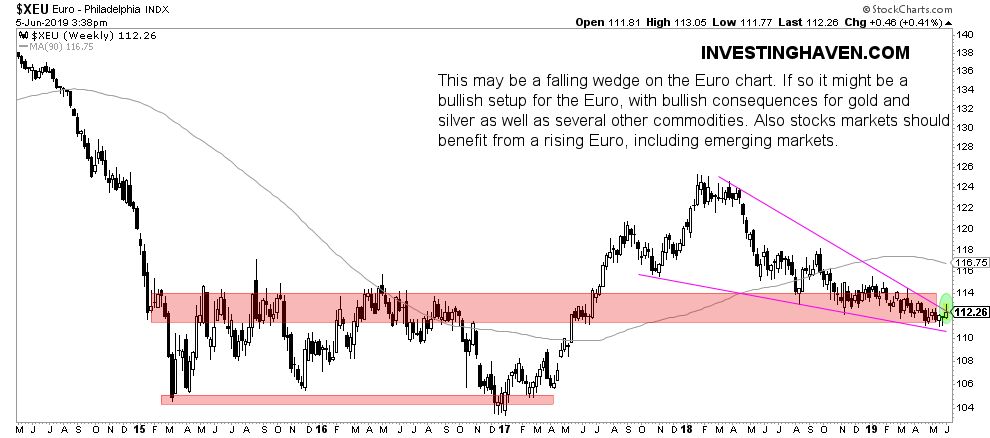

“The Most Important Chart For Global Markets Signals A Trend Change”. These are really big statements, and we take them really seriously. The Euro chart which according to our proprietary leading indicator methodology is the most important financial instrument for global markets as it sets the tone for most other markets is hinting at a trend change! This may have a serious impact on global stock markets, our gold forecast and silver forecast, top gold stocks, and top commodities.

The Euro chart has a track record of indicating important trend changes in global markets before they take place.

As per Tsaklanos his 1/99 Investing Principles it is 1% of the times that trends change, and it determines 99% of the time that markets move in a certain direction (trend).

One of the important correlations is the Euro to gold correlation. We could easily say it’s the Euro to precious metals correlation. In the last 8 years, since gold’s bear market started, the Euro and the price of gold have moved in the same direction.

Moreover, as the Euro started to fall strongly from important resistance levels at the top of its long term falling channel (monthly chart) it coincided with fast falling stock markets. This is an intermarket dynamic we highlighted in our investing tips for successul investing.

In sum, the Euro consistently tends to start moving in a certain direction, especially from crucial resistance and support levels in its secular chart patterns, before other global markets change their trend.

Right now, we see a falling wedge pattern on the weekly Euro chart. This may suggest the start of a medium term trend change. It would favor gold and silver prices, precious metals stocks, and arguably also global stock markets!

If the Euro changes trend we pay (a lot of) attention.