We are getting close to the last free edition of our Investing Opportunities series. This is edition #14 and we have 2 more to go which means in January of 2020 we will turn this ‘freemium’ service into a premium service. In this update we move our more conservative positions to aggressive market segments because our leading indicator for stock markets (as well as for the stock market risk cycle) is finally breaking out!

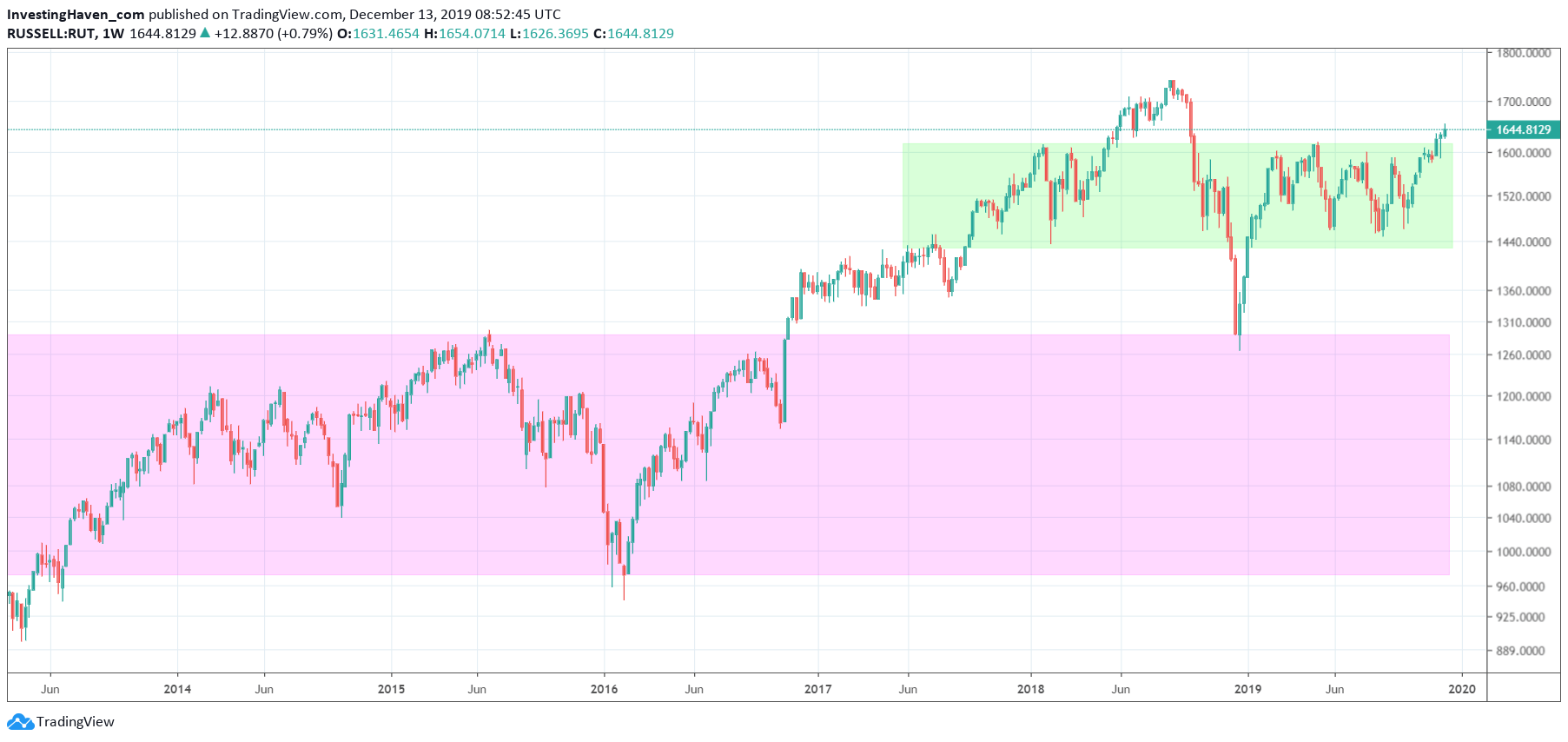

In the meantime we continue with the optimization of our portfolio to reflect the ongoing market trends. If anything with the breakout of Russell 2000 above the 1625 level we know for sure this is a bullish RISK ON cycle that now started! µ

Remember we identified the Russell 2000 level of 1625 already a very long time ago. This week the breakout got confirmed. What does this mean for our portfolio?  First of all we want to be in more aggressive segments right now. That’s why we want to sell the more conservative Storagevault Canada (SVI.V) after we book a profit of exactly 20%. Note that we booked this profit at a time when markets were shaking, particularly in September and early October.

First of all we want to be in more aggressive segments right now. That’s why we want to sell the more conservative Storagevault Canada (SVI.V) after we book a profit of exactly 20%. Note that we booked this profit at a time when markets were shaking, particularly in September and early October.

Moreover, Xebec Adsorption (XBC.V) is not looking as good at current levels as we expected. This may turn bullish, even as of today or next week, but we believe there are far better opportunities out there. We sell XBC.V with a small loss of 4%.

With our capital we want to move into more aggressive segments. We have two of them. Which ones exactly? One tech stock for which we got an entry point confirmation and one potential commodities stock for which we wait for an entry point confirmation.