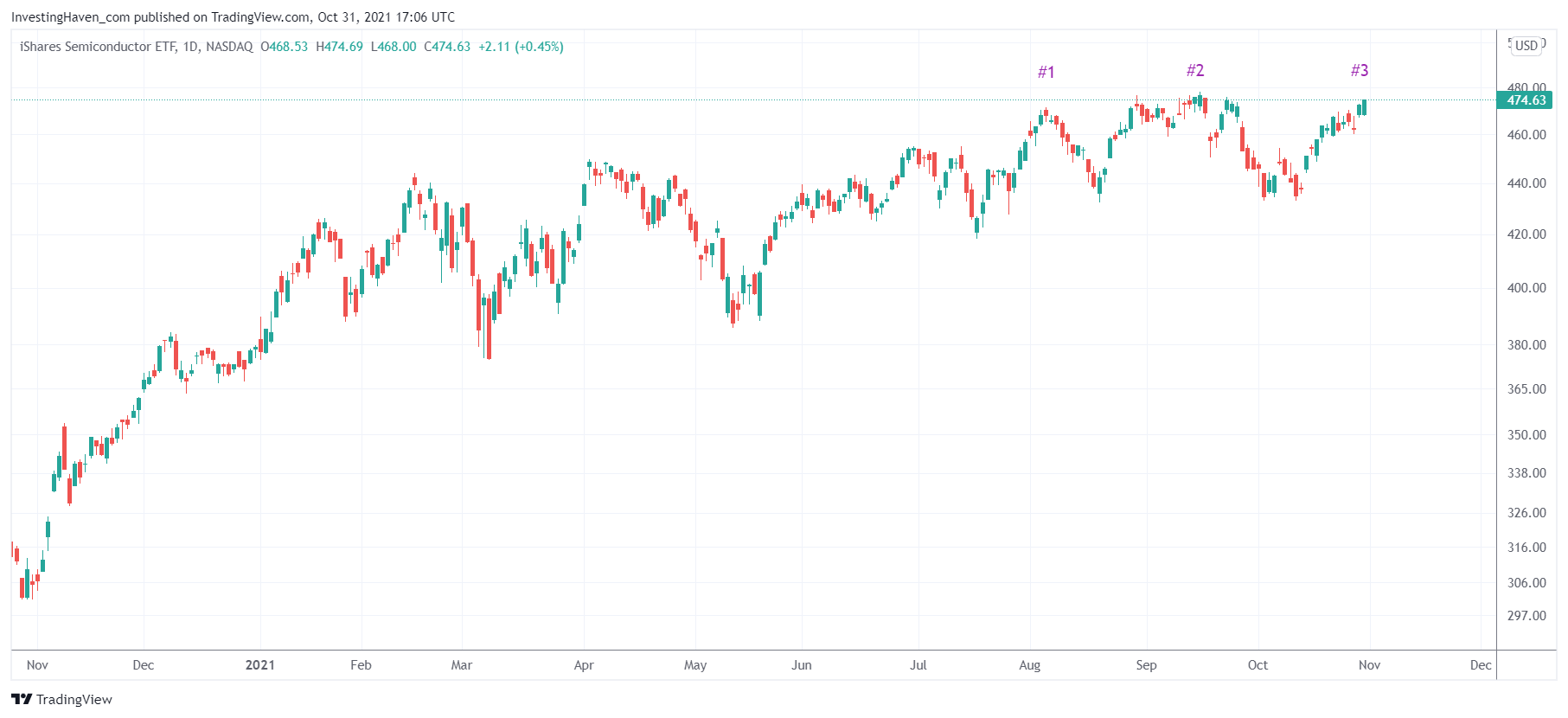

The Nasdaq printed new ATH on Friday. After a very weak month of September we got a solid month of October. Interestingly, semiconductor stocks are attempting to break out to also print new ATH. Our forecast is for a solid end of year rally which will push semiconductor stocks to new highs either in November or in December or both (breakout, back down, new and confirmed breakout).

