Which sector will outperform in 2023: tech stocks or traditional energy stocks? After a very nice run in the first 5 months of this year, one would intuitively answer that traditional energy stocks are a better opportunity. However, the charts have a very different message: tech stocks will outperform. We let the market speak and forecast based on chart readings and trends, not based on articles about gurus like Mister Buffett and his oil exposure.

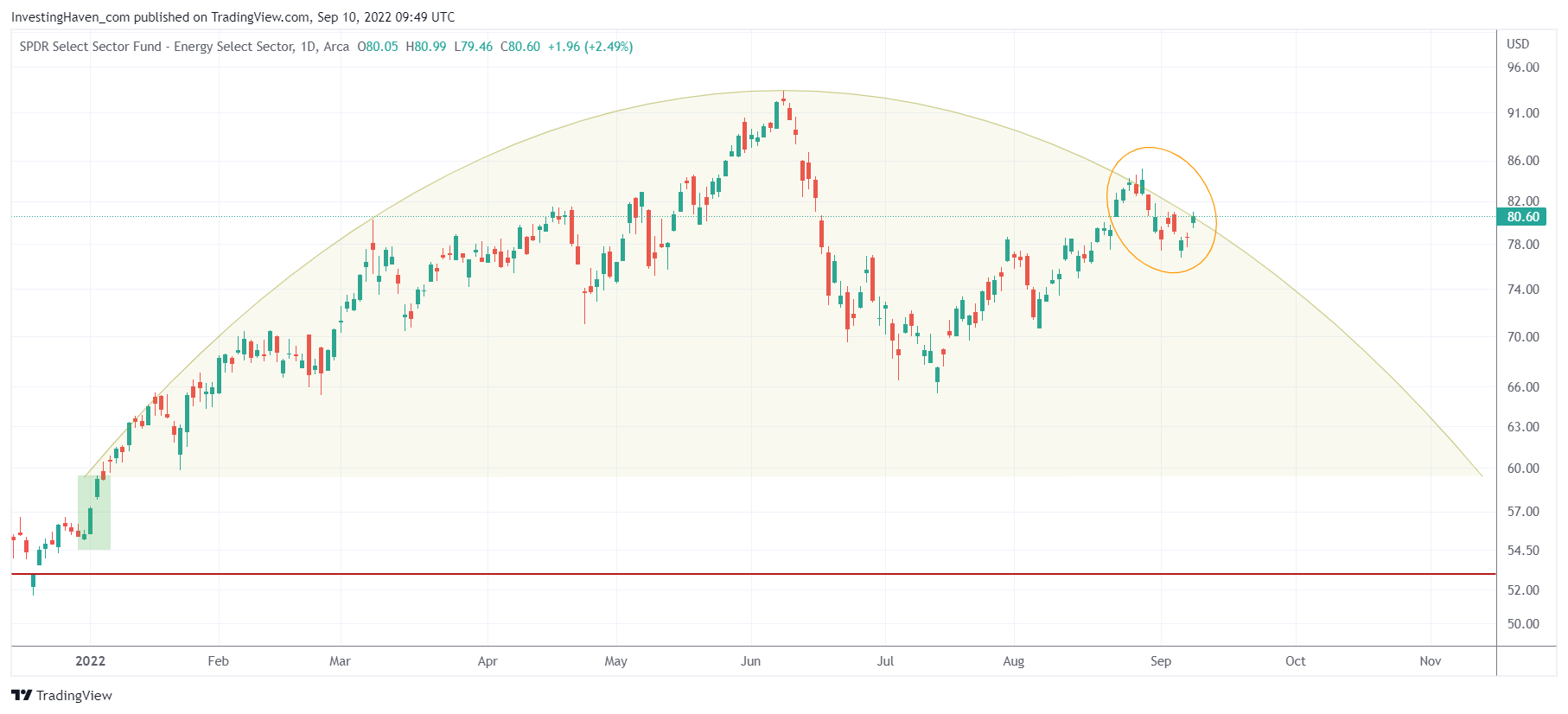

The sector chart for traditional energy stocks is XLE ETF. It is true that an important test is ongoing and that this sector will resolve to the upside. There are plenty of reasons to not initiate positions in this sector.

