We have said it many times before: the Euro is not simply a currency, it is one that helps understand the big picture risk trend in global markets! So the high level direction of the Euro helps understand whether capital is flowing to risk assets (or not). This is what we call intermarket analysis. Last week we shared this Phenomenal Setup In The Euro, Global Leading Indicator which featured the monthly Euro chart and the importance of April’s monthly closing price. Today we follow up on this with new findings, and a bullish forecast for the second half of 2021.

We explained last week why the monthly Euro chart is not just impressive from a chart perspective… we also explained how this might impact global markets going forward:

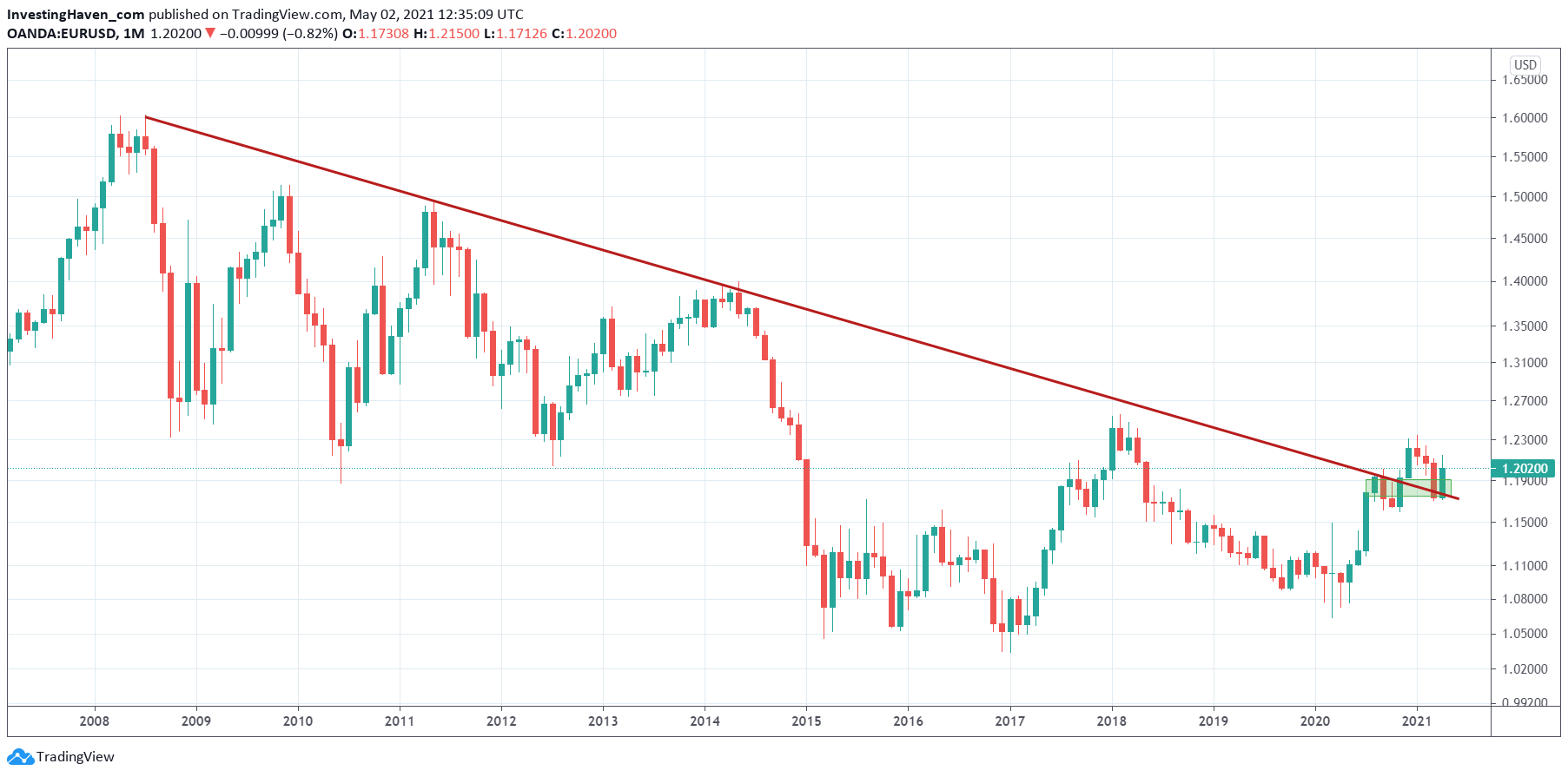

- First of all, the Euro is now confirming a breakout after a 12 year downtrend! This is major, this is breaking news.

- Second, look at the structure between 2014 and today. A giant W reversal. Hugely bullish!

- Third, a bullish micro reversal took place (on its daily) right at a 12 year trendline.

