Emerging stock markets are continuously in red in recent months. That’s primarily because of strenght in the USD with, consequently, weakness in emerging market currencies. Is the bleeding in emerging market currencies about to stop here or can we expect a continuation of the slide in emerging market currencies and, with that, in emerging stock markets?

Emerging markets in 2018

Emerging markets in 2018 have done very poor. After the peak in January of 2018 it was downhill for emerging stock markets. That was primarily a result of USD strength and emerging market currencies weakness in 2018.

Our thoughts on this was straight: the peak of emerging stock market early 2018 came after last year’s breakout in emerging markets. The weakness, so far, brought emerging markets back to their breakout point.

This is a very recent article with up-to-date chart which makes our point: Emerging Stock Markets: Beautiful Test Of 2018 Bull Market Breakout

What’s next with emerging markets in 2018 as they reach secular support, is the question.

Emerging market currencies in 2018

To answer this question we look at emerging market currencies in 2018.

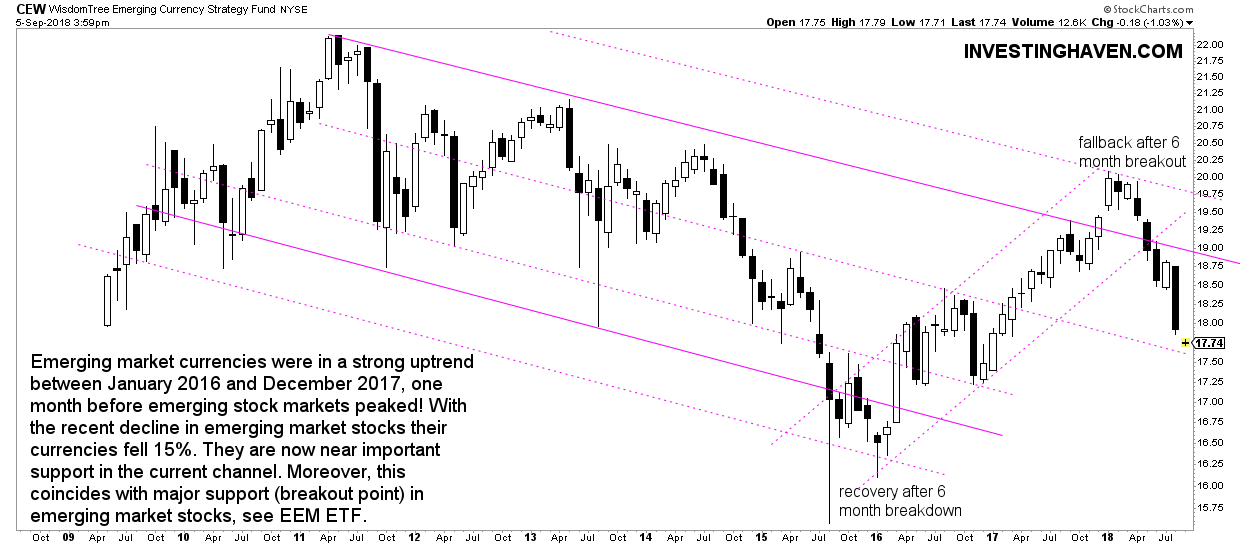

The chart below is quite clear. The group of emerging market currencies have now reached important support levels. Note the breakdown in 2018 on the chart, as well as support at 17.50 in this important band which was, last year, the transition period from bearish to hugely bullish.

Because of this we believe that emerging market currencies will find strong support right here right now.

In other words, as long as emerging market currencies continue to trade above 17.50 we are quite convinced that this level will provide support both for emerging market currencies in 2018 as well as emerging stock markets. If that’s the case we are looking at a very juicy buy opportunity in emerging stock markets in 2018!