Tech stocks sold off hardly in the period February-April. Tech stocks are the ones to rebound first. That’s what characterizes 2021: big rotations, big reversals, like the big breakdown in industrials & financials that started last week. So it pays off to watch trends closely, and not get disappointed if you are not realizing a profit in a sector. If you track that sector, and wait a few months, you might see a bullish reversal. Note that we mentioned the tech stock recovery story, back in May on our public blog Nasdaq: This Week’s Bullish Micro Reversal Deserves Your Attention.

That’s how it currently goes with tech stocks, and biotech is one of our favorite sectors as per the tech charts.

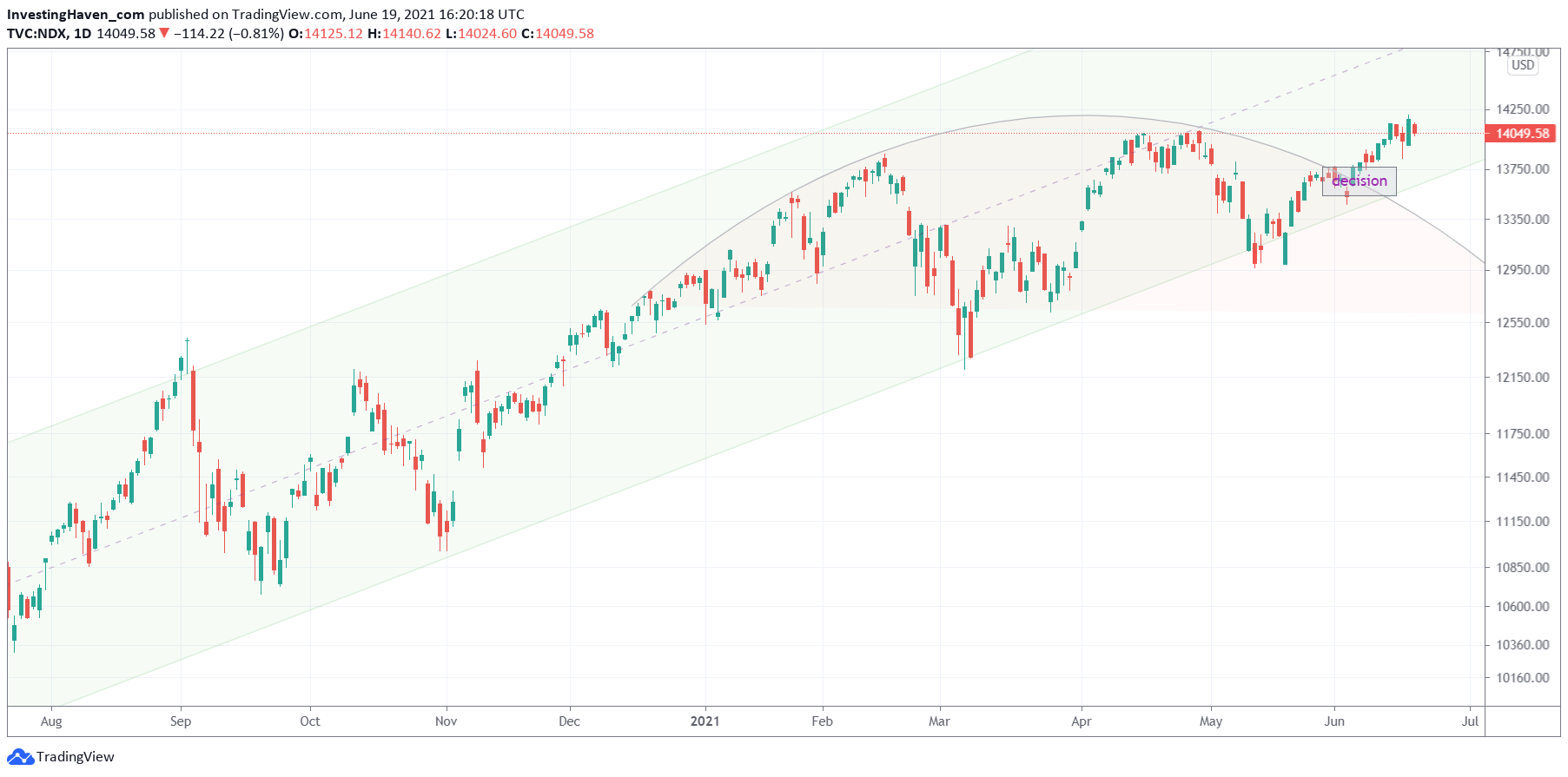

The daily Nasdaq chart says it all: on June 4th we got what we call a ‘break up’ of the rounded pattern. We marked this decision point, and it happened exactly in that short time window that we indicated on the chart back in May. Bullish long term, a back test of support of this channel may happen if stocks come under pressure in the next few weeks.

