Many investors are scared.

The recent trend made most investors very uncertain.

There is nothing wrong feeling uncertain. What is important is understanding whether an uncertain feeling is justified and how to handle it.

What is even more important is to avoid emotions take control over the mind. Uncertainty comes from volatility and volatility is the result of sector rotation.

In other words, whenever you feel uncertain as an investor it likely is because new trends are arising. That’s exactly when you have to be ultra sharp.

As explained in 7 Secrets of Successful Investing narratives are one of the points of failure. What explained in our must-read pieces “The Shocking Reality Of This Market” (see intro) is how narratives are currently preventing investors from seeing what is happening in reality in this market.

Here are a few findings which are all discussed in great detail in our detailed research:

- As CPI + PPI numbers were released, on Wed and Thu, innocent investors were trapped in the inflation narrative. They sold quality stocks while big buyers were entering the space.

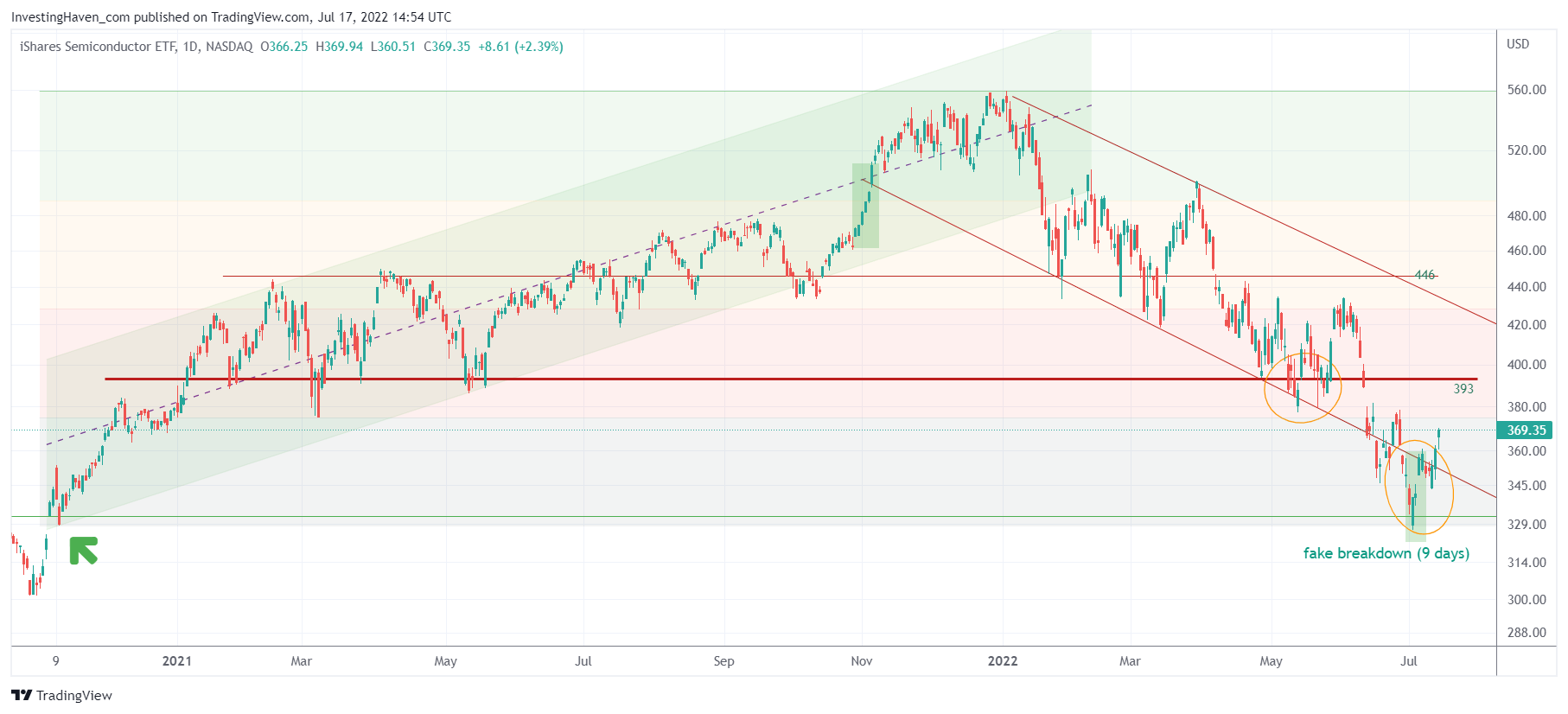

- One such sector that got bought, heavily, is the semis space. The chart below makes the point.

- It’s not just semis, there are other sectors that got bought lately. We would say ‘heavily bought’.

- The sell-off in May / June / July happened in 3 waves. Sectors sold off separately. The first sectors to sell off are bouncing now.

- All sectors went through strong reversal points, the numbers are clear, all listed in our research.

- The last man standing was the USD. We made the point that it changed its course, last week to be more specific.

- The inflation narrative is very tricky just because recent CPI + PPI numbers are lagging. The futures market is telling a very different story, and we started seeing it and signaling it in our work back in June already.

- The Nasdaq was the first to lead markets lower, already turned higher but bias and narratives prevented investors to see this happening.

The SOXX ETF, as a leading representative in the Nasdaq, has so many great insights and is a great illustration of the shocking of reality of this market: innocent investors got trapped in a major bear trap, emotionally beaten down by narratives that are outdated by now.

In our Momentum Investing portfolio we are overweight in one absolutely top semis stock. It will outperform the market. It is trading near our entry point.