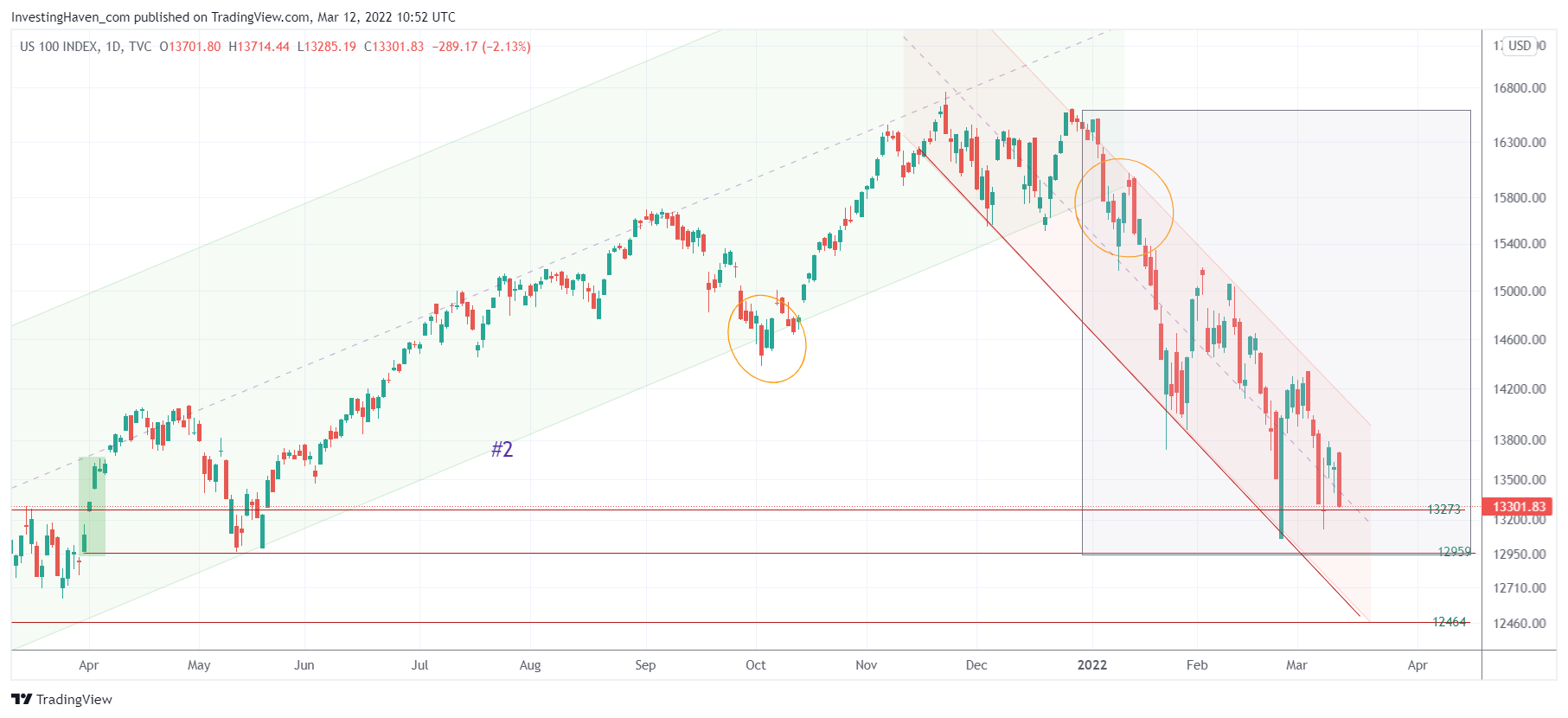

Technology stocks are completing a 4 month downtrend. Since November 10th they started a violent consolidation followed by a violent decline. Anyone holding tech stocks who is frank will admit it: the puke phase is here. What’s interesting is that the puke phase mostly tends to coincide with a turning point. Is the tide about to turn in the Nasdaq?

The Nasdaq index is printing higher lows, for now at least. It looks like bears have a hard time pushing this index lower. The line in the sand is 13,273 points (3 day closing basis).