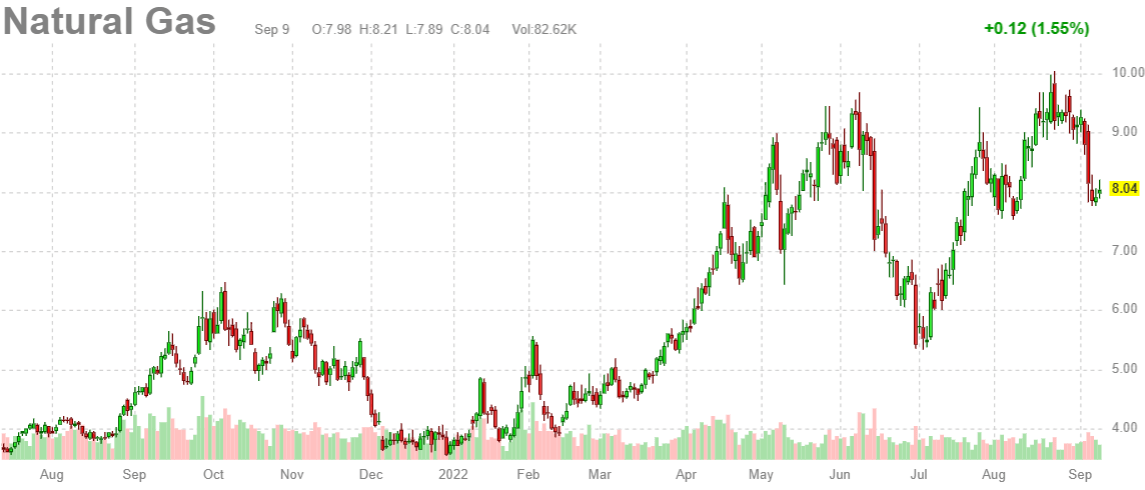

Leading indicators of XLE ETF are on the one hand the direction of broad markets (S&P 500 or the Dow Jones) but more importantly futures prices of crude and natgas.

Natgas looks horrible, it’s a double top and we don’t see natgas clear 10 USD for a long time.

Crude has come down a lot, while it might settle at or around 80 USD it certainly won’t be a catalyst to push XLE ETF much higher (best case: marginally higher).

