One of the most important leading indicators of markets is the Euro. It has a history of setting the stage for ‘risk on’ or ‘risk off’ cycles. As said in our 100 Investing Tips For Long Term Investors we better take large moves in currency and credit markets very seriously. Where do we stand today with the Euro, and what can it reveal to investors?

In the bigger scheme of things, as said last week we believe, the Euro is in an uptrend. This means ‘risk on’ for the coming 9 to 18 months.

We explained this in great detail in this article a week ago: Why The Euro Could Trigger Strong Momentum Into Commodities in 2020

But with the recent sell off in markets, which started right after the FOMC Meeting on Wednesday, did anything change in the Euro setup?

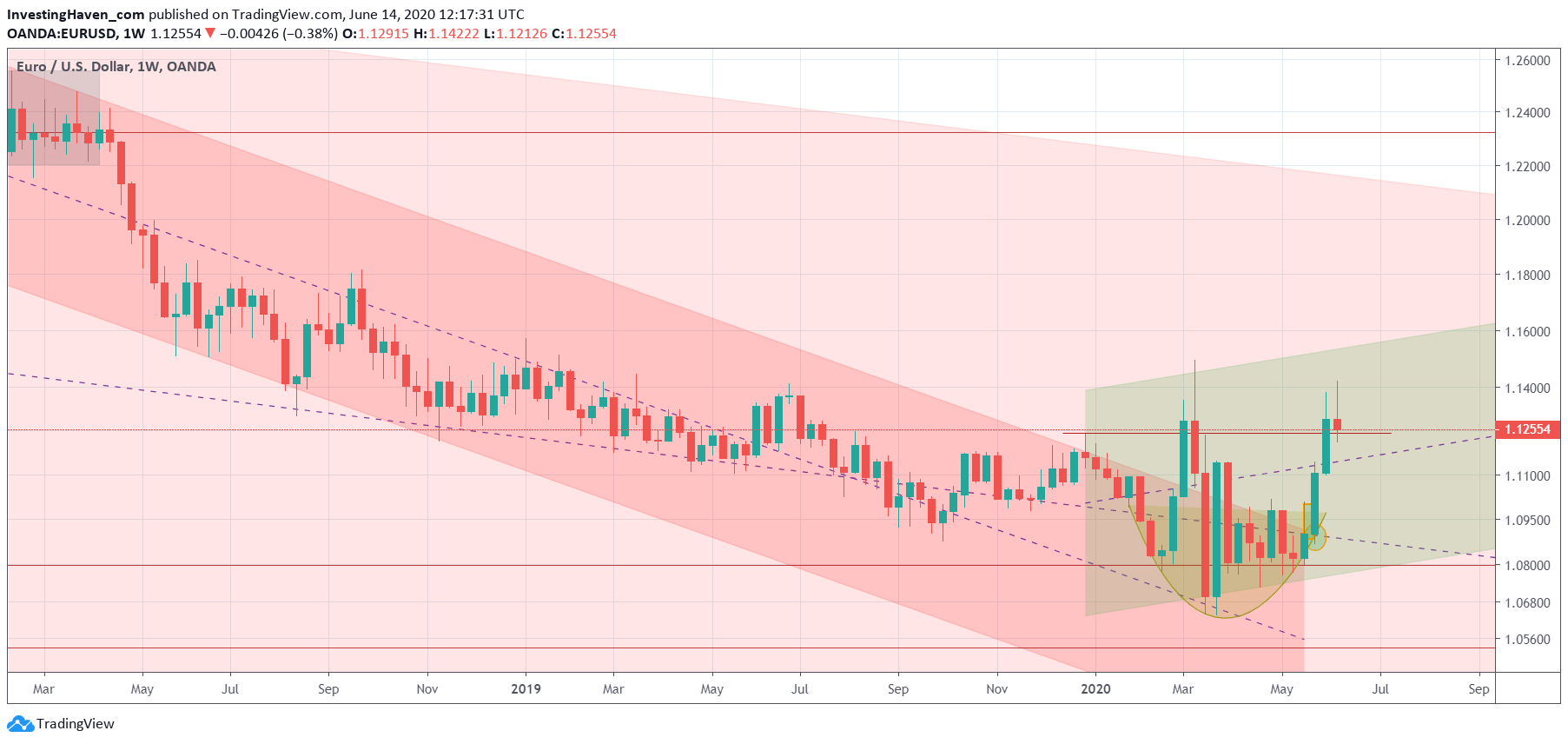

Structurally, nothing changed. We mean by this the longer term trend is intact, the Euro is pointing higher. We can see this on the weekly chart embedded in this article.

Shorter term, say for the coming 4 to 8 weeks, the Euro is testing important support at 1.12 (EURUSD).

Why is this so important?

Because a fall below 1.12 in the EURUSD would trigger more selling in the Euro (ultimately to 1.08), and this would trigger more selling in global markets.

However if 1.12 (EURUSD) holds we can expect some consolidation especially if this comes with easing in interest rates moves and some of our other leading (crash) indicators.

In our Momentum Investing methodology we refined our approach this week, after being stopped out by the U.S. Fed last Thursday. Our investing strategy remains intact, but we add a very precise approach to spot very precise entry points for our investments. When we say precise, we really mean ultra precise. Current market conditions require investors to think as investors, but execute their investments like traders (must read alert, accessible after signing up). This new (ab)normal in markets require investors to be sharper than ever before, and this is not going to change before 2021.