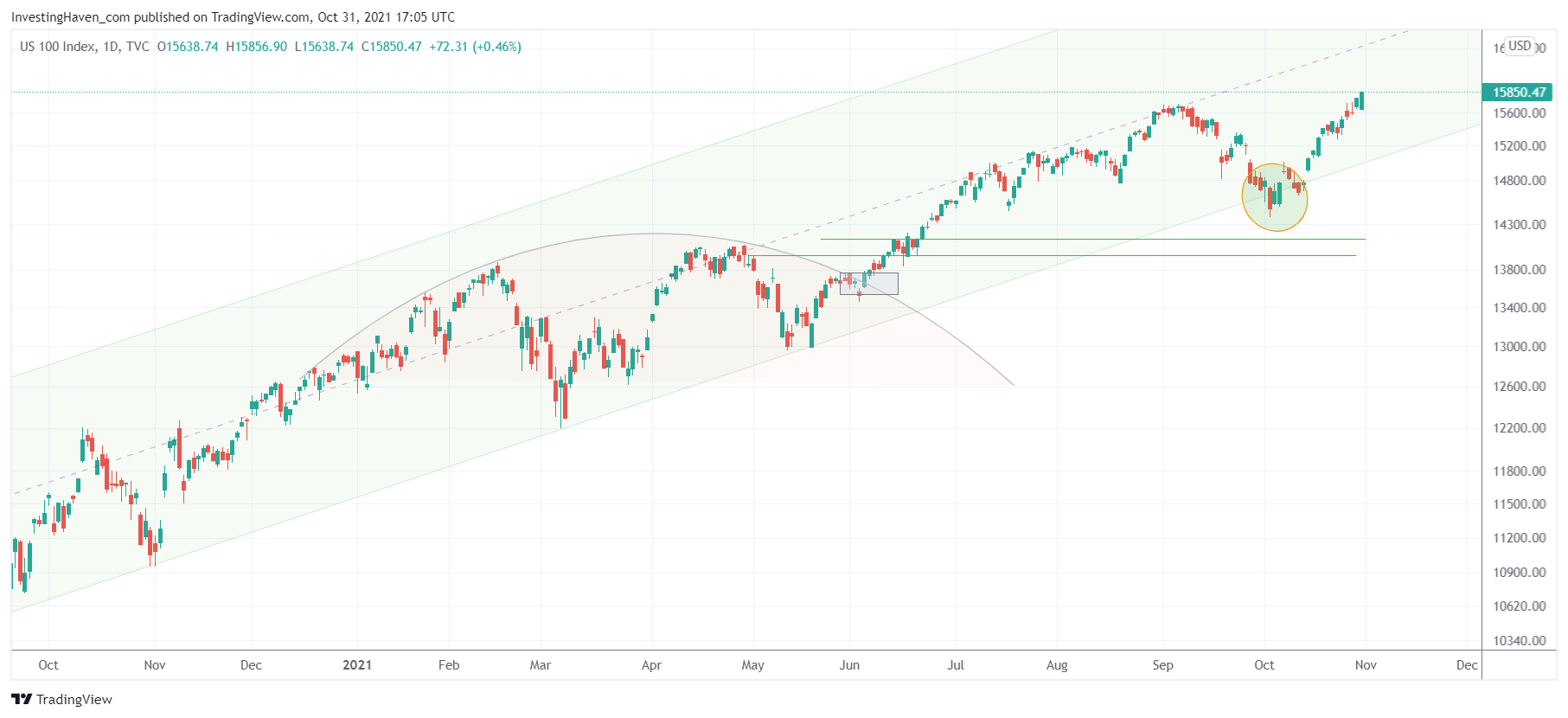

The first chart represents the Nasdaq on the daily timeframe.

Pretty impressive recovery in October after an attempt to break down (yellow circle). We expect the Nasdaq to invalidate its breakout in the month of November, only to test the 15000-15400 area at a certain point. If that level holds it would imply that the Nasdaq is ready for a move above 16k.

In the meantime we see semiconductor stocks setting higher lows and starting the 3d attempt to break out.

Semis overall look really constructive here. The ‘golden rule’ in investing is that whatever ‘works’ at the 3d attempt (or right after attempt #3) is really powerful. In the case of semis if they break out now (attempt #3) or ultimately need one more attempt it would be a really reliable breakout. Even if they get back down (after breaking out) it could still be reliable. A breakout test is not a bad thing, it is a good thing (it can feel scary for an investor).

In our Momentum Investing portfolio we initiated a position in a semiconductor stock that is really promising, both fundamentally as well as chart-wise. This stock will release quarterly earnings on Thursday, so it will be interesting to watch if it can confirm the strongly bullish outlook we see in the chart.