As the S&P 500 and Dow Jones are near all-time highs we see a big divergence in some of our leading indicators. On the one hand the US Dollar is breaking down which is great news for risk assets, especially commodities and precious metals investors. At the same time, Treasuries keep on rising (bond yields falling) which tends to provide headwinds for risk assets. Even though this is a divergence which is hard to solve (eventually the market will come with answers) we do know from history that one market is will outperform with these conditions: precious metals. Our gold forecast (2200 USD) and silver predictions (+30 USD) for 2021 which we published 9 months ago are about to materialize.

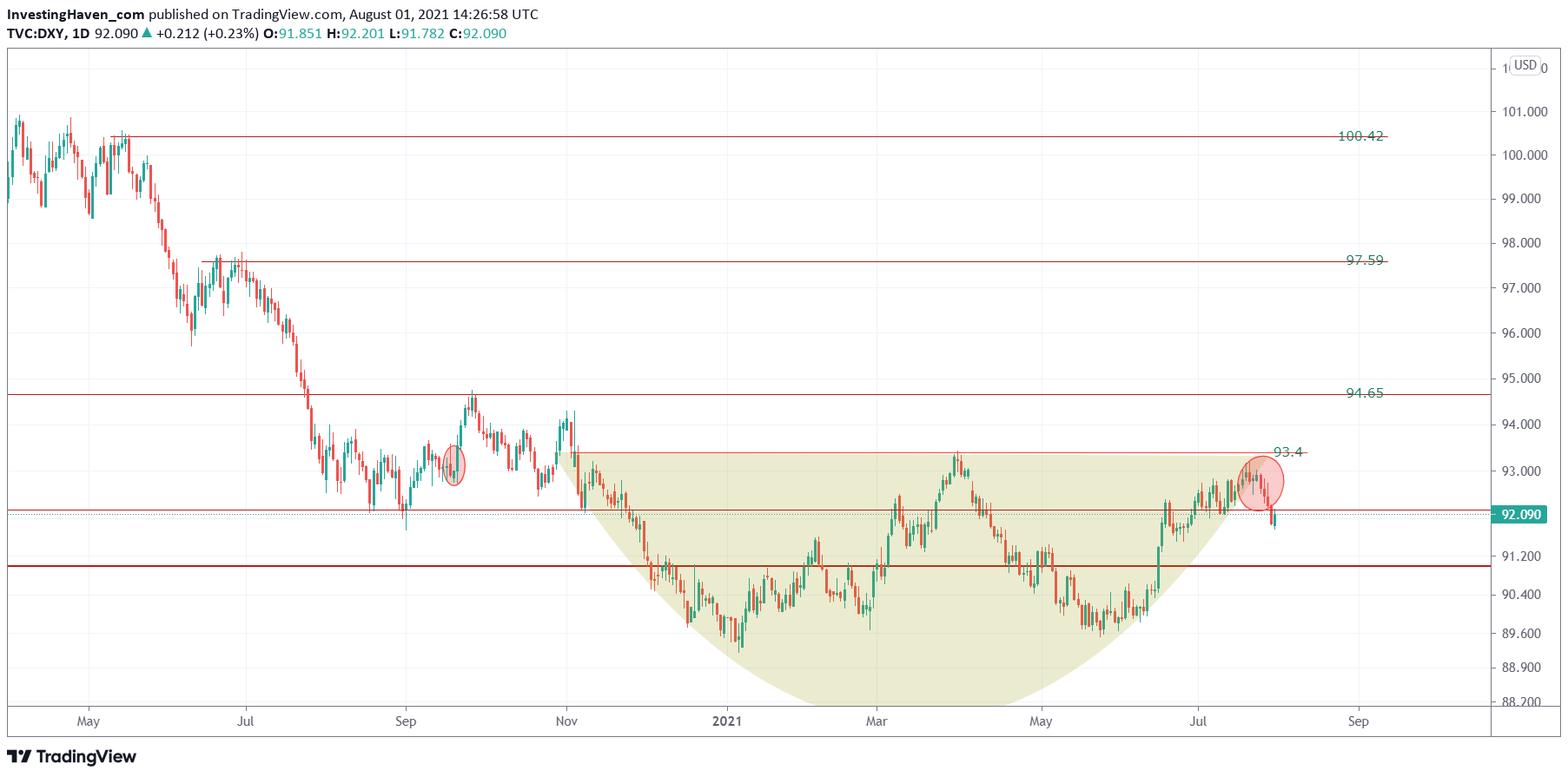

The first chart is the USD with this obvious W reversal which was in the making for 9 full months.

It broke down! It invalidated more specifically last week Thursday. It confirmed this breakdown 3 days after it moved outside of its 9 month pattern.

