Last week’s dramatic turning point in markets presumably mark the start of a new uptrend. However, the start a new uptrend typically requires work and this comes with volatility. The start is typically not smooth. So, you need advanced charting skills to identify them.

This is what we wrote premium research service:

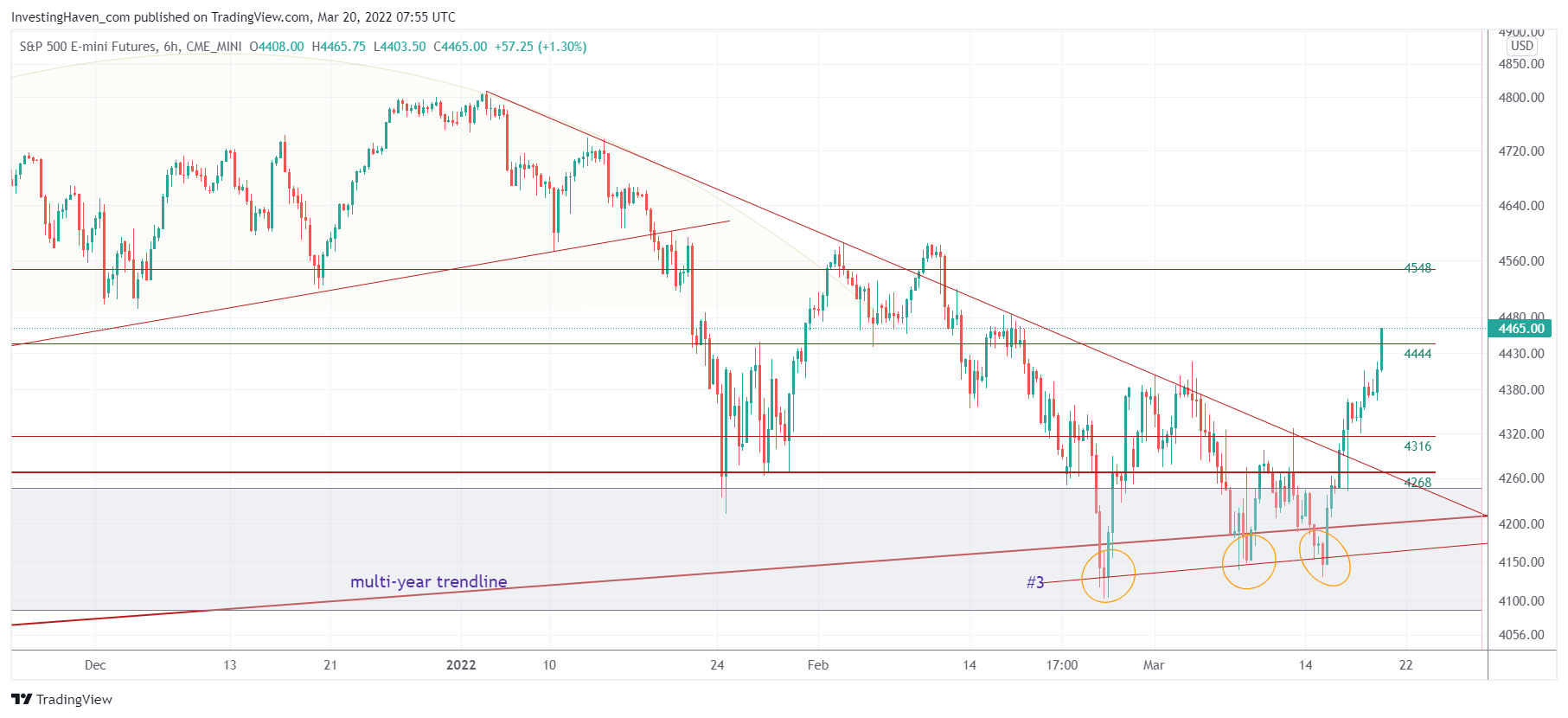

The S&P 500 has a very clear message according to us based on our chart analysis:

The multi-year rising trendline was perfectly respected with 6h candle closing prices. There is a higher low. We have a new trendline, see #3. This might last for weeks or months, we don’t know. All we do know: there is a new trendline in the making which will hold until it breaks. Very important: the slope of the trendline #3 is slower than the previous one (most of 2021). This makes sense, it’s the next stage in the bull market: still a bull market, but slower because the bull is ‘aging’.

