Global markets continue to be volatile. One week they have a bullish bias, the other week they have a bearish bias. News really doesn’t help to understand the future direction as financial news is really meant to play on emotions of investors. At InvestingHaven we stay focused on our leading indicators, their chart patterns and especially which intermarket trends arise. What we see today is no evidence (yet) of a stock market crash in the foreseeable future. The jury is still out, but we continue to believe that the Next Stock Market Crash Will Be In 2022. Short term we see another crucial test because of this golden rule of any turmoil starting in currency and credit markets, as said in our 100 investing tips.

Per our 1/99 Investing Principles it is 1% of the time that investors should be on high alert. This is one of them, we’ll explain why.

The crash in Treasuries is something we covered extensively lately. Especially in our detailed piece Investing Opportunities #4: Volatility Is Tough, How To Handle It we covered the crash of Treasuries, with the key point being that we have to be extremely rigorous about the domino effect it can trigger.

If and when currency markets accelerate a major move (violating major chart levels).

So far we have not seen this.

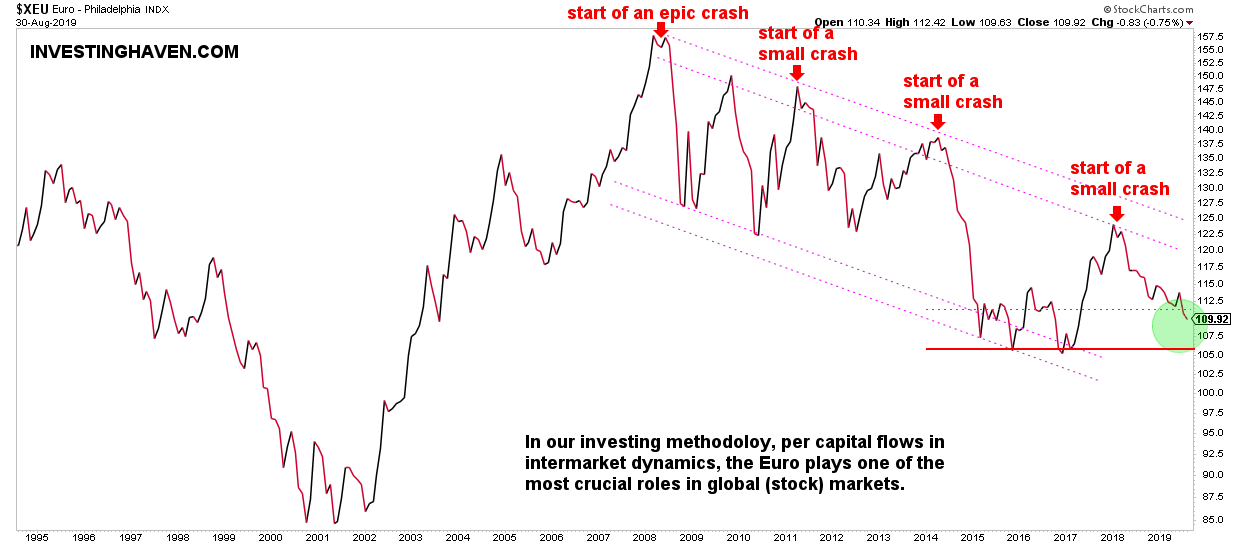

As said in the past it is the Euro that we consider the leading indicator for global markets!

What do we read in the Euro chart?

First, the monthly chart shows that the Euro is hitting major support levels. The potential quadruple bottom is what stands out on this chart.

The Euro has another 3% to fall so it is now in a crucial area. Any violation, to the downside, would imply serious turmoil of global stock markets.

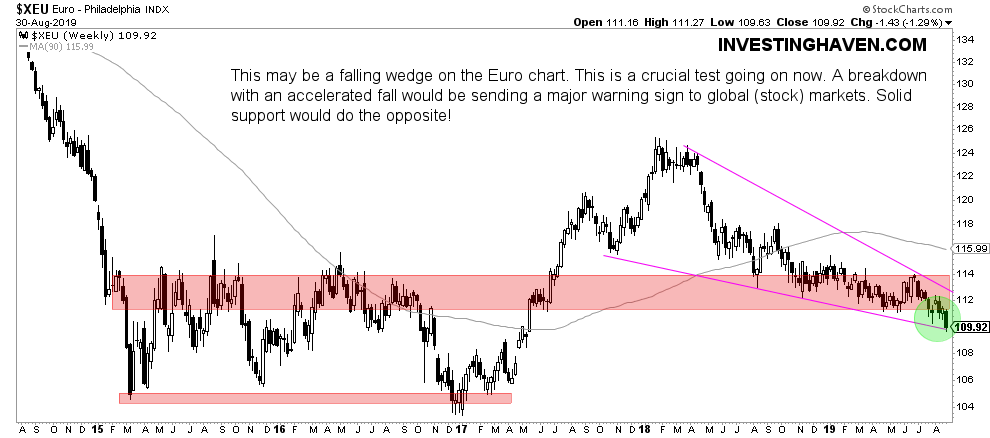

This conclusion becomes blatantly clear on the shorter term timeframe: the weekly Euro chart.

This falling wedge which mostly tends to have a bullish resolution makes clear that the next few weeks will market the first important test, before eventually the 105-106 level is tested (if it gets that bad).

Ed. note: We provide in-depth analysis to our ‘free newsletter’ subscribers. We bring premium content with specific investing tips on a weekly basis, mid-week, free of charge. We do this for 4 months. Subscribe to our free newsletter and get premium investing insights in 2019 for free.