This was the one chart which caused us some concern for our gold and silver forecast to come true. This obstacle is now out of the way, and gold and silver can thrive in the 2nd half of 2021!

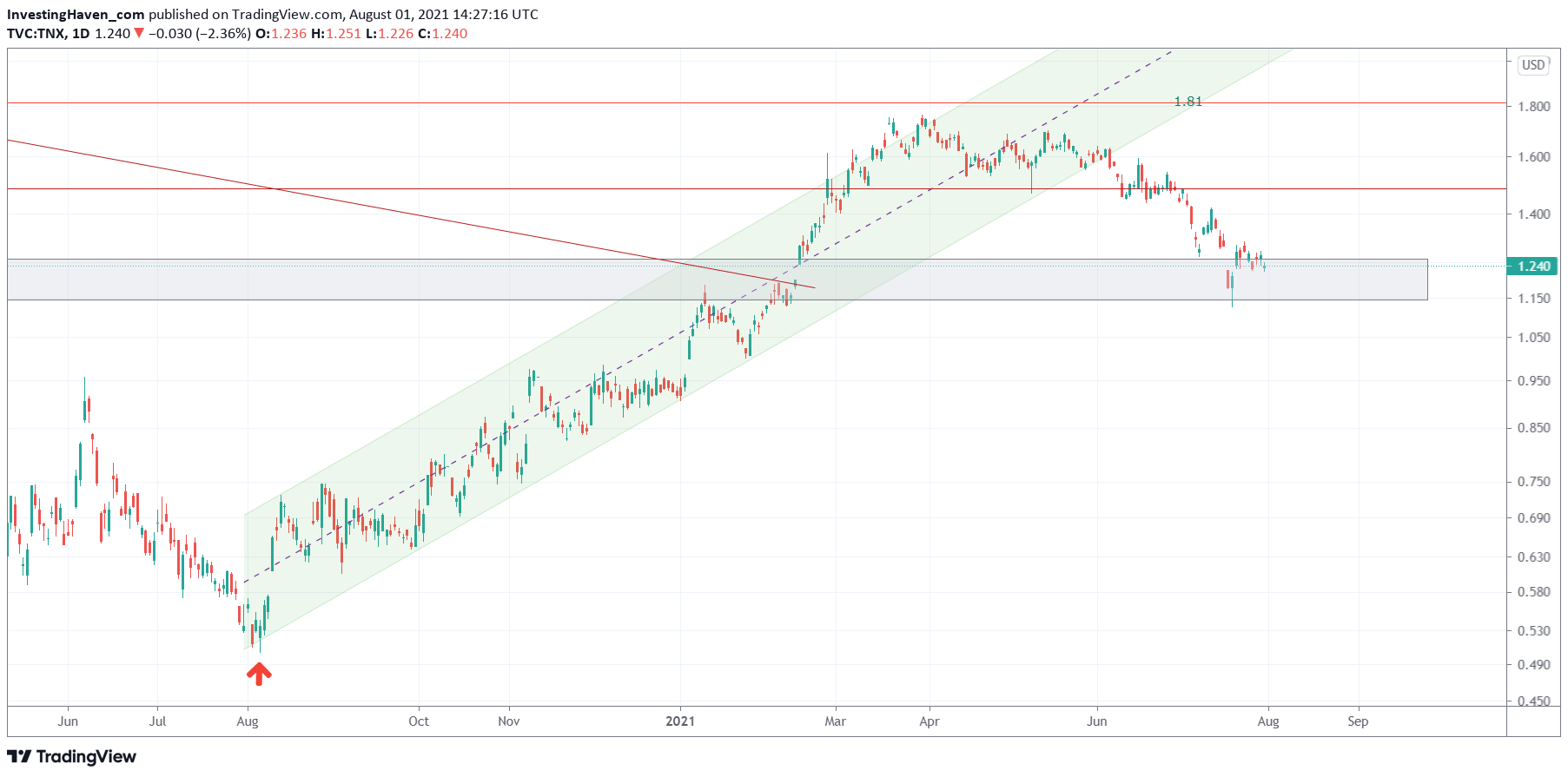

Bond yields, featured below, was already very supportive of precious metals. However, it also needed some sort breakdown or weakness in the USD. We now have both in place.

Bond yields broke down on June 1st, which is why we expected silver to break out in that first week of June. It didn’t happen, but it will happen in August/September.

Note that falling bond yields may become a serious concern for stock markets. Here is how we think of it:

- IF TNX (10 years bond yields) respected 1.15 and consolidate in the grey area on the above chart we will see a regular pullback in stocks indexes as we go into fall.

- IF TNX falls below 1.15 we might see a move that is much more significant than a regular retracement.

Whatever happens in broad stock markets we have seen over and over again that silver (stocks) can do extremely well even if broad stock markets do moderately well or even if they retrace.