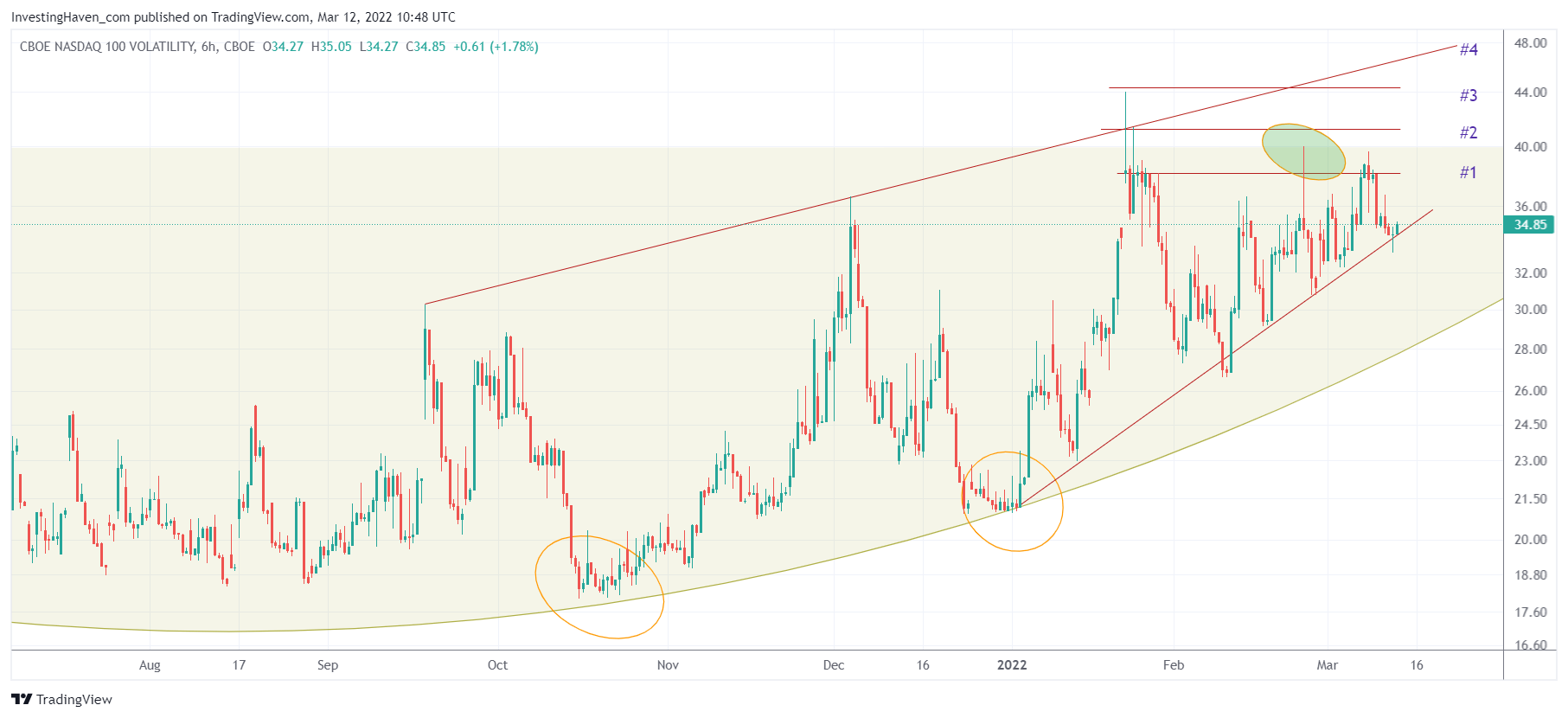

If anything, the Nasdaq volatility index is struggling here. Two good days in markets and this index breaks down after a violent bear market that started on January 4th (see trendline).