Biotech is close to becoming one of our favorite segments in the Nasdaq.

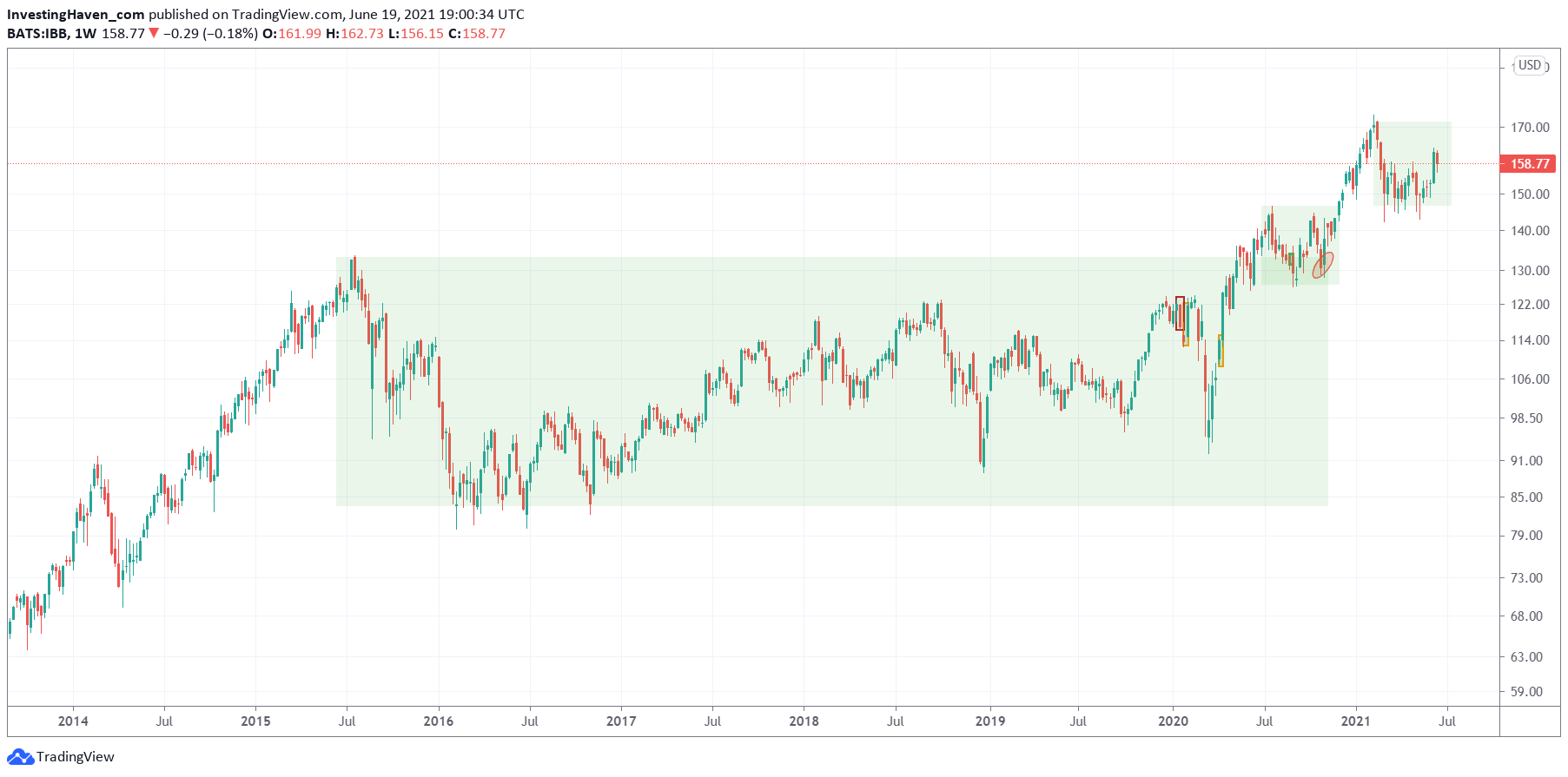

The weekly chart has this amazing reversal over 5 years with two mini-reversals in the last 2 years.

