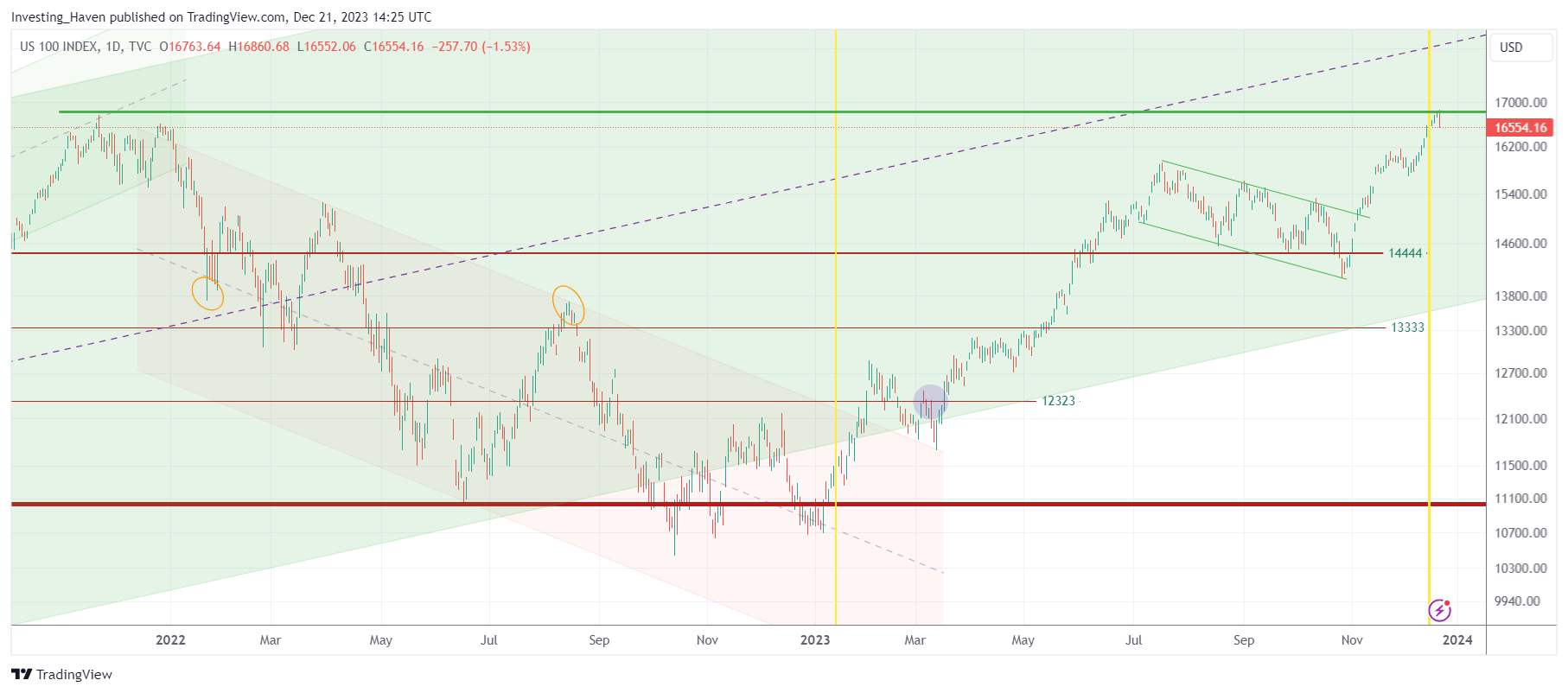

In a stunning finale to 2023, the Nasdaq surged to test its former all-time high (ATH), setting the stage for what promises to be a volatile start to 2024. As the market scales new heights, a logical point of inflection has been reached, raising the odds of increased volatility, in both directions to be clear. Investors, riding the waves of optimism, are raising sentiment as evidenced by the recent surge in bullish ratios, making bi-directional volatility almost a fact. As a reminder, we expect regular volatility in 2024, no market crash, and continued leadership of the Nasdaq as explained in great detail in When Will The Nasdaq Hit All-Time Highs In 2023 or 2024 as well as a Beautiful Nasdaq 20-Year Chart.

