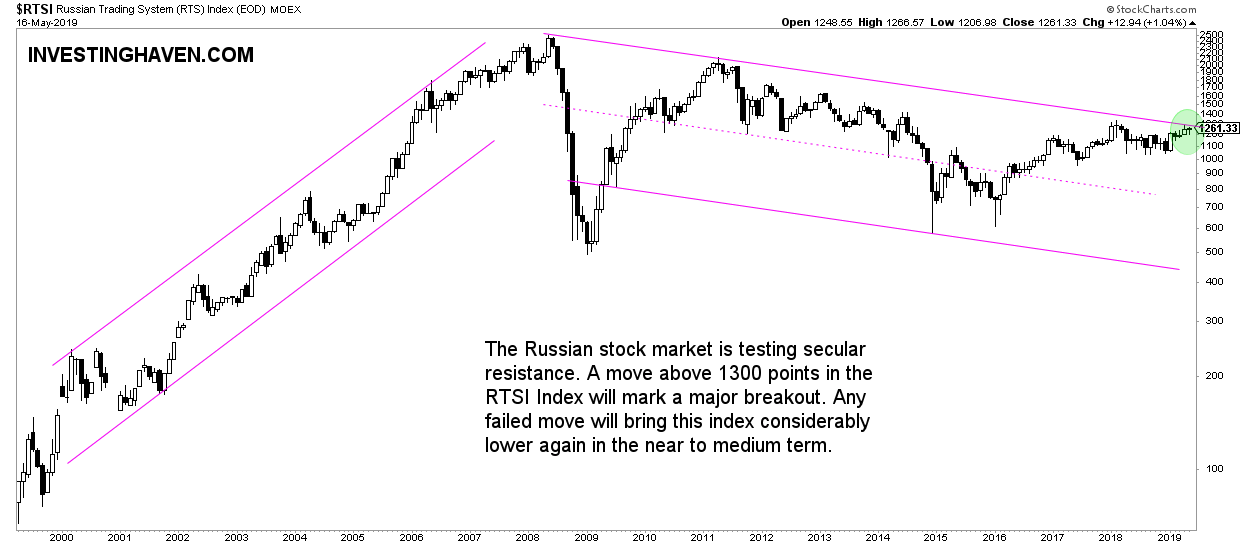

Russia’s stock market was under heavy pressure a few years ago. No coincidence the 2014-2017 period went into history books as the Russian financial crisis. No coincide the stock market at Russia crashed. At InvestingHaven we embrace stock market crashes because of their long term opportunity: Why Investors Should Love Market Crashes, And How To Make Money From It. It just needs some time. A year ago we identified this: Russia Stocks Crashing. Buy Opportunity Of 2018. It was at 1000 points of the Russian stock market index. Now at 1260 points the index is testing a secular breakout level. Will this become one of the TOP investing opportunities of 2019?

The Russian stock market is a classic case of how to follow a stock market crash, and how to invest in it.

One thing is clear: you don’t just invest during the crash, you give it time to stabilize first. Gold investing tips!

That’s what we did, and we saw a first opportunity to get in somehow a year ago, at 1000 points of the Russian stock market index RTSI.

The whole point is that not any investor pays attention after a crash. That’s because media brainwashed investors with a never ending series of fear-mongering headlines for a year or so.

The negative perception that’s created afterwards lasts for many, many years! An investor that cannot raionalize things will never think of investing in that particular market, in this case Russia.

According to Wikipedia:

A decline in confidence in the Russian economy caused investors to sell off their Russian assets, which led to a decline in the value of the Russian ruble and sparked fears of a Russian financial crisis. The lack of confidence in the Russian economy stemmed from at least two major sources. The first is the fall in the price of oil in 2014. Crude oil, a major export of Russia, declined in price by nearly 50% between its yearly high in June 2014 and 16 December 2014. The second is the result of international economic sanctions imposed on Russia following Russia’s annexation of Crimea and the Russian military intervention in Ukraine.

But at a certain point the tide may turn, and that’s what MAY be happening now in Russia.

We tipped the Russian index at 1000 points, a year ago, after the last heavy sell off. Right now, the index trades at 1261 points, and it is testing for the 3d time its secular breakout point within its long term falling channel.

We will soon know whether this will be a major investing opportunity, we patiently wait for the breakout to be confirmed first!

One way to play this market is through the ERUS ETF.