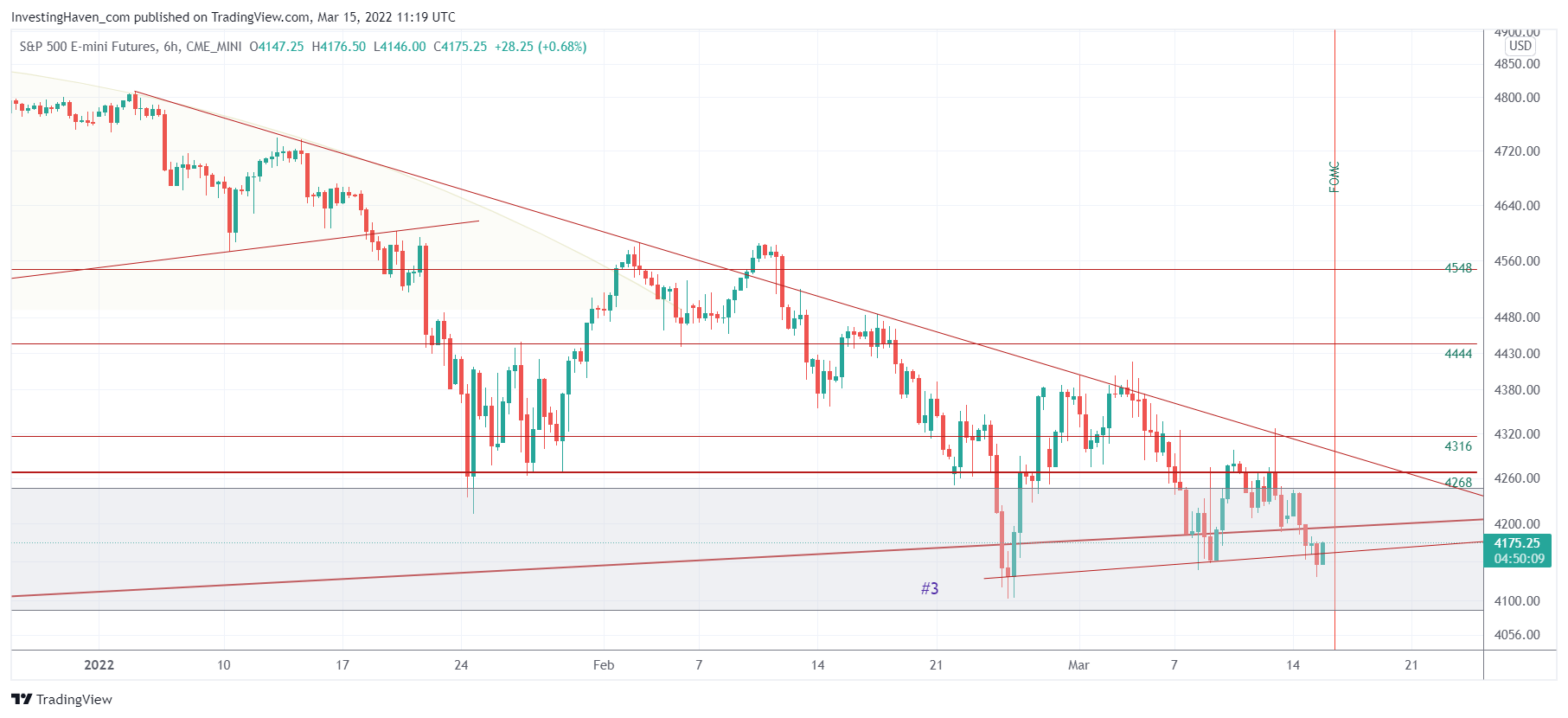

It’s very hard to see this. On Tuesday, March 15th, in pre-market trading, prior to the start of the uptrend, it looked like this:

This is what it looks like today.

