It should be clear by now that we have bullish expectations about emerging markets in 2020. We said overall on emerging markets “mildly bullish in 2020 and wildly bullish in 2021”. Now that was on emerging markets as a group, as clearly explained. However, the top emerging markets in 2020 will do very well. They are the ones to lead the way higher for the rest of the group. An emerging new bull market in emerging markets is something an investor doesn’t want to miss. Similarly shorter term oriented traders don’t want to miss this opportunity neither. It’s all about how to position yourself, when and how to accelerate, to get the maximum out of it.

We are very close to an impactful decision point in emerging markets, and we want to illustrate this with 2 leading charts.

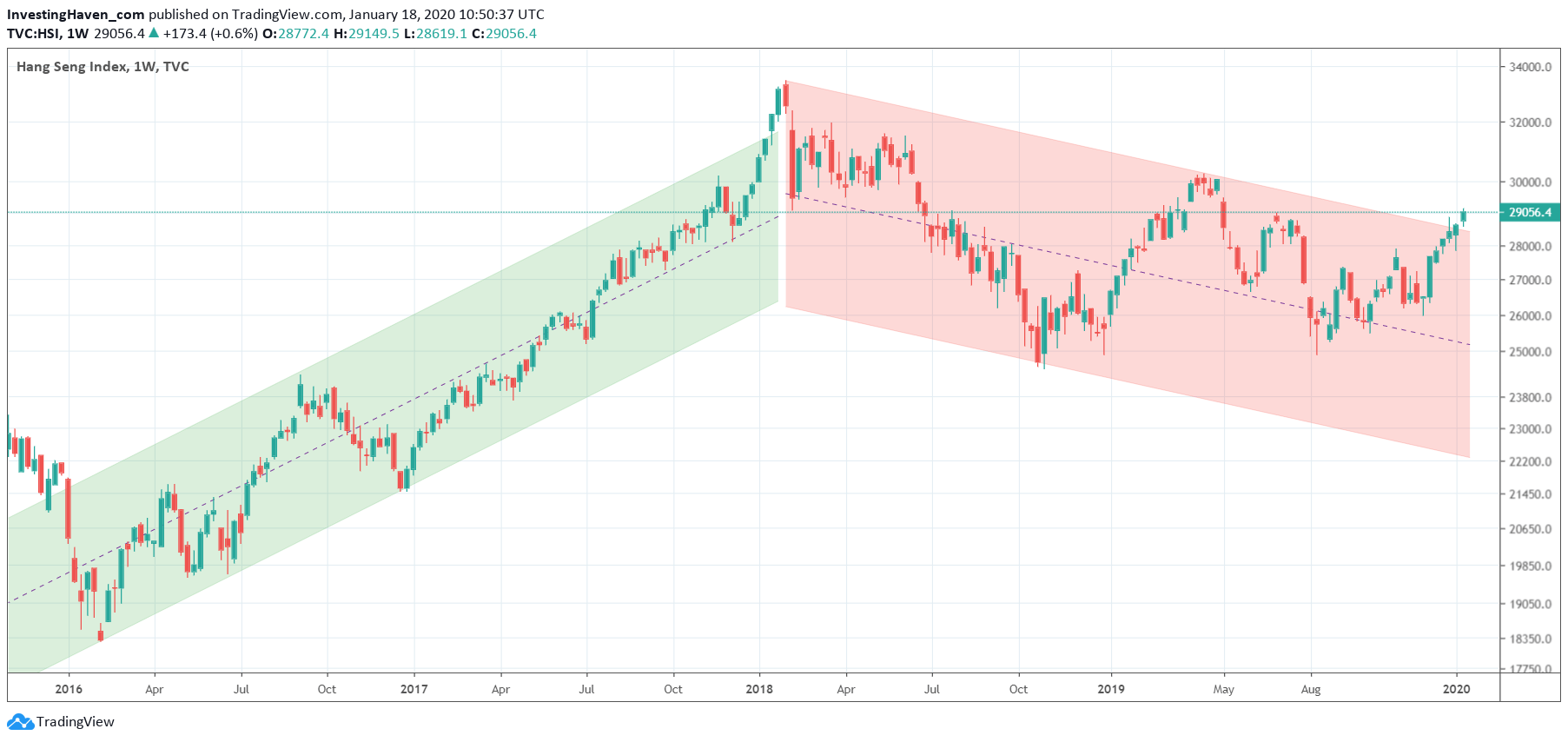

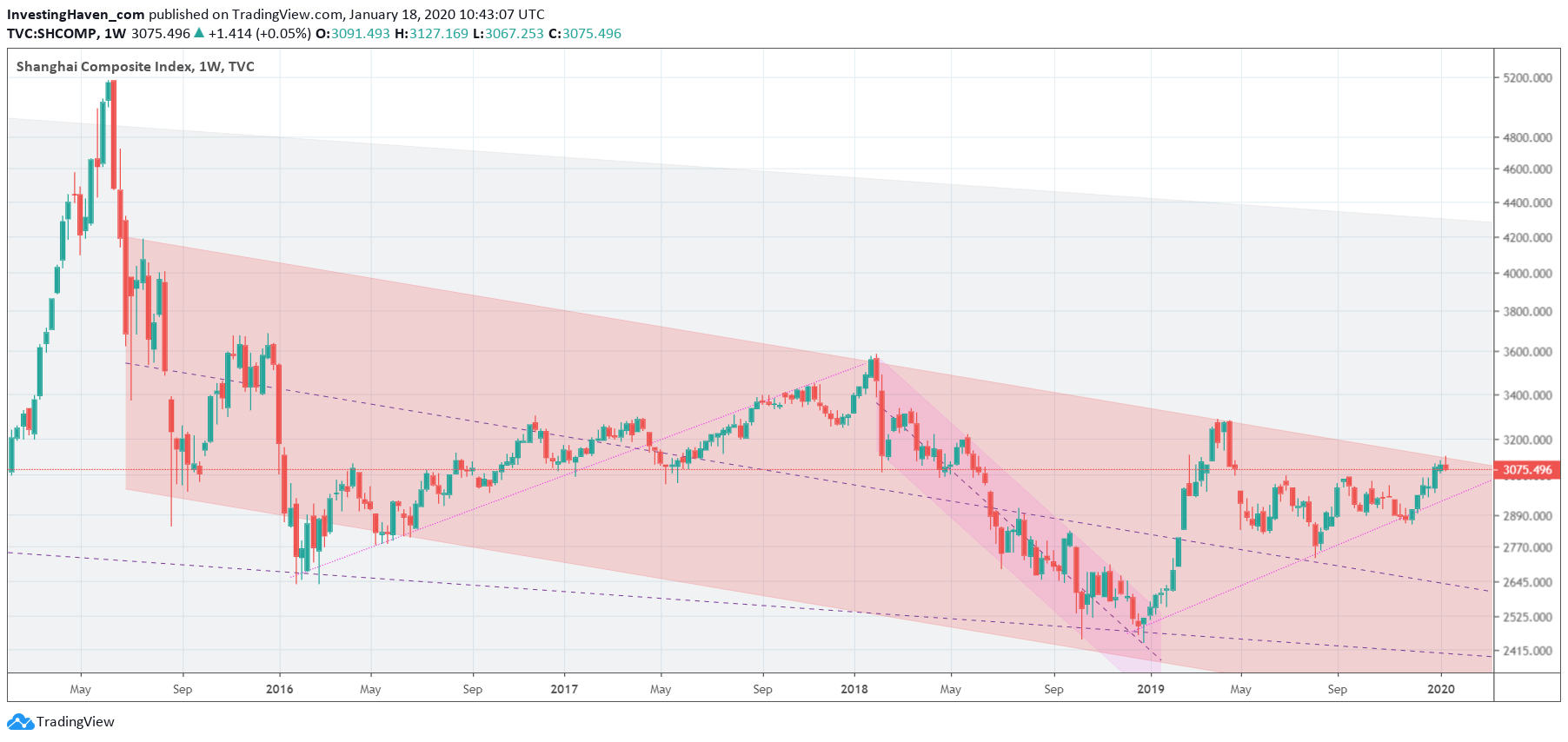

There are 2 leading indexes in emerging markets that key influencers of the EEM ETF that we play: the Hang Seng index (first chart) as well as the Shanghai Exchange (2nd chart). We feature the weekly charts to make our point.

The Hang Seng weekly shows a breakout. This index has a positive impact emerging markets, and says a powerful new bull market is starting “as we speak”.

However, the Shanghai Exchange trades right at resistance now. If it overcomes resistance we’ll have a breakout here as well, and it will be the final point of resistance for emerging markets to decisively move higher.

It would validate our bullish thesis, and it will make 2020 a phenomenal year especially for premium service members.

A breakout is a process, and it might take a few attempts until it really ‘happens’. Between now and then there will be an epic fight between bulls and bears.

This is the way we framed this to our premium members update: “The Shanghai Exchange is the most important and presumably last ‘bastion’ to overcome in emerging markets.”

So here it becomes interesting, as the million dollar question is how exactly to play this new emerging bull market.

Waiting for an entry point for too long will leave decent profits on the table. Getting in too early if it appears that the breakout is postponed will put you in a frustrating situation.

We believe we have to distinguish an investor approach from a trader approach.

For investors it is simple: 3 weekly consecutive closes of the SSEC will confirm the new bull market. Simple.

For traders it becomes more challenging. As a human being you would probably ‘speculate’ on the breakout. After taking a long position you would go through a rollercoaster, emotionally, until the Shanghai turns higher as well. Some would use a stop loss to protect themselves, but which price exactly would you choose?

Pretty challenging.