Emerging markets are among the markets that are hardest hit by Corona crash disruption. What we mean by this is that the otherwise clear and clean trends in emerging markets have entirely disappeared after the (because of the) Corona crash. Where do we stand now in emerging markets?

We can be very brief when it comes to emerging markets: they are in no man’s land.

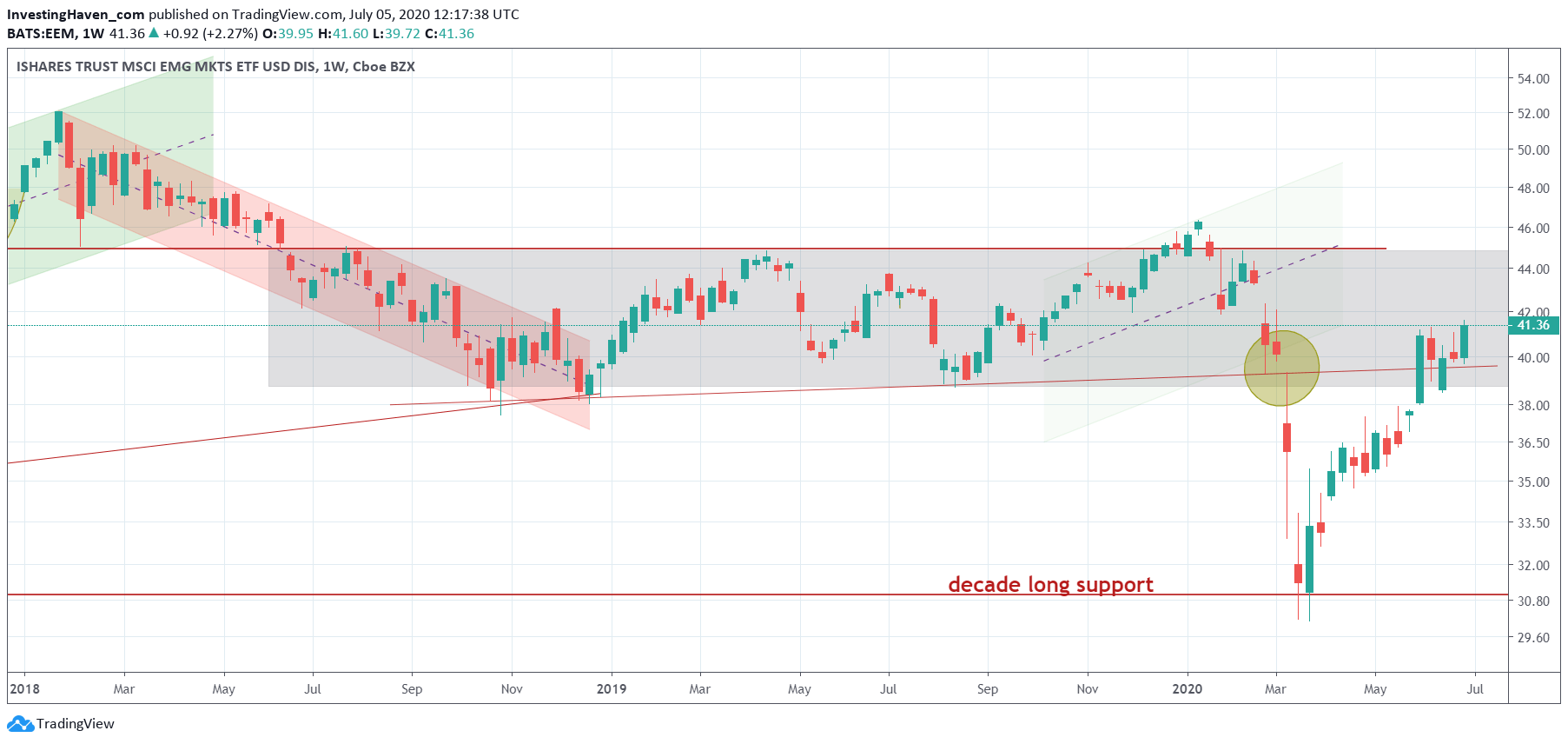

The EEM chart, weekly timeframe, makes that point.

The Corona crash was pretty violent, and disrupted the start of a new uptrend (light green rising channel).

The subsequent decline was violent, and brought EEM ETF to its decade long support.

The recovery was pretty violent, to the upside, and brought EEM back into its 12 month consolidation area.

Where from here? It’s unclear, and all we can tell is that 38.50 points in the line in the sand. Below 38.50 we’ll probably see selling pick up. Above 38.50 points we’ll see a prolonged consolidation in the 38.50 – 45 point area.

For now we believe that emerging markets simply need time, and that’s the problem with most investors they want to force their trades/investments. The move from the current 41.36 level to 45-ish does represent a 9% move, not bad but no confirmation that this will be a strong bullish trend as only above 45 points will see a bull market develop.

We believe emerging markets will do well, but not yet … until proven otherwise.