This was our conclusion from last week:

What the Euro charts tell us is that stocks in general, but primarily commodities will do well in the long run. Validation of this thesis: Euro must continue to close above 1.20 points in the next 3 to 5 months.

As April of 2021 came to an end we see that the Euro printed a good closing price. Slightly higher would have been better, but the point is that the Euro closed above the 12 year falling trendline.

This is good, and the next 3 months we ideally see prices above 1.18 (without touching 1.18 even not intra-month). This would confirm a new secular bull market in the Euro. It’s the best case scenario for bulls.

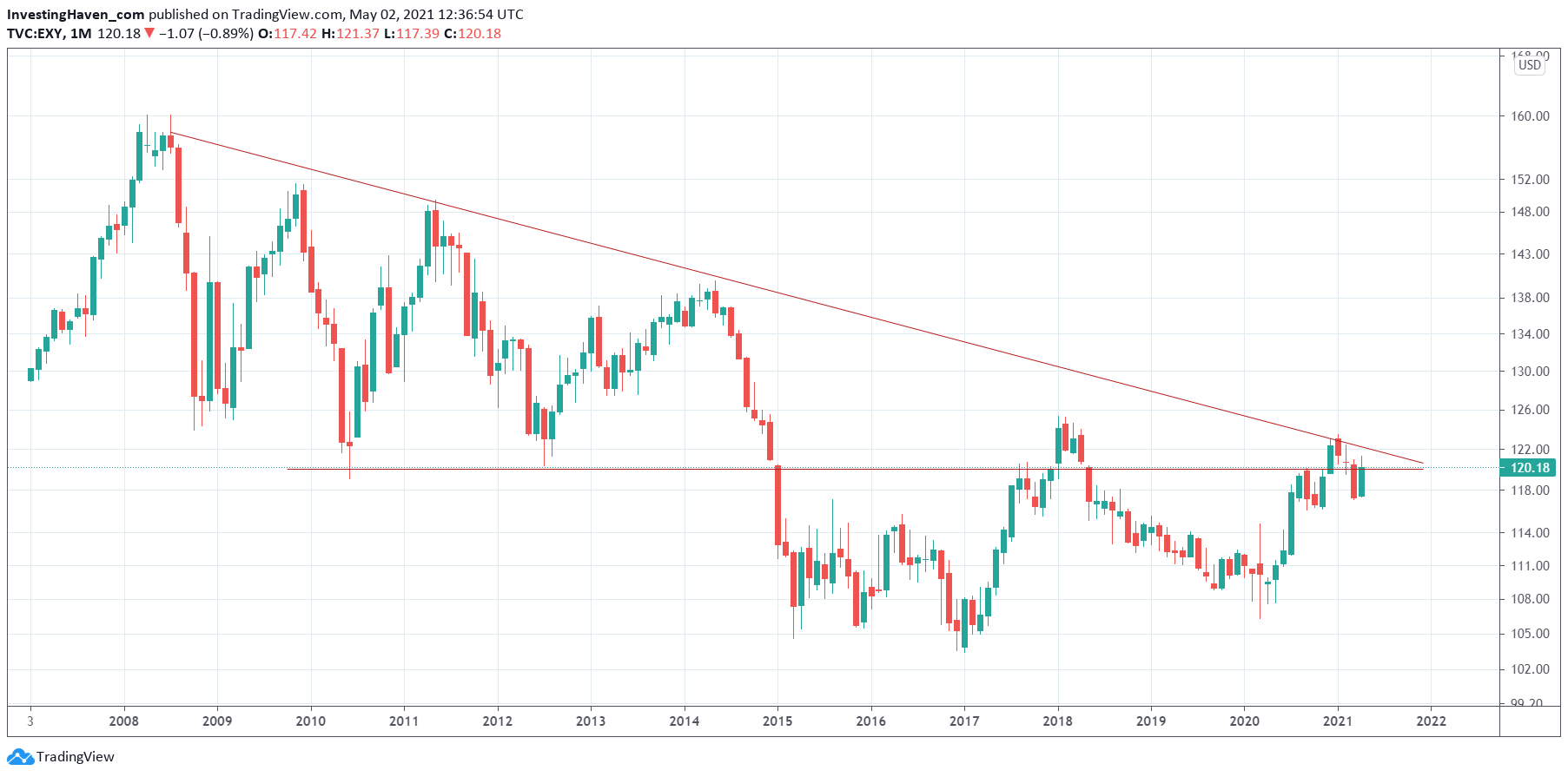

The one chart we didn’t feature in the past is the Euro index. Slightly different than the EURUSD chart featured above.

Our point of view is that the ultimate confirmation of a new secular bull trend in the Euro will be there once the EURUSD trades above 1.18 points and the Euro index (below) breaks the falling trendline to the upside. A few more months are required to meet both conditions. Ultimately we believe it will happen late this year, and it will bring good momentum into markets (again, which is a while ago).