After a nice run in a handful of tech stocks, one that lasted two months, it is clear that the market is changing direction again. MegaCap8 stocks are cooling off. The dominant dynamic in markets, since 18 months, is sector rotation. It goes without saying that the market is preparing new trends, or a continuation of former trends, now that the hottest index of 2023 is confirming a local turning point. This does not imply that we have a secular bearish turning point, because we don’t see a secular bear market in our cycle analysis in 2023.

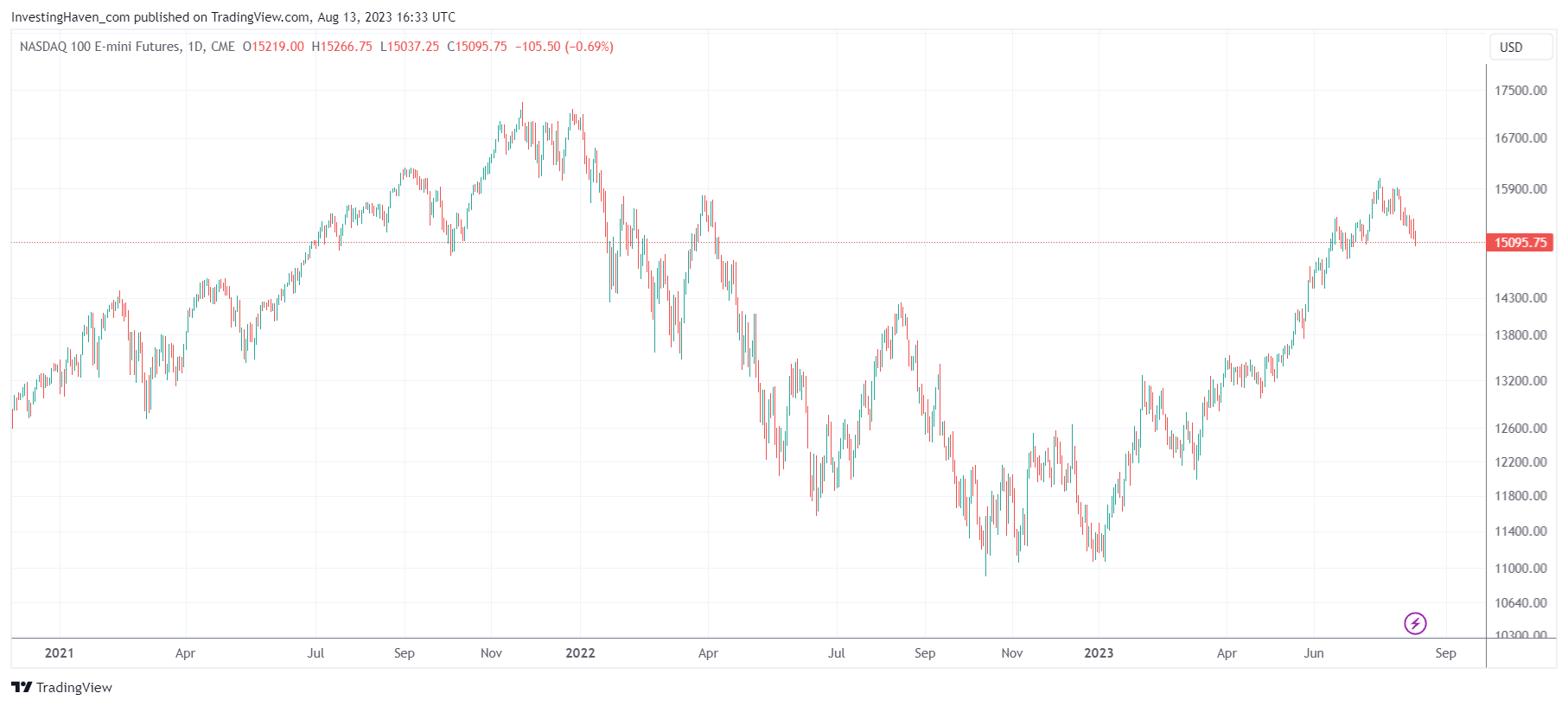

The chart shown below is the Nasdaq chart. It was hot in June and July, it only took a very small break the volatility window in the last 10 days of June. Pretty impressive.

As seen on the chart, August 1st was not just a new month but also a turning point in this index. The uptrend is now broken, the most likely path is a pullback?

How low can the Nasdaq 100 index go? Very simple, the August 2022 highs are the first target, around 14200 points. That’s a first target, not necessarily the ‘end point’ although a reasonable lower target is 13500 points.

The downside potential is not tremendous, to be frank. We are talking max. 10% downside, not a big deal in the bigger scheme of things. Short term traders might find a lot of value in chasing this pullback, regular investors shouldn’t be too concerned.

The other question that comes up is this: who will benefit from sector rotation? A great question, also a very valid question, given the ongoing market dynamics, in the cycle that started 18 months ago, in which capital flows from sector to sector.

We see 5 potential beneficiaries, not ranked in a particular order:

- The broader energy space.

- A few niche energy sectors. We identified 2 very specific opportunities in the alternative energy space, as explained in great detail to our premium members. Yesterday, they received a list of 11 stocks in the alternative energy area: [Sector Rotation] 2 New Trends In The Alternative Energy Sector.

- Health care. Interestingly, the health care sector ETF shows relative strength lately.

- Industrials. Not all industrial stocks, but some of them look really good long term, not vulnerable to the expected pullback in the Nasdaq. We like 2 industrial stocks which we featured 2 weeks ago in our premium research service: Highlights Across Our Favorite Sectors: 15 Stocks Reviewed.

- Silver. It is a matter of time until the long term consolidation in silver resolves to the upside. While the waiting feels long, the rewards will make silver investors forget that they ever felt impatience.

What we are saying, and seeing, is a natural flow of sector rotation. This is a healthy process, though a tough one to ‘get right’ because not any portfolio will have positions that go up concurrently.

From the above mentioned beneficiaries, the upside potential is most outspoken in the niche energy sectors and silver, medium to long term.

Below is the Nasdaq 100 index, with a local top (bearish turning point, though not a secular turning point). We are looking for charts, sectors, stocks that have the exact opposite setup: a bullish turning point, after a long consolidation.