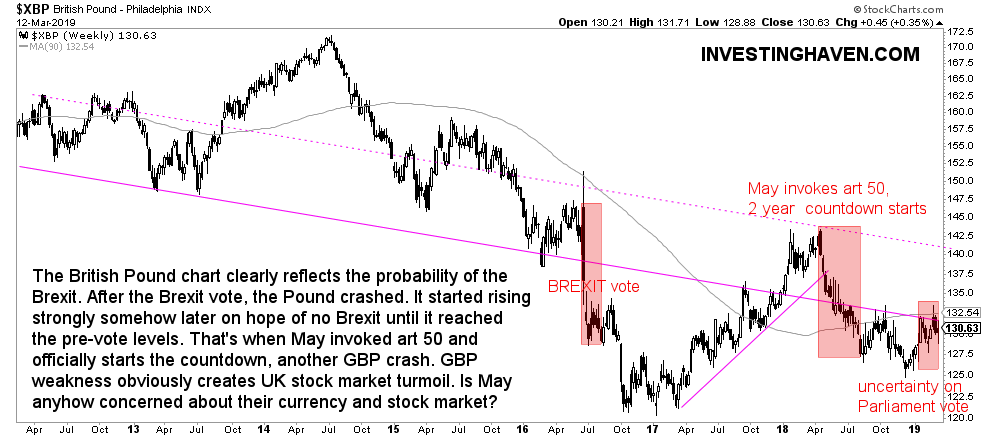

The British Pound chart over the last 2.5 years clearly reflects the probability of a Brexit to materialize. GBP weakness obviously creates UK stock market turmoil. Is May anyhow concerned about their currency and stock market? Intuitively, one would expect the government to also be somehow concerned about its currency and stock market. We are not sure Mrs May or any of her advisors ever checked the chart of ‘their’ British Pound.

The Brexit news is again all over the place.

We are not interested in the news, nor in the fundamental or economic analysis of any vote. We are only interested in the impact on currency, credit and stock markets.

From a Brexit timeline perspective it is clear how the rollercoaster of the Brexit discussions can be mapped on the chart of the British Pound.

- After the Brexit vote, the Pound crashed.

- The British Pound started rising strongly somehow later on hope of no Brexit until it reached the pre-vote levels.

- However, when May invoked art 50 in March of 2018, and the countdown officially started, it resulted in another GBP crash.

- In recent months, with the uncertainty with the Parliamentary votes, the Pound acted weak as well.

Be that as it may, not only is the Pound weak, also does it create weakness in the U.K. stock market.

Looking at the chart of the Pound (see below) but also the British stock index (not in this article) leaves any investor with the question whether Mrs May or any of her advisors is interested at all in any of this?

We do not have an answer to this question, and it is certainly not the most important question to sort out.

What we do know is that the British currency and stock market should be avoided as long as there is uncertainty, it is the only wise thing to do.