This is a new bull market. We said it over and over again: no stock market crash in 2023. We showed it with similarities and differences between 2008 and 2022, we presented very precise indicators (that hardly anyone else is following but are very accurate) to confirm when this nascent bull market will be confirmed. Here is a data point that was published by Yardeni Research, in the public domain, earlier this week, that confirms our viewpoint.

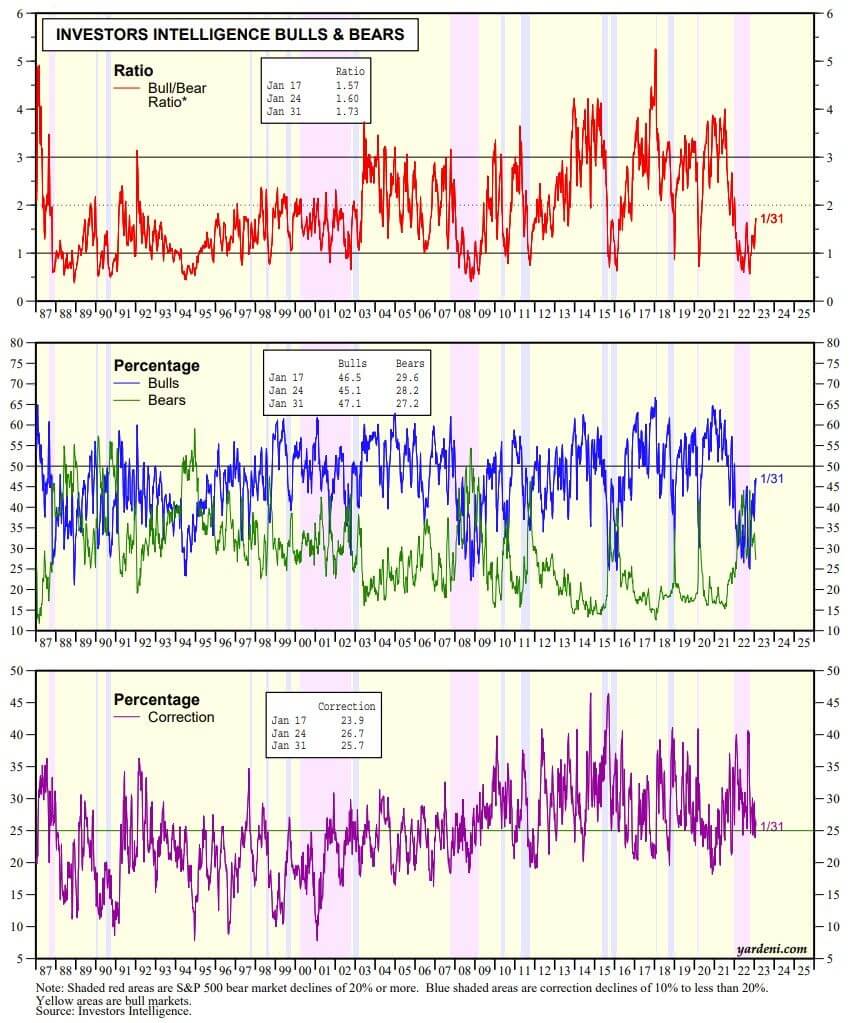

Yardeni looks at sentiment, more specifically the ratio bulls vs. bears. He calls it the BBR indicator, it stands for the Investors Intelligence Bull/Bear Ratio. It is sentiment among investor, particularly those expecting a bullish vs. a bearish outcome.

Below is a chart and commentary from Yardeni’s site:

Last summer we observed that the BBR was as bearish as it was during the tail end of the Great Financial Crisis in early 2009. During last year’s bear market, the BBR fell below 1.0 numerous times. We noted that such readings have a history of providing excellent buy signals for contrarian investors. In recent weeks, the BBR has risen above 1.00 to 1.73 during the January 31 week. That’s consistent with early bull market readings.

A market with more bears than bulls is very unusual and a characteristic of a turning point. Note that a market like the one we had in 2022 requires a lot of time to resolve. So, while the signs of a new bull market were obvious by carefully analyzing charts, the vast majority of market participants could not see it because of 2 reasons:

- The duration of the consolidation was very long, making any bull doubt his assessment.

- The noise was tremendous, with doomsday predictions all over the place.

Both points reinforced each other of course.

If we carefully check the upper pane of the chart, we see that over the course of the last 30 years only a few times did the BBR spend several months below 1.00.