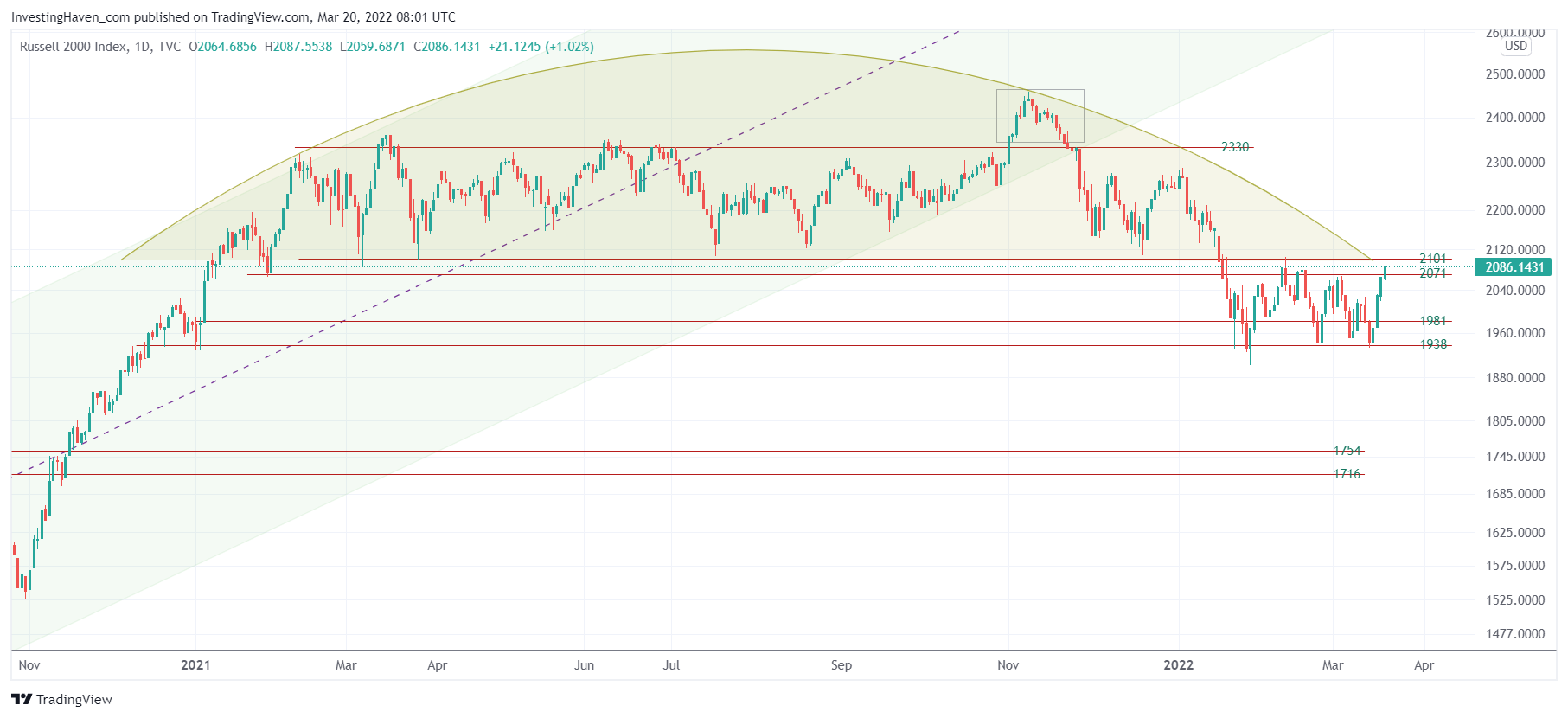

Although the S&P 500 confirmed the end of the downtrend, we need the Russell 2000 to clear 2101 points. It might be competing a bullish reversal here, it failed to move below 1900 points. A tiny push higher, and it will confirm the bullish intention of this market.