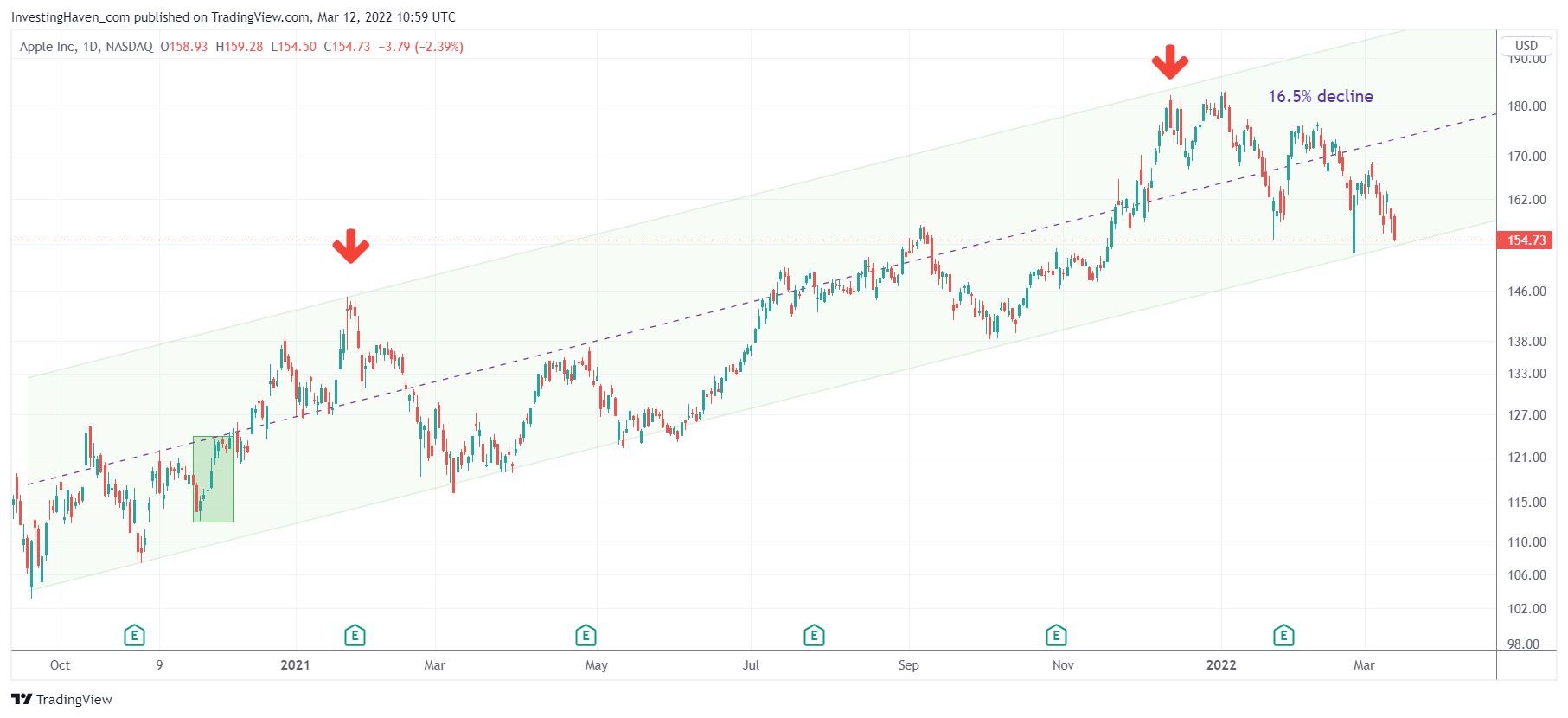

Apple is now testing 16 month support. We featured the red arrow on below chart in December, when we said that this is a topping pattern. Since then, Apple came down 16.5%, presumably time to end the downtrend? Or will it accelerate the downtrend from here?

It’s pretty simple with tech stocks: they are either working on a turning point in which case they will start turning bullish as of mid next week. Alternatively, in case they cannot move higher, they might get vulnerable to a really big breakdown.

From an intermarket perspective, it’s clear that commodities set a local top. Commodities have been rising since the 2nd week of February when stocks turned down. Consequently, if commodities are topping here, we can reasonably expect capital to flow into stocks. The Nasdaq, after a 4 month downtrend, might have lost all trust from investors in which case “all sellers have left”.

We believe it’s worth betting on the former but want to ensure we stay protected for the latter.

Many tech stocks will need a lot of time to recover as the damage has been enormous. However, a select few sectors look really good. In our Momentum Investing portfolio we opened a position in a very promising tech stock which has amazing fundamentals and financials. Moreover, in our automated trading services in which we trade the S&P 500 for our members we have accumulated several profits which largely outweigh the few losses in recent months, largely outperforming our peers and indexes.