Swings Ahead: The Nasdaq’s return to its ATH marks a psychological milestone, yet it serves as a ‘guarantee’ of potential choppy waters in the months to come. As expectations soar with each tick upwards, the market finds itself at a crossroads, navigating the delicate balance between euphoria and caution.

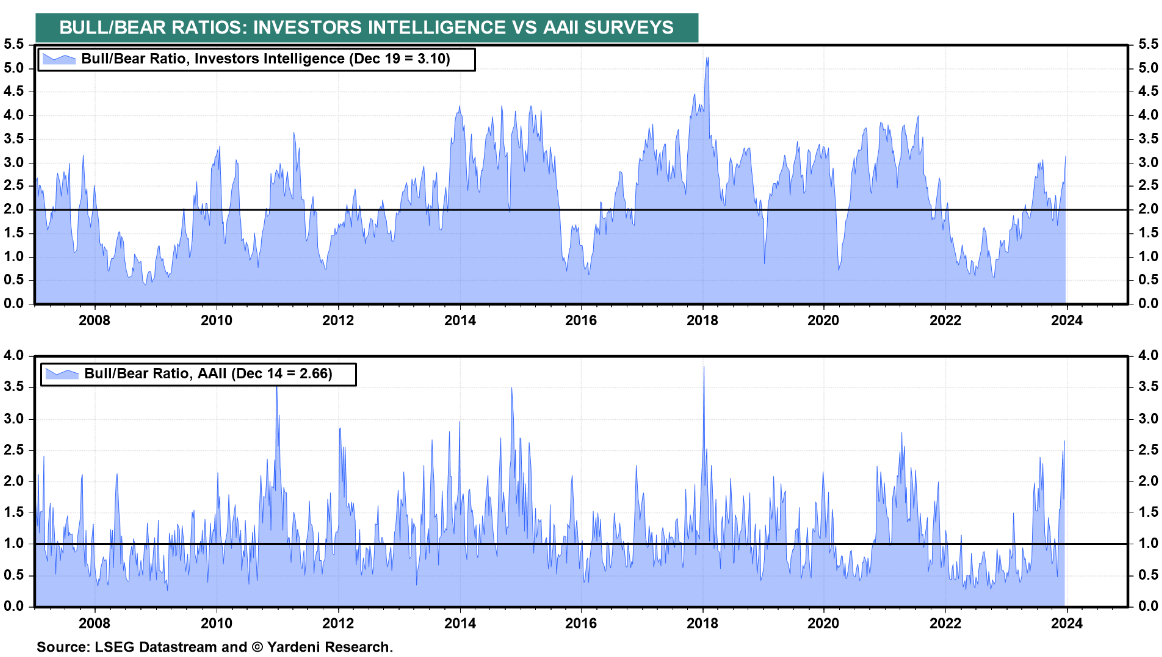

High Expectations and Bullish Ratios: The surge in the Investors Intelligence Bull/Bear Ratio to 3.10 and the AAII ratio to 2.66 underscores the prevailing bullish sentiment. Bears make up a mere fraction of these ratios, indicating an overwhelmingly optimistic outlook among investors. This fervor sets the stage for heightened volatility as the market has to handle the challenge of meeting lofty expectations. Chart courtesy: Ed Yardeni.

Nasdaq’s Leadership Role: Having been a frontrunner in hitting ATH, the Nasdaq’s performance often sets the tone for broader market sentiment. Yet, this achievement also signifies a potential shift in the market landscape as explained in almost all of our 2024 forecasts. The dawn of 2024 might witness a rotation, with capital flowing out of large caps and tech mega caps, seeking opportunities in smaller caps and other segments of the market.

The Year Ahead: As investors prepare for the journey into 2024, a clear and effective strategy becomes mandatory. The Nasdaq’s ATH test, while celebratory, demands a measured approach. The potential for choppy price action necessitates a careful assessment of risk and a consideration of the dominant sector rotation to understand which sector might emerge out of the unavoidable coming wave of volatility.

Conclusion: The Nasdaq’s return to its former ATH serves as both a cause for celebration and a call for sharpness, considering epic sector rotation which marked market dynamics in 2023 and is set to continue to dominate in 2024.

As 2024 unfolds, the market is poised at a critical juncture, and investors must prepare for the potential turbulence ahead. The journey through choppy waters requires a strategic mindset, where adaptability and a keen eye for emerging opportunities will be the keys to success.