It was just 2 months ago when we wrote Organigram Holdings’ Selloff Morphing Into A Screaming Buy Going Into 2020. What happened since then in the cannabis market is really (really) ugly. Not often do we witness such a heavy sell off. It was the 2008 moment for the cannabis stocks space. Organigram Holdings (OGI) came with an earnings warning two weeks ago, and the market punished this stock seriously. From hero to zero in 2 months.

Note that readers who follow our work should have noticed the article in which we warned that Organigram Holdings Started A Secular Breakdown. This article came exactly one week after the ‘screaming buy’.

If the chart shows something ugly you better listen. That’s what we did, and shared it immediately once we saw it!

This is a quote from this last article about the breakdown:

Unfortunately, this stock has more room to fall, even to the $4.00 area. We believe it will stop falling there. That’s another 20% downside.

OGI indeed stopped falling at $4.00, as expected.

However, two weeks ago, when the company warned the market that revenues would be lower than expected, the market sold OGI heavily (as in, really heavily).

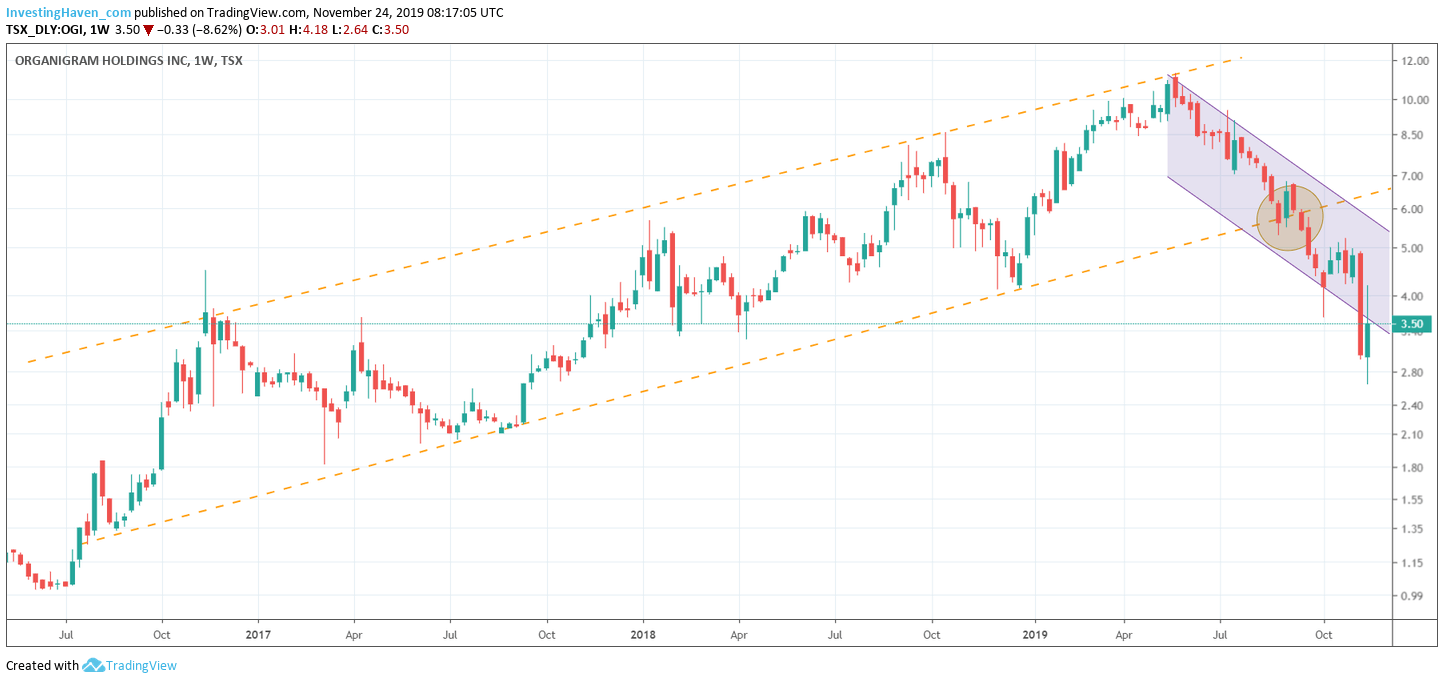

The chart below shows this huge red candlestick from last week.

This week there was some sort of relief rally. Still not meaningful in the bigger scheme of things, as the stock now trades right below the falling channel.

Yes, there is more downside.

Yes, we are glad we are able to spot the breakdown in time (don’t say we didn’t send a warning right on time).

No, this probably did not prevent from readers, including ourselves, to still burn fingers!

The cannabis space needs a lot of time to repair this damage. Eventually there will be bullish things happening in this sector, though not exactly as in the years before.

The lesson? The chart does not lie, a breakdown is a breakdown, period. You better sell the breakdown, and miss some potential upside. That’s more worth than not avoiding a potential heavy sell off. It takes a few times until investors learn this message, and this applies to ourselves as well obviously.

The other lesson? The absolute top was reach on August 21st, 2019. That’s the day OGI started trading on the TSX, after graduating from the TSXV, see press release. The company said this was good because the stock would be available to a larger audience of investors. In reality that larger group of investors appeared to be happy to short the stock like there was no tomorrow. The lesson here is to be careful once structural changes take place in a stock: can be very positive, can be the opposite, and certainly don’t listen to what management says (obviously they will bring the good news show)!