Mobilicom Limited is a tiny tech stock in Australia with a market cap of $30M. It has received recently multiple large orders in the robotics and drone segment. Is this tiny tech stock one of the top investing opportunities of 2019? How promising is this, which are pros and cons and is it worth considering given the risk of a nano cap stock?

Mobilicom Limited trades on the Australian Stock Exchange (ASX), and is a nano cap stock which by default means a very high risk. Our article should be read with this in mind.

The fundamental case for Mobilicom is very simple: they are both in the drones business as well as the wireless communication networking systems. This article shows that Mobilicom is getting traction in its drones business unit. No coincidence as it’s a blue ocean!

Fundamentally, there is an amazing opportunity for drones to solve ‘the last mile’ problem in online commerce. It is the last mile to the customer that is the most difficult one for logistics. This is a great article that makes the point. This is also the opportunity we see for Mobilicom.

Mobilicom Limited: Cash Burn offset by Revenue

Earnings per share went from -4.12 at the end of 2017 to -1.46 at the end of 2018. This looks like an amazing improvement in relative terms, which it is, but in absolute terms this is still a serious loss.

As expected, the company has to rely on shareholder dilution to fuel its growth, as an answer to its cash burn. We find back in the annual report that Mobilicom Limited created 50% new shares in 2018:

- Number of shares at the end of 2017: 147M

- Number of shares at the end of 2018: 217M

Remember, 50% shareholder dilution is huge, and it has to be offset by very, very strong revenue figures in order to survive and grow into an economically viable business.

That’s why it’s crucial in this phase to get strong traction in terms of customer orders. That’s what we are looking for, and it is the absolute condition before even considering to take positions in a nano cap stock!

Mobilicom Limited: Financials 2018 and first results 2019

Top line and bottom line financial results of 2018

From the company’s annual report:

The company has improved its financial results,year over year across all parameters, growing it revenues to $2.6M, up 74% from $1.5M in 2017. The increase resulted from both recurrent and new customers, as well as from more products from different applications and new geographic markets.

Government grants for the year increased by 59% compared to 2017.

Operating expenses were lower than planned, reflecting strong execution and a significantly lower net cash burn rate for the period. This has allowed the company to maintain a strong cash balance of $5.0M for 2018 year end.

The loss for the consolidated entity was reduced to $3.2M, down 47% compared to the prior period.

In terms of revenue this is how the company evolved year-over-year:

- Revenue in 2017: $1,519,719

- Revenue in 2018: $2,640,006

That’s good. And we want to see more of this, much more.

After Mobilicom published their annual report on Feb 26th, 2019, they came out with more good news as it relates to revenue:

- On March 6th, 2019, the company announces a strategic partnership between its drones business unit and solutions with Yuneec which is among the largest drones manufacturers in the world (selling 1M drones per year). Yuneec drones will contain parts / solutions from Mobilicom’s SkyHopper. The company did not disclose the incremental revenue because of this deal.

- On March 19th, 2019, the company launches a new drones solution which for they expect $1M of revenue in 2019. This will be largely driven the Israel Ministry of Defense ($572,000 purchase order).

These are encouraging signs, and the right type of evolution and news we want to see.

Mobilicom Limited: To Buy or Not To Buy

The million dollar question is if this nano cap stock is worth buying. It may be one of those positions that deliver 30% to 100% upside as per our formula to turn 10k into 1M.

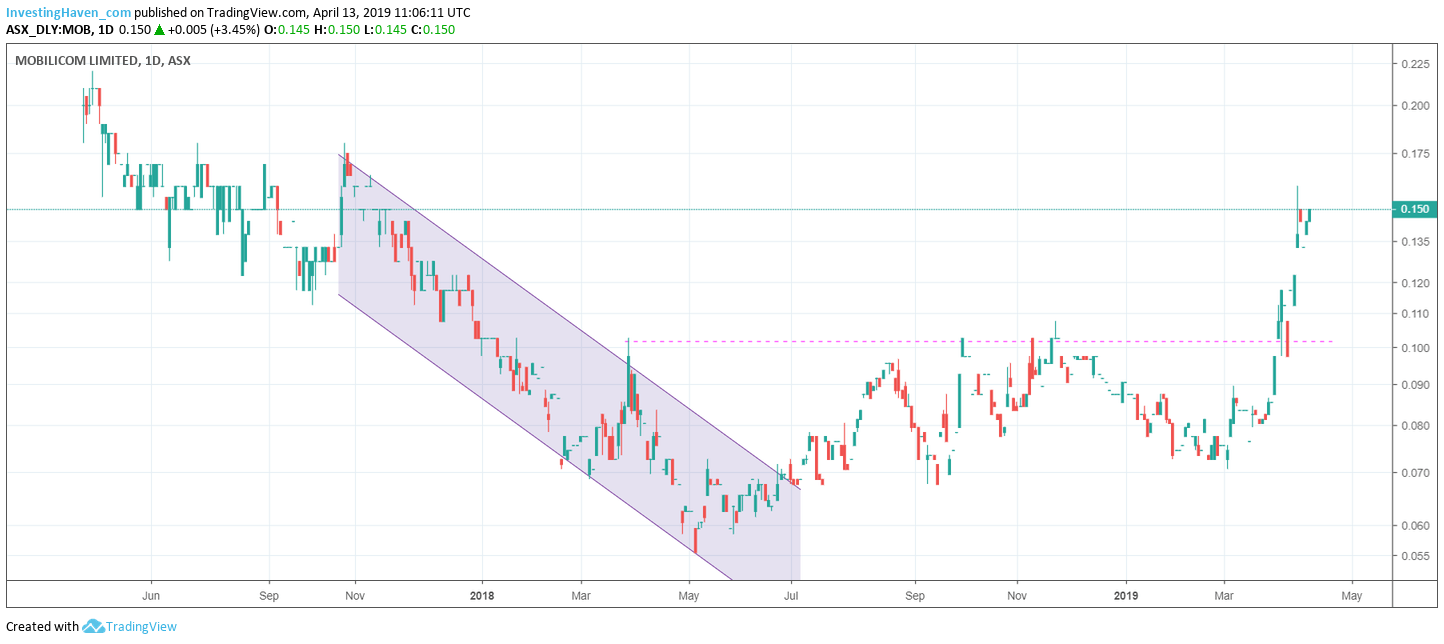

Although this stock has almost doubled in recent weeks, since the 2 announcements in March outlined above, we still believe there is upside potential. This is our rationale:

- There is a fair chance that revenues will go much, much higher in 2019. The $2.6M from last year should easily rise. We would think $3.5M revenue should be feasible.

- Unclear how many more shares the company will create, so shareholder dilution is an unknown. However, the cash at hand as 2019 kicked off was $5M so they will easily survive this year (at a minimum a large part of the year) without raising capital.

- With the above assumptions the price-to-sales ratio is approx. 9 times. That’s not bad at all, given that a fast rising top semiconductor stock like Xilinx has a similar P/S ratio.

- Fundamentally,

We believe this is a buy, though a tight stop loss is strongly recommended! Very important: the liquidity of this stock is not very high, some days there are no transactions and some days there is just 10 to 20k transactions. Liquidity is always a very important attention point for nano cap stocks, so for anyone considering to go long positions must be very small in this stock at this point in time, not more than 30 to 50k to avoid issues when selling at a later point in time.