After another volatile few weeks it becomes clear what is at stake in stock markets: an epic breakout or the start of an epic breakdown in the form of a stock market crash. Our leading indicators for global markets do not suggest a market crash is coming, nor does our U.S. market forecasting indicator, but the global stock market chart suggests to keep eyes very wide open as it trades within a very important decision area (one of our 100 investing tips).

One of the very important fear indicators, or defensive assets indicators, is clearly on the rise: 20 year Treasuries in the U.S.

Investors are sending a significant portion of their capital to this safe haven asset.

What exactly does this mean, and how NOT to read this chart?

First of all, this breakout visible on the first chart tells us that a portion of investors’ capital goes to a safe haven. They are taking their measures against a storm that may or may not be underway.

This does not mean that a market crash is imminent. There have been plenty of times in which stocks continued to rise with rising Treasuries.

In other words, it is a capital allocation thing, and a preference for defensive assets, that we should conclude.

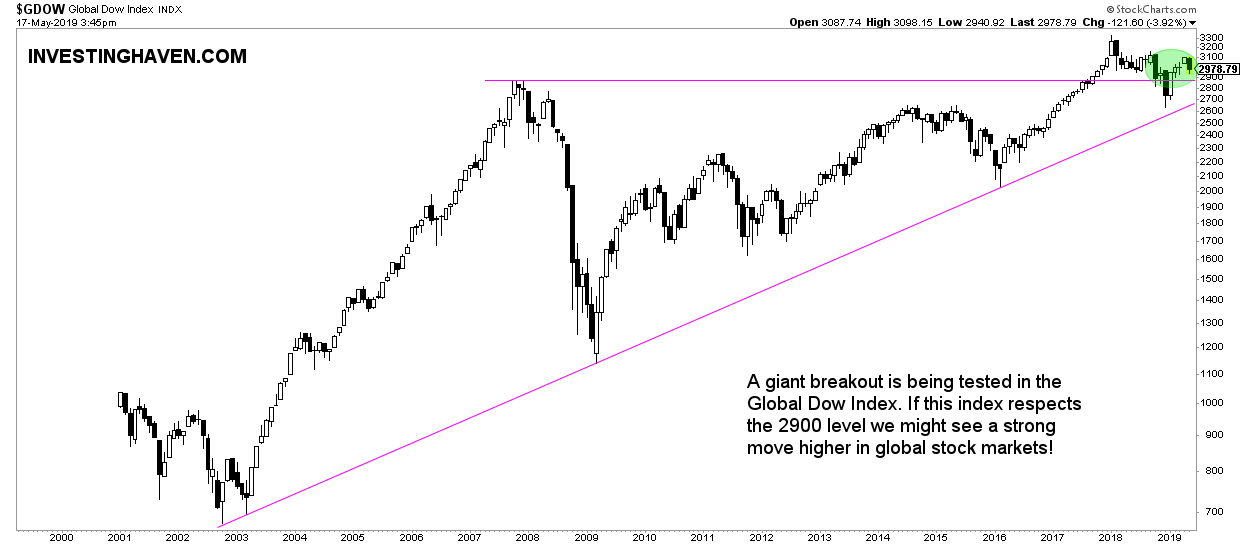

The above conclusion does make sense looking at the global stock market index Global Dow Index (GDOW).

After a peak in January of 2018 we now see some up-and-down right above the breakout level at 2900 points, the top of October 2007. See the green circle on below chart.

What we learn from this chart is that there is an epic fight between stock market bulls and bears across the globe. This will resolve, at a certain point, maybe not immediately.

Scenario 1 is that both the 2700 level as well as the 2900 level are respected. In that case we will see a strong secular bull market in global stock markets! Treasuries will fall over time, or at least rise at a slower pace.

Scenario 2 is the one in which the 2700 level fails, and global stocks start declining. The breakout of last year gets invalidated, and a period of struggles, maybe even an outright crash, may follow.

We are not looking at scenario 2, we believe we will move into scenario 1, but best practice is to keep eyes wide open for every scenario.