Financial stocks did tremendously well since October of last year. That’s when bond yields started a strong uptrend. No surprise, both assets are strongly correlated as per intermarket analysis. It may feel like financial stocks have gone too high too fast, which may be true but in the bigger scheme of things this might be just the start of a secular breakout. We predict that financial stocks have more upside potential in the longer term, regardless of what they will do shorter term.

The bigger picture of financial stocks is pretty impressive. We look at the XLF ETF to come to this conclusion.

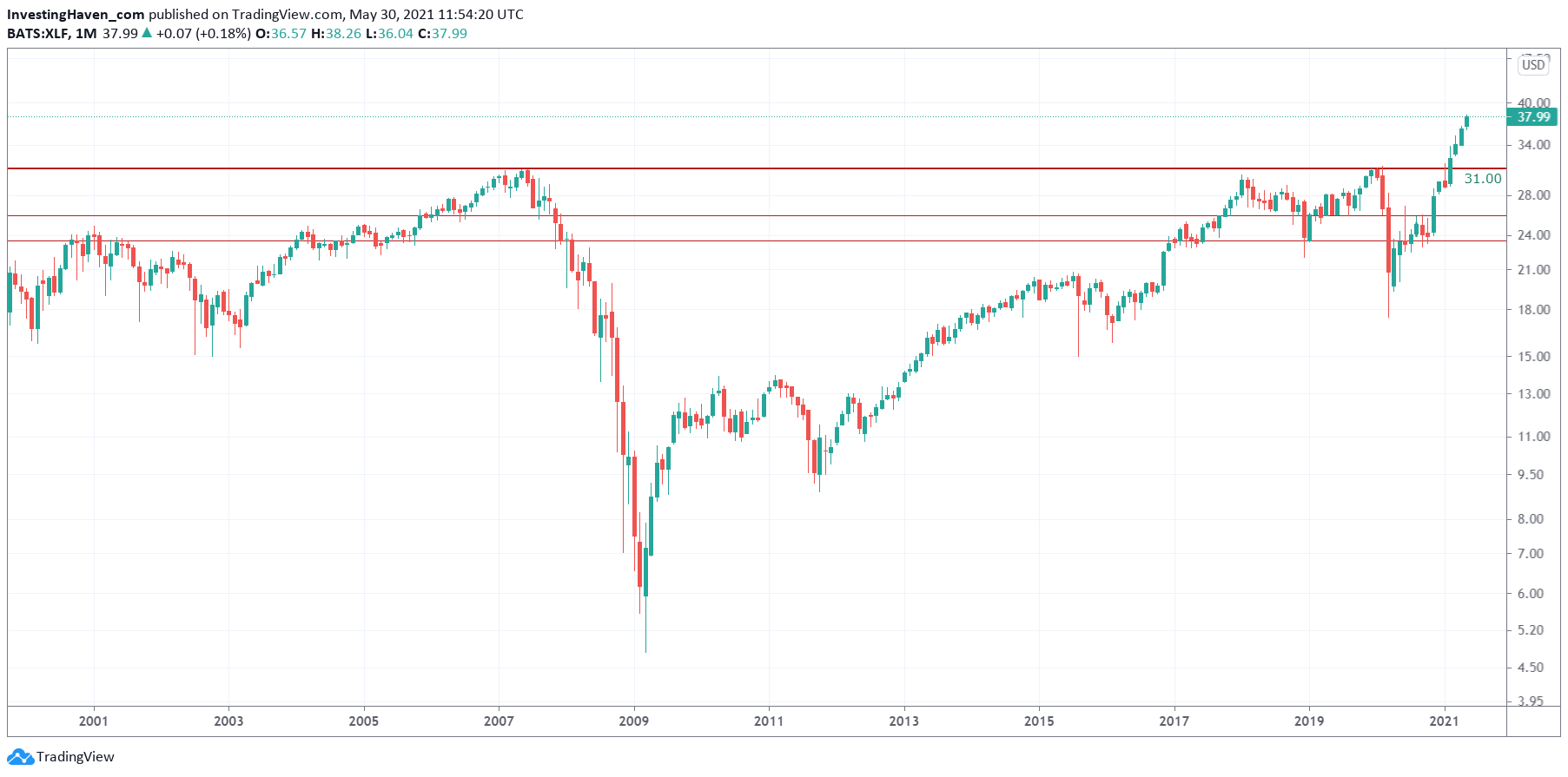

Below is the monthly chart, the longest term timeframe which shows the huge collapse of financial stocks in 2008/2009, followed by a large reversal.

What we observe on this secular timeframe is a huge cup and handle formation: the cup took 10 years to complete (2008-2018), and the handle some 2 years.

Since January of 2021 XLF ETF broke out, above its 2007 highs. It is now some 20 pct above its 2007 highs. ‘Just’ 20 pct.

Pretty impressive, isn’t it.

The million dollar question is whether there is (more) upside potential.

We believe the answer is yes, for those investors that have patience.

We would also not be surprised if this instrument comes down close to its breakout level, whenever the next retracement takes place.

As long as bond yields don’t fall too much we see XLF ETF hold up and move higher. And better focus on either large cap financials (lower risk) for safety or regional banks (whenever XLF has momentum) for leverage.

Moral of the story: never forget to focus on the big picture first when assessing an opportunity.