This is episode #12 in a series of 16 Investing Opportunities articles. This edition is published right at a time when we write our annual market forecasts for 2020 and beyond which are absolutely worth reading. In this edition however we focus on one thing only: try to catch one of the next multi-baggers for our 10k-to-1M portfolio. In edition #9 we identified a shortlist of some 10 stocks for our value portfolio, after which we selected 2 of them as the winner in edition #10. Our top pick trades almost 10 pct higher in the meantime while our 2nd pick is some 5% above our buy level. Last week in edition #11 we identified one cryptocurrency for our 10k-to-1M portfolio which we call MOMENTUM INVESTING portfolio. This crypto is about to start a massive move, it is a ticking time bomb. We are patiently waiting for a confirmation. In today’s edition we go back to traditional stocks and present readers the shortlist of small cap stocks which we are following. That’s because not everyone has a crypto account, and some investors simply want to stay away from the extreme levels of volatility in crypto markets which is absolutely fine. For more traditional investors we have a shortlist of 5 small cap stocks which we reveal in this edition. We discuss what we want to see in order to get a buy signal. Because that’s the process you have to go through to pick the absolute winners.

Per our 1/99 Investing Principles it is an absolute minority of stocks that are worth your capital.

We look at 1,000 stock charts per week, of which we select some 10 that are worth investigating. That’s 1%, the other 99% is for the dustbin. Out of those 10 is mostly some 5 that constitutes our shortlist, and the remaining ones go to our watchlist.

Those are the volumes you have to go through to retrieve a very powerful shortlist.

And even then sometimes it appears that your shortlist may be valuable, but that the timing is not right. Because specifically when it comes to small cap investing which is where we find most of the multi-baggers we are looking for in our MOMENTUM INVESTING portfolio the most important thing we need is a RISK ON cycle.

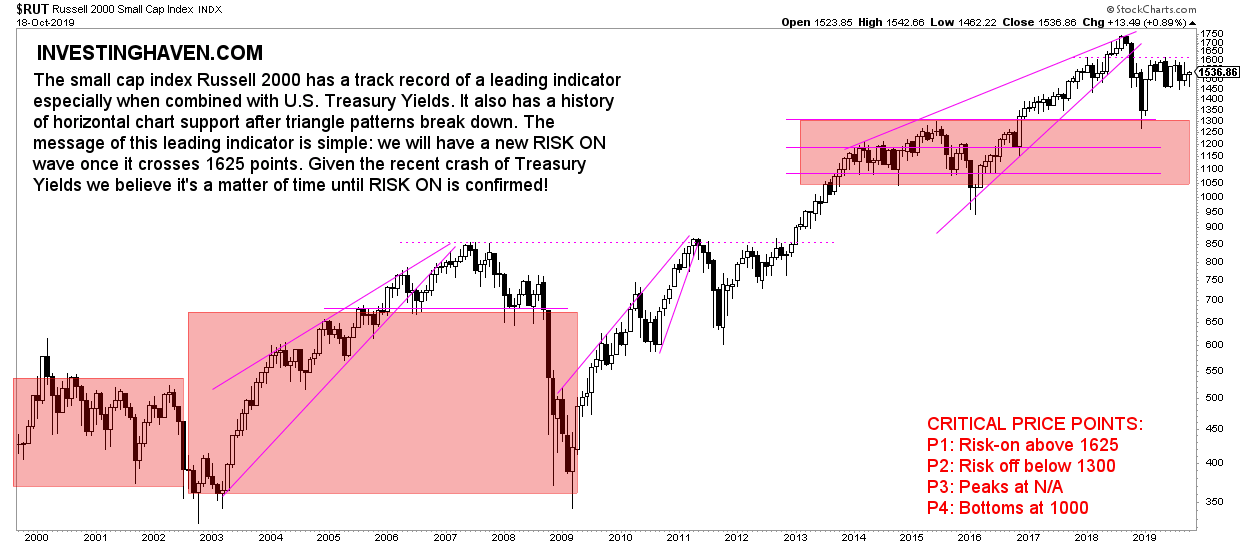

Our guide for this is the Russell 2000. It is not only the ultimate small cap index, it also signals to us RISK OF and RISK OFF depending on where it trades on its chart (as per the patterns we identify).

Currently our risk indicator (Russell 2000, shown below) is very close to test its ‘RISK ON breakout point’. We identified this a year ago, and it comes in at 1625 points. That’s 6 pct above current price levels.

This chart really helps us understand whether we can consider small cap stocks or not.

As per Stan Druckenmiller:

Only maybe one or two times a year do you see something that really, really excites you.

The point of Druckenmiller is this: the few opportunities per year that pass by are so profitable that it really pays off to wait for them and go aggressively after those opportunities. It is a much more profitable idea to only trade a few times per year and get serious returns as opposed to trade much more often in a much more diversified way.

Our track record of opportunities that did really excite us in 2019 but that also delivered from 70 to 300% is there. We hit 3 of them only in 2019, in a matter of 10 months:

- Bitcoin: signaled on Feb 25th a new bull market, confirmed a giant breakout on April 2nd, after which BTC went up 3x.

- WELL.V: a small cap stock that went up 100% after we tipped it early June.

- First Majestic Silver: a 70% rise in a few months.

Yes, we also tipped QIS.V which in the end went nowhere, and we sold with a small loss. And there is the MJ space where we considered that a bull market would have started, but it went south in September. That’s why we allow for one loss per year.

This is not your average guy who hits this. There is certainly not any newsletter subscription worldwide that has this track record in one and just one year! Not any.

Going forward we believe we are close to entering another trend, and it is in the small cap space.

We believe the time is coming now for small cap stocks

In the remainder of this we will share the charts of 5 small cap stocks that we have on our shortlist after reviewing some 1000 small cap stock charts.

Our detailed findings along with 5 charts are documented in the remainder of this article.