When it comes to predicting the overall health of the stock market, few indicators are as reliable as small cap stocks represented by the Russell 2000 index. By examining the chart of small cap stocks index, Russell2000, we can gain valuable insights into the market’s patterns and potential opportunities for investors this summer. For instance, mid-May, we observed how the same small caps index became vulnerable as This Leading Indicator Loses Bullish Structure, it went lower which resulted in Value Stocks Lagging and 5 Growth Stocks Leading. The exact opposite might be happening now.

