There are interesting setups in stock markets currently. If anything, the most noteworthy of all of them is the Friday afternoon breakdown attempt of the S&P 500. It was pretty nasty out there, and the S&P 500 index was in breakdown territory before recovering. The next few days will be crucial for stock markets, and we are not going to attempt to forecast anything here. Another noteworthy setup is the one in financial stocks. The XLF ETF is at a make or break level.

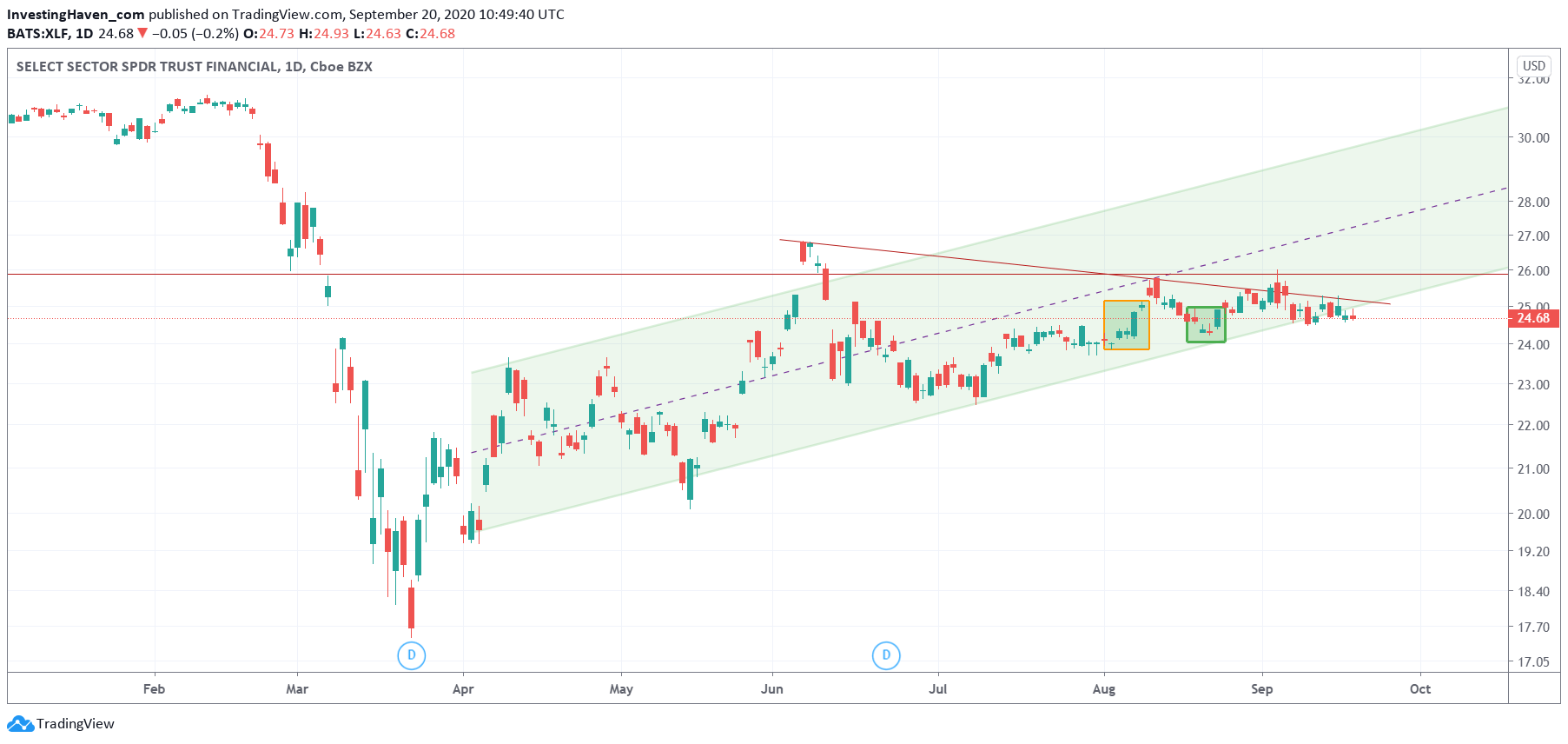

The XLF ETF represents financial stocks. Its chart is special, to say the least.

What we seen on this chart is a very strong reversal pattern, particularly after the June sell off. This sector is now testing the edges of its 4.5 month rising channel.

Let’s not be naive here: this is a make or break level.

