Is SVB’s bank run the start of the next stock market crash? If the bank run is not solved quickly, and if contagion is the result of, it won’t be pretty. In that cash a market crash becomes a higher probability outcome. Here is one specific chart that we are watching: financials (XLF ETF).

There are many indicators to track. Social and financial media are full of indicators, charts, data points, to the extent that you get lost in an overload of data.

Keep It Stupid Simple also applies to financial markets analysis.

We track a limited set of leading indicators. All of them are shared every weekend with members in our premium research service Momentum Investing (another must-read alert is shared this weekend). There is one additional chart we’ll be watching closely: XLF ETF.

That’s not because we are interested to take a position in XLF ETF, or any stock in that ETF. We’ll consider XLF ETF one of our indicators to understand contagion risk of SVB Bank.

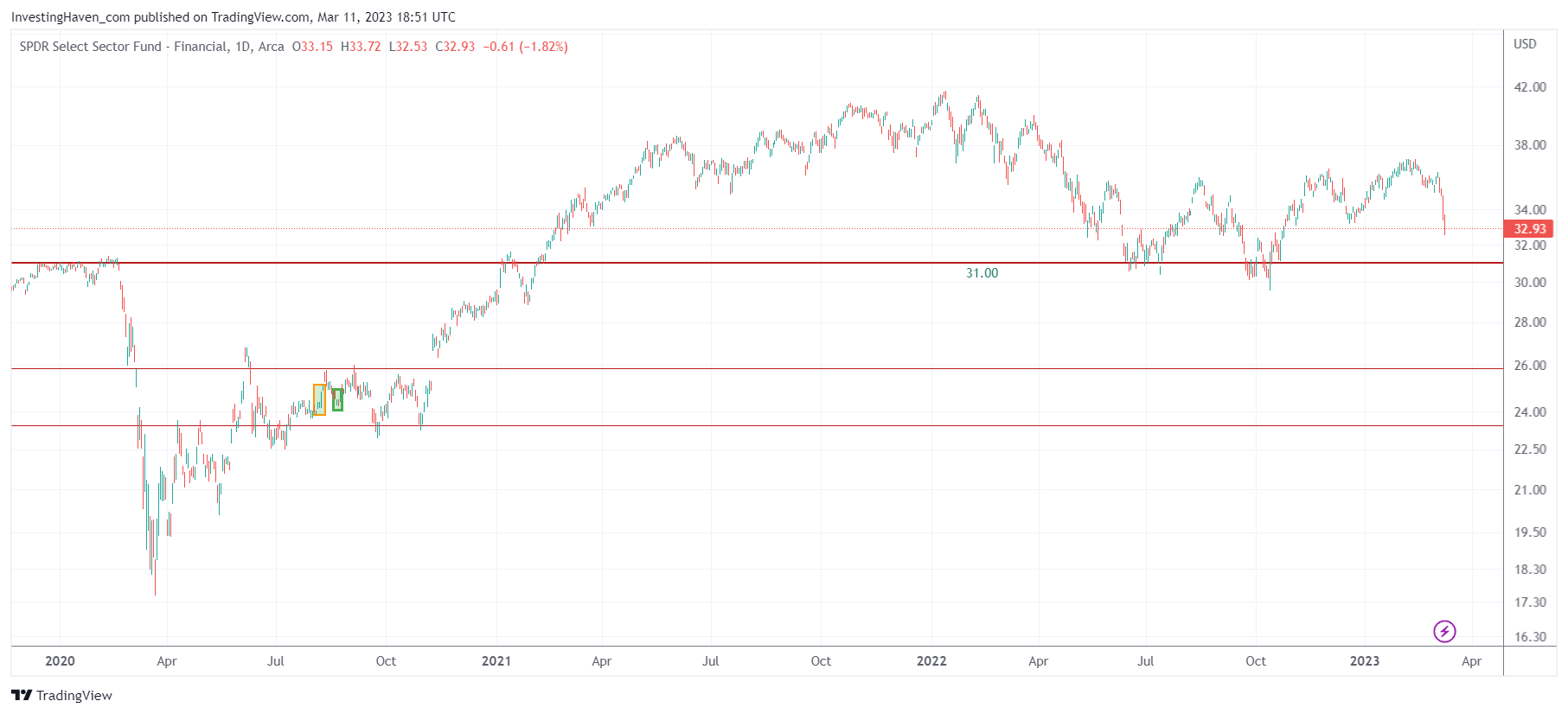

The message of XLF ETF is very simple: 31.00 better holds. IF 31 is respected (on a 3 to 5 day closing basis) we can expect a bullish reversal as a likely outcome. However, once 31 gives up, it will result in a really quick move to the 24-26 area. That’s because there is not a lot of support between 26 and 31.

A bad outcome in markets should be signaled by a violation of XLF ETF. More specifically, the breakdown level is 31 points.