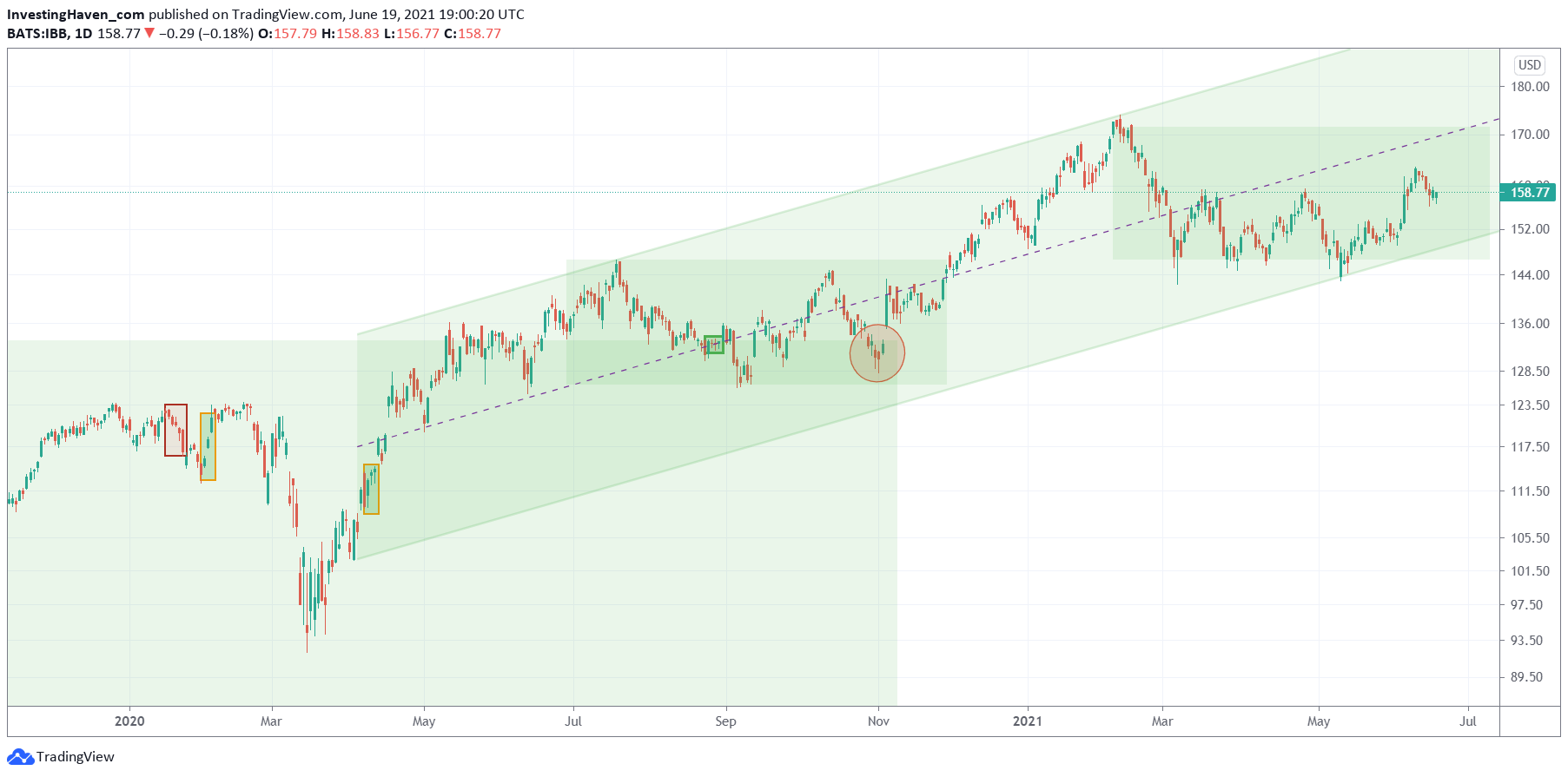

If we zoom in we see that the Nasdaq now has a defined channel in which it moves. This sector printed a very nice bullish reversal in the period March-May.

From an anecdotal perspective we like the fact that biotech is not hot today. ‘Nobody’ is talking about biotech stocks. It makes us very excited about this sector.

From an anecdotal perspective we like the fact that biotech is not hot today. ‘Nobody’ is talking about biotech stocks. It makes us very excited about this sector.

In our intra-week Momentum Investing updates we featured the Nasdaq recovery in more detail, some 6 weeks ago. We didn’t feature biotech stocks yet, but we might do so. We found some really ‘juicy’ setups in scanning markets recently.