As per our India stock market forecast 2019 we tipped the Indian stock market as our top favorite for 2019. We did so more than 3 months ago. We identified 10,800 points in the Nifty 50 Index (NIFTY) as the line in the sand. Today, this index trades at the same level. In other words, the Indian stock market continues to be at a major make-or-break level, though we see an even more challenging picture in the Bombay top 30 index. The findings in this article are in line with the ones from our 15 leading indicators and dominant market trends.

India Stock Market At Major Decision Point Early 2019

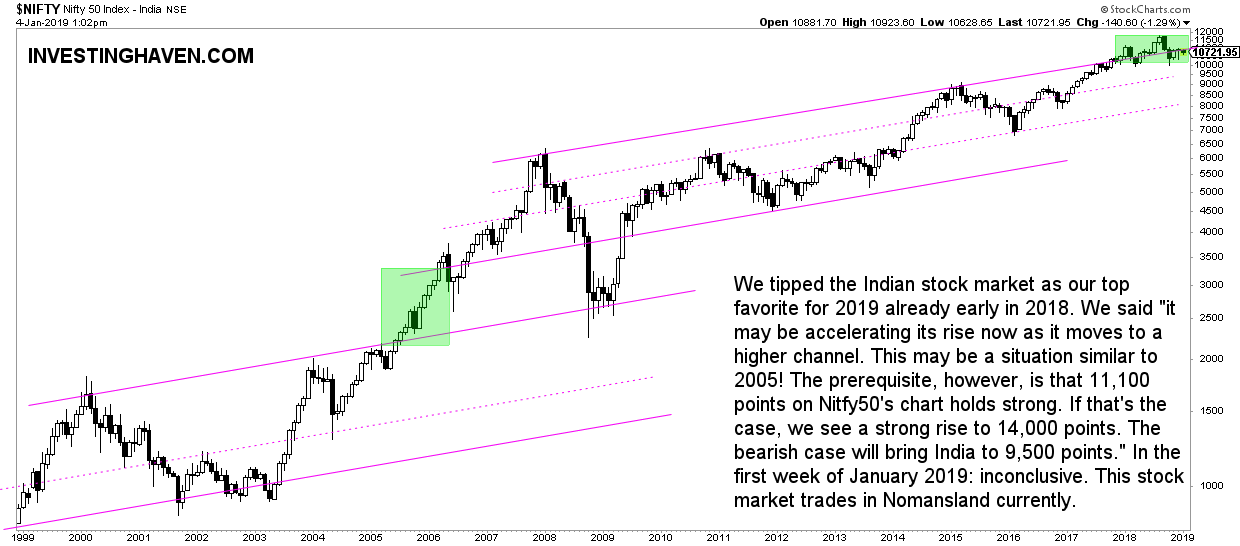

We explained in our 2019 forecast on the Indian stock market that both economic fundamental data points and leading indicators suggested a major decision point. We also showed this on the chart of Indian stocks chart specifically the Nifty 50.

As said in our 4 Top Emerging Markets in 2019 (EEM) the long term chart of India tries to move from the current rising channel to a higher one (not created yet on the chart). That’s the key in forecasting: try to identify a point where a market is heading towards.

We strongly sense that India will accelerate its rise. If that’s what is happening right now we will see a similar move as the one in 2005 where India moved to a higher level channel.

So, in sum, if economic data and leading indicators continue to favor India’s stock market, and Nifty 50 continues to trade above 10,800 points, it will likely accelerate its rise. In this case we will see 15,000 points in India’s stock market in 2019.

The first chart which represents the Nifty 50, top 50 companies in India, helps understand the points made above.

All conclusion made before are still relevant:

- It is an absolute must that 10,800 points should hold.

- If not the subsequent decline would bring this index to 8,500 à 9,500 points.

- However, if support holds we see a rise back to 11,000 points.

The key finding about Indian stocks is that if and once it starts rallying it would rise to a higher channel. “This may be a situation similar to 2005! The prerequisite, however, is that 11,100 points on Nitfy50’s chart holds strong. If that’s the case, we see a strong rise to 14,000 points.”

India Stock Market: More Evidence of Decision Point in 2019

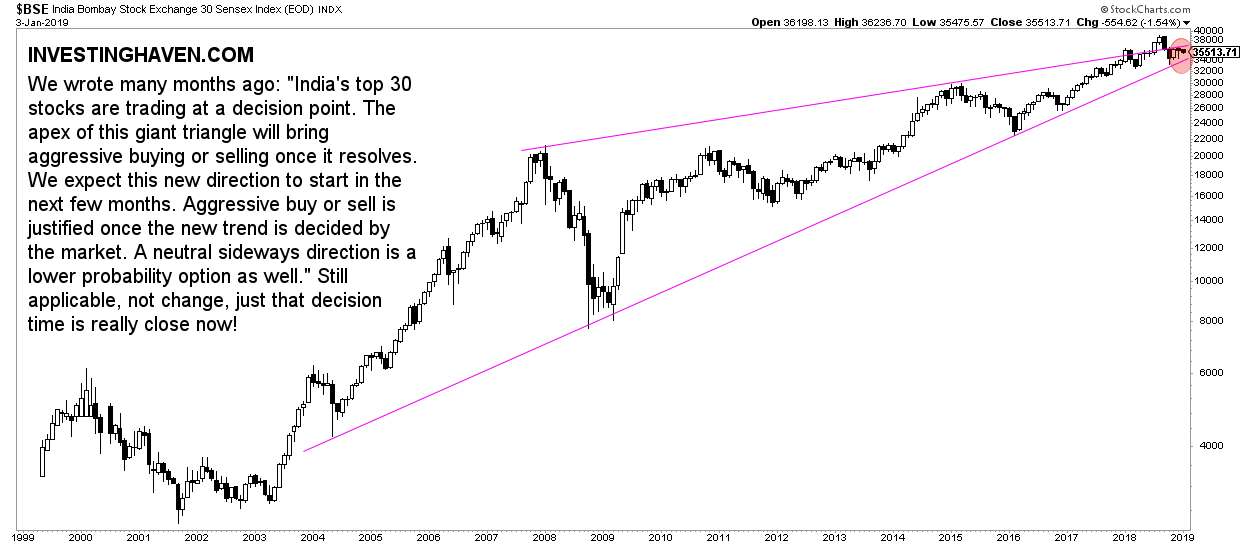

There is this other key index for the Indian stock market: the Bombay 30 index.

We wrote many months ago: “India’s top 30 stocks are trading at a decision point. The apex of this giant triangle will bring aggressive buying or selling once it resolves. We expect this new direction to start in the next few months. Aggressive buy or sell is justified once the new trend is decided by the market. A neutral sideways direction is a lower probability option as well.”

Below is the chart of the Bombay 30 index. It makes our point. The conclusions from back then are still applicable other than decision time is really close now!

What this second chart adds in terms of value is that it shows even more how important this make-or-break level is. The giant triangle in this specific form will have major implications once it breaks out or break down.

Stay tuned, in a couple of weeks, ultimately a couple of months, we will have an answer on the new trend in 2019 when it comes to Indian stocks.