the summer of 2014.

We do think that inflation expectations will drive gold prices higher, and will lead to the 7th attempt for gold to break through gold’s stubborn 6 year bear market well at 1375 USD.