We are not going to forecast anything at this point, we are going to watch how this market develops. A lot, if not everything, will depend on what the leading indexes will do in the next few days.

Let’s put it in plain simple terms: in case the S&P 500 continues its consolidation (read: does not break down) we will see financial stocks outpeform.

Why do we think so?

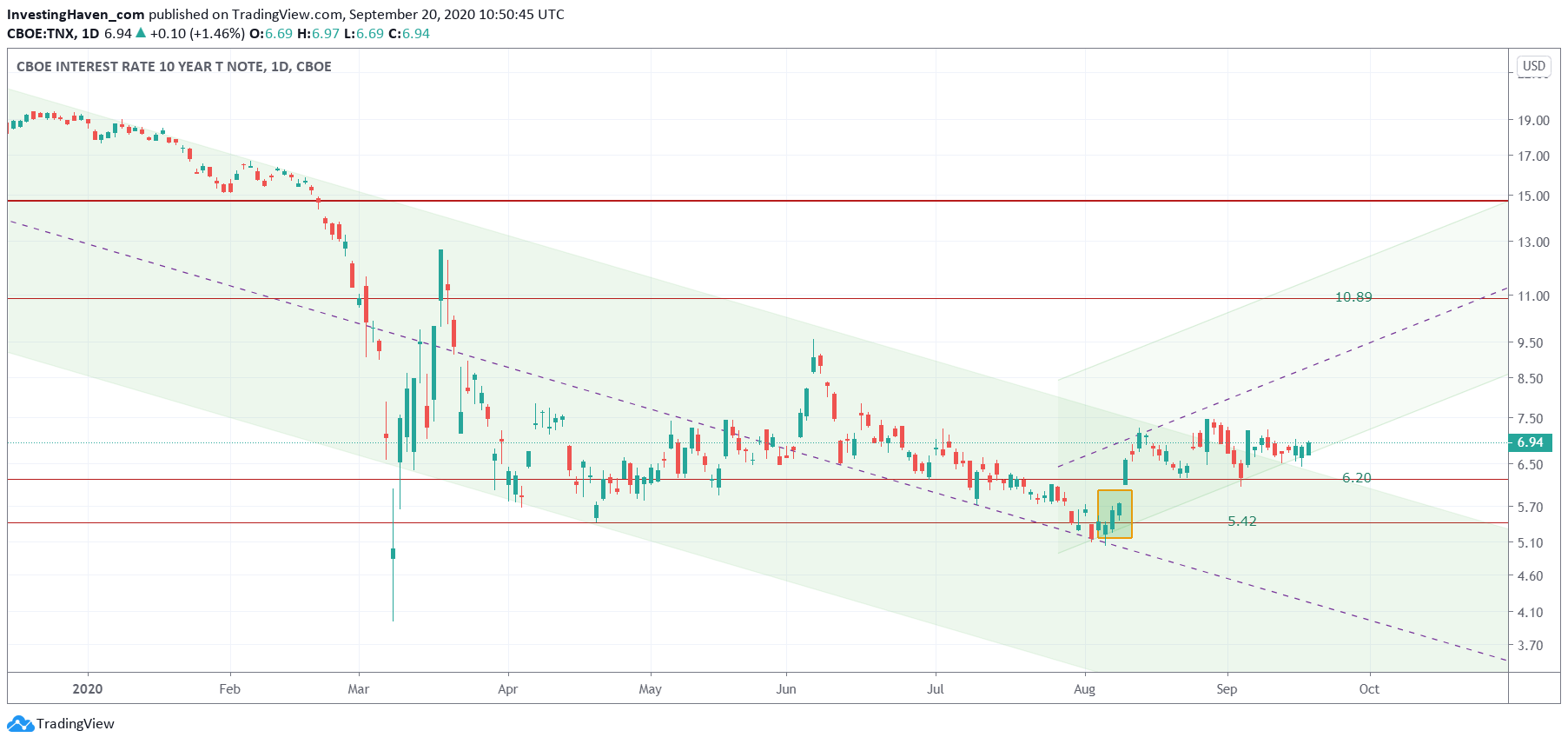

Because of its leading indicator: interest rates.

10 year rates are slowly but surely moving out of their crash channel, the one that started in February of this year. Note how this ‘break up’ attempt is taking a month now, and it looks like we have 3 full days above the falling channel.

In our Momentum Investing portfolio we took a position in a financial stock, just a few days ago, one that clearly outperforms its peers. In case the S&P 500 holds (does not break down) we expect this financial stock to go 30 to 50 pct higher before coming New Year.