In hindsight, it is always so easy to see the optimal investing decisions. It is dangerous to think in ‘in hindsight’ terms. However, it can be very insightful if used appropriately, which is to learn something new about the market and its often unusual behavior. This article contains one such insight from the unusual behavior we noticed in the month of March (no forecast in this article). One such insight comes from the retracement that the Nasdaq went through in the month of March of this year.

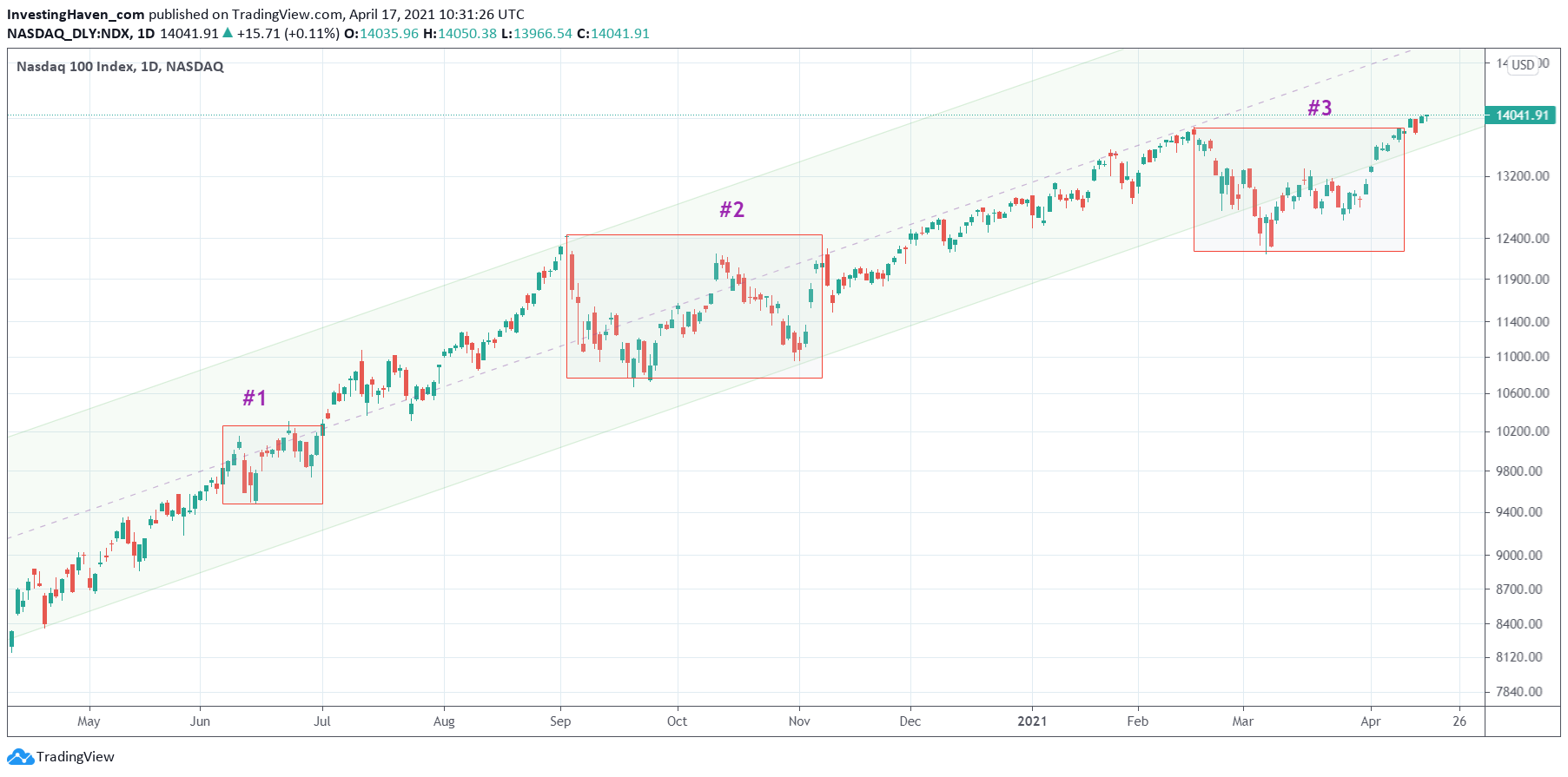

It was the 3d retracement since the recovery of the Corona crash. Mid-February of this year marked the start of what appeared to be a very violent selloff in tech stocks.

We can see on the daily Nasdaq chart how orderly it started but how unorderly it turned out. What’s really unusual is the time that the Nasdaq went below its rising channel, especially in the second half of March.

We often can make use of the rule of three which means that a market can fall for 3 consecutive days outside of a structure like a trend channel. If it gets back into its structure on day #4 there is no harm done.

In the last week of March we see some 8 consecutive days of trading outside the channel structure. Very rough, very unusual, and very shaky. Regular risk management rules should have closed any Nasdaq position. Yet, the Nasdaq managed to recover. It now trades as if nothing irregular ever happened.

How can investors handle this type of situation?

There is not a lot we can learn from this other than waiting to open new positions on the 2nd leg of a reversal in a volatile cycle, not the first leg. It’s the one and only take-away we can find, and it requires perfect timing skills.

We have seen a lot of damage created in individual tech stocks. The Nasdaq index now trading at ATH does not reveal the carnage that was created in many tech stocks, especially because the larger tech stocks did hold up well (think e.g. Microsoft).