In our Rapid7 Stock forecast for 2019 we said Rapid7 (RPD) would rise to 50 USD in 2019. Is this price target still in play after the sell-off in October and November?

In order to answer this question we have to check how the company is performing since we published we published this forecast 3 months ago.

As a reminder, Rapid7 provides security services, cloud based. Not only is it solving a big problem with basic security services, also did it focus much more on analytics in order to pro-actively signal security holes in the system landscape of a company. It started taking this service to the next level, last year, with machine learning and artificial intelligence.

In other words they are solving a real problem.

On November 6th the company published their Q3 results. These are some highlights:

- Total revenue for the third quarter of 2018 was $65.5 million, an increase of 30% year-over-year.

- For the third quarter of 2018, GAAP loss from operations was $(10.0) million, compared to GAAP loss from operations of $(13.0) million in the third quarter of 2017.

- For the third quarter of 2018, GAAP net loss was $(10.5) million or a GAAP loss per share of $(0.22), compared to a GAAP net loss of $(10.3) million or a GAAP loss per share of $(0.24) for the third quarter of 2017. For the third quarter of 2018, non-GAAP net loss was $(0.8) million or a non-GAAP net loss per share of $(0.02), compared to a non-GAAP net loss of $(6.6) million or a non-GAAP net loss per share of $(0.15) for the third quarter of 2017.

- Adjusted EBITDA was $0.2 million in the third quarter of 2018, compared to adjusted EBITDA of $(5.6) million in the third quarter of 2017.

Moreover, in their business updates, we liked very much the following:

- Annualized recurring revenue (ARR) for the third quarter of 2018 was $217.4 million, an increase of 46% year-over-year.

- Their renewal rate for the third quarter of 2018, which includes upsells and cross-sells of additional products and services, was 120%. The expiring renewal rate, which excludes upsells and cross-sells of additional products and services, was 90% in the third quarter of 2018.

- 81% of total revenue in the third quarter of 2018 was recurring revenue, which is comprised of content subscriptions, maintenance and support, cloud-based subscriptions, managed services subscriptions, and term licenses, up from 71%.

- Ended the third quarter of 2018 with 7,400 customers, an increase of 10% year-over-year.

- In August 2018, we issued $230.0 million aggregate principal amount of 1.25% convertible senior notes due August 2023.

In other words, the company keeps on growing, has a tremendous recurring business, and has secured sufficient capital to survive a long time but also do acquisitions.

In other words, fundamentals are truly awesome!

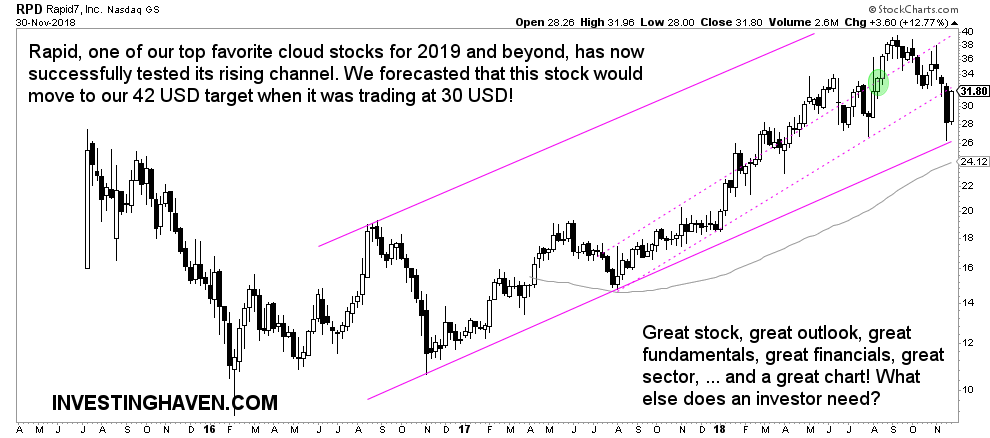

From a chart-perspective we see a great setup for Rapid7.

During the downturn in recent 2 months it became clear that Rapid7 was resilient enough. There was great buying right at support as seen on below chart.

Not only does this suggest to us that fundamentals and chart are aligned, but also does it suggest that our 50 USD forecast for 2019 is still intact. The only way we see our forecast invalidated is if and once global markets collectively break down which, so far, we do not anticipate based on the info we have at hand.