Latin American stock markets played catch up this week. We consider this one of the best momentum plays in the short term. But is there lots of upside potential? Is it too late to enter?

Visibly, the writing was in the wall. Latin American countries had to catch up sooner rather than later.

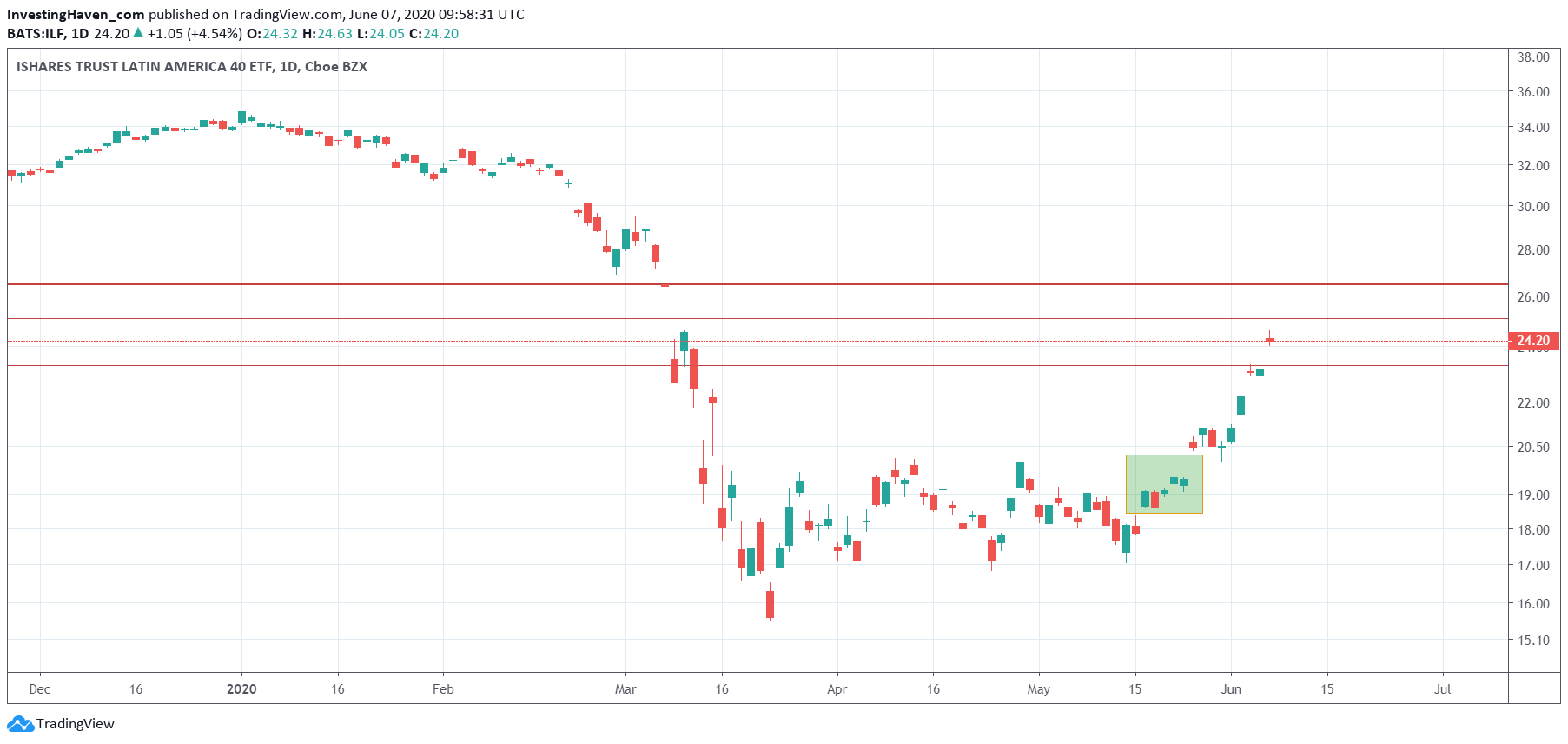

The indicator we use to track Latin American stocks in ILF ETF. Its daily chart is shown below.

The most important characteristic of this chart was the perfect bullish reversal pattern. It had all it required to qualify as a perfect bullish reversal, with a high level of confidence of a strong move higher.

What was the best timing to enter Latin American markets?

Arguably there are 2 ideal moments to enter Latin America:

- The moment the volatility ended. This has the green annotation on the chart. It’s the moment buyers and sellers agree that their fight concludes, bear give up and it creates room for bulls to take control.

- Arguably, the better moment was 5 days later, right after the ‘backtest’ of the resistance of this green annotated box. There is one green candle with a wick (7 trading days ago), that’s the ultimate confirmation of what we would call the ‘breakout’.

In our Momentum Investing service we had been tracking Latin America for a while, and we decided to enter as per option 2 explained above. So far it delivered us an unrealized profit of approx. 12% on one of the two positions we hold in our Momentum Investing portfolio.

We think it’s a bit too late to enter Latin America now. The upside potential is some 27 points in ILF ETF, some 10 pct upside. Better to wait for a pullback in a few weeks or months.

Members of our Momentum Investing portfolio have an edge, as they receive our buy alerts as close as possible to the best timing to enter a market. This delivered consistently trades of +10% in recent weeks, with our Latin America position being just one of those trades.