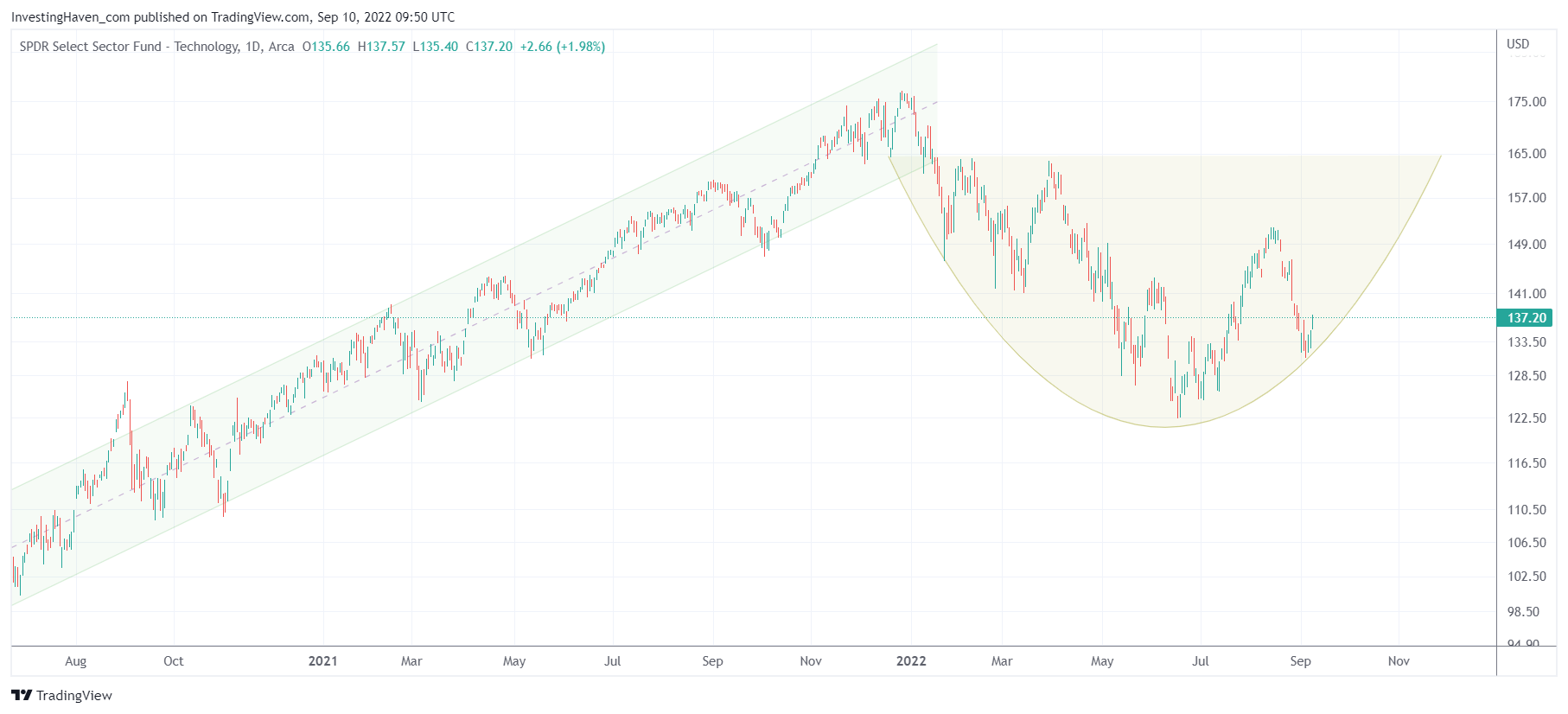

Let’s switch to tech stocks.

Last week we wrote: The Nasdaq Has Serious Doubts Whether It Should Be In An Uptrend vs. Downtrend

The short term volatility created in 2022 is very tiring. We recommend staying focused on the big picture. This is what we see big picture (commentary is based on the daily Apple chart)

IF our expectation is right, we can reasonably conclude that 2022 was a base building year, characterized by violent swings (in both directions). This sets the stage for a major breakout and bullish trend in 2023.

Remember, growth stocks are among the most profitable segments of the market when they are in an uptrend. That’s why we continue to cover the Nasdaq chart.

We better be sure about the future direction of tech stocks. If they were to resolve higher, we don’t want to miss this trend now that it is emerging… certainly not by being exposed to energy that has all the signs of topping.

The XLK ETF chart has a bullish reversal. While the final outcome is inconclusive at this point in time, we have sufficient evidence that this reversal will hold and resolve as a bullish structure.

But the big problem is impatience of the investor.

But the big problem is impatience of the investor.

If you were to ask 100 investors whether they prefer energy vs. tech, you might have a surprisingly high number of energy enthusiasts. Why? Because XLE ETF was bullish in recent history and the human brain is great at sticking to its comfort zone which is how it felt about the recent past.

The other reason is the narrative. Be careful with narratives, they make you see things that are not there any longer. As per our 7 Secrets of Successful Investing narratives are defined by repetitive message in media.

In our view, the chart has a clear winner: 2023 will be more bullish for tech stocks compared to energy stocks. As always, being selective is a pre-requisite for success!