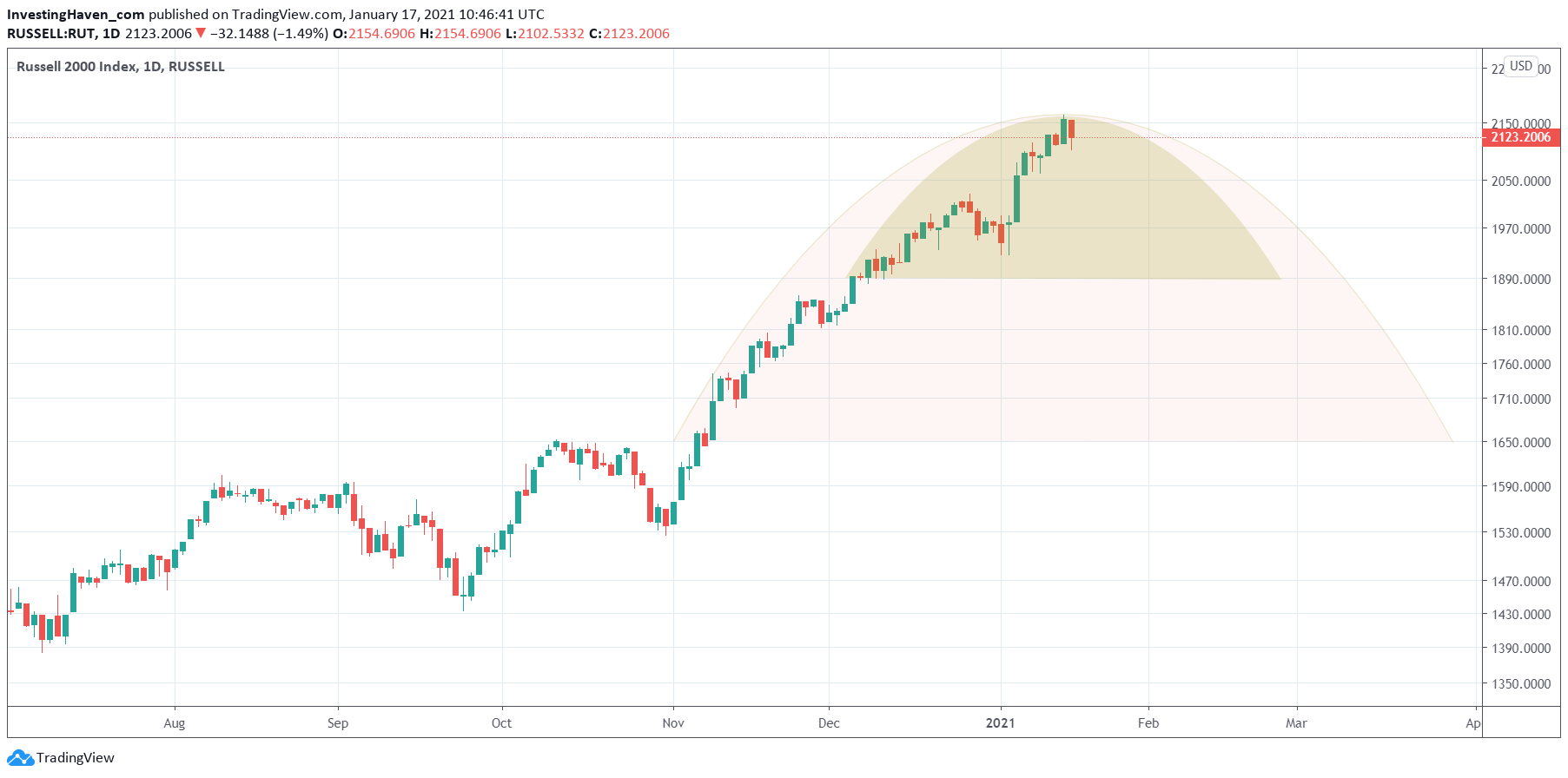

Let’s face it, the recent stock market rally was amazing but can’t continue forever. And the leading stock market indicator, the Russell 2000, is sending a first warning sign. On Friday, we saw a potential rejection combined with a double topping reversal on its daily chart. Better be careful with this setup, as the downside potential is significant. Long term our 7 Market Forecasts for 2021 remain valid, our longer term bullish stock forecast remains valid, but short to medium term we expect a rough period, especially in February of this year.

As a reminder we consider the Russell 2000 to be the global stocks leading indicator. Whenever the Russell 2000 is strongly bullish it is mostly when all stock markets globally are hugely bullish.

If the Russell 2000 is about to fill the gap on its chart it may fall back to the 1700 area. That’s a 19% drop. We are not forecasting it *will* happen. We are saying it *may* happen as there is no support once stocks start feeling the pressure of the US Dollar as explained in Dollar Ready To Create Havoc With Markets.

This topping pattern may be a process that will take days or weeks to complete. This index may drop fast, consolidate around 1970 for a few days or weeks, and then drop fast again once 1890 is lost as support.