Stock markets had the best January in many years, arguably among the best returns in any January in history. Is this green light for stock markets? Is this the green light to buy stocks?

We already revealed partially the answer to this question in our latest monthly dominant trend market update. This is what we wrote:

All global stock markets recovered strongly after respecting major support. No no signs of a 2008-alike scenario whatsoever. The picture might turn bullish soon, but there is still downside risk. The line in the sand: 2.50 for 10 year rates, 110 in the Euro, 1300 in the Russell 2000. Emerging markets might have confirmed a giant breakout test, super bullish for the next years. Gold is close to a major test at $1400.

The market conditions look good, though not confirmed to be bullish as of yet. However, they are certainly not catastrophic as some have argued. Especially the comparison with 2008 and 1987 are _not_ relevant. We created a special set of charts to make the point that a 1987 market crash is not in the cards in 2019.

So if stock markets are not bearish, but also not confirmed to be bullish yet, they must somewhere in between, right?

The answer to this question is ‘yes’.

And the million dollar question becomes: are stock markets THE place to in 2019? In other words will we see an unusually strong bullish move in broad stocks markets, worth your capital?

As per our 100 investing tips:

What happens when applying the investing tip ‘less is more’ to the ‘2 mega opportunities per year’ tip? It pays off to be patient and invest only a part of your capital. The prerequisite, of course, is that you are able to spot those exceptional opportunities.

The type of opportunity we are talking about is a 3-fold increase in a market segment similar to what we explained in our Canopy Growth Stock Forecast 2019 as well as potentially very bullish move explained in our Palladium Prediction Of $5000 by 2020.

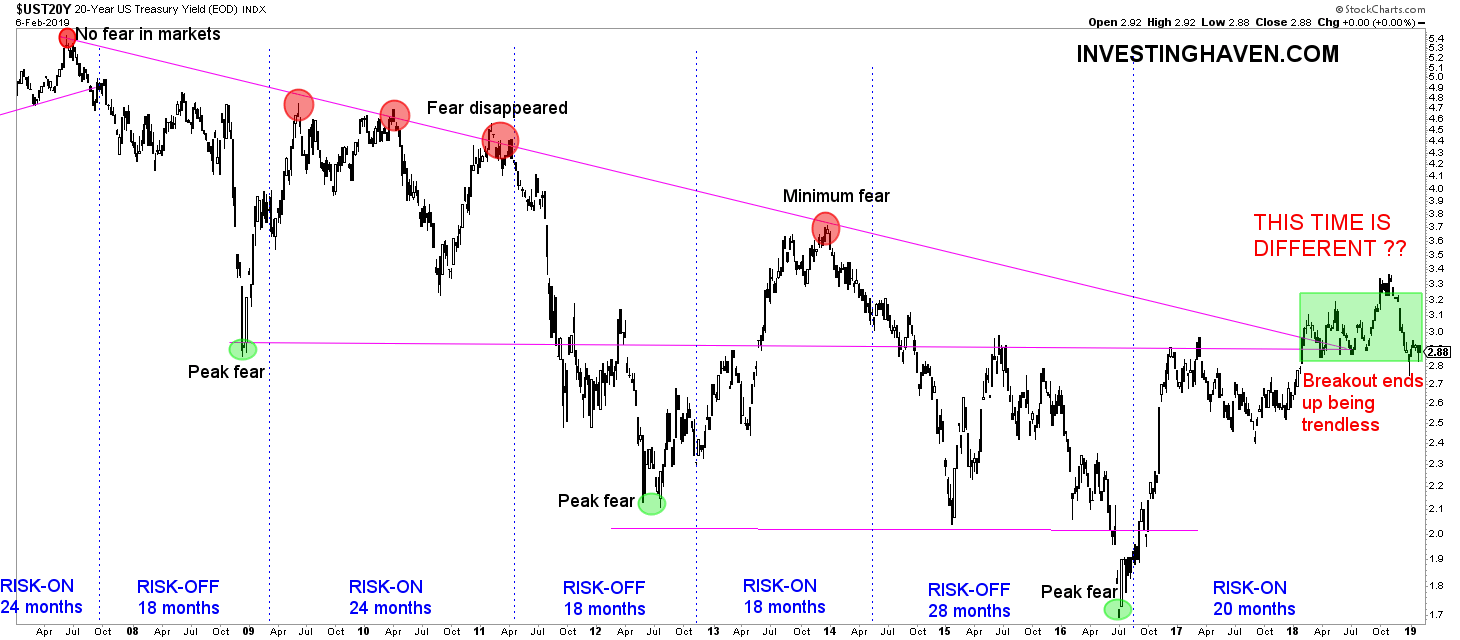

At this point in time we would not believe it is justified to go all-in broad stock markets. We may see a strong move, but our leading indicator is not confirming this yete. There is a downside risk which we cannot neglect. The following chart makes the point. The green box shows the indecisiveness of yields, and as it is a leading indicator for stocks it also implies indecisiveness of stocks.

A breakdown would be very bad, a breakout would confirm that ‘this time is different’. We believe it is worth waiting a bit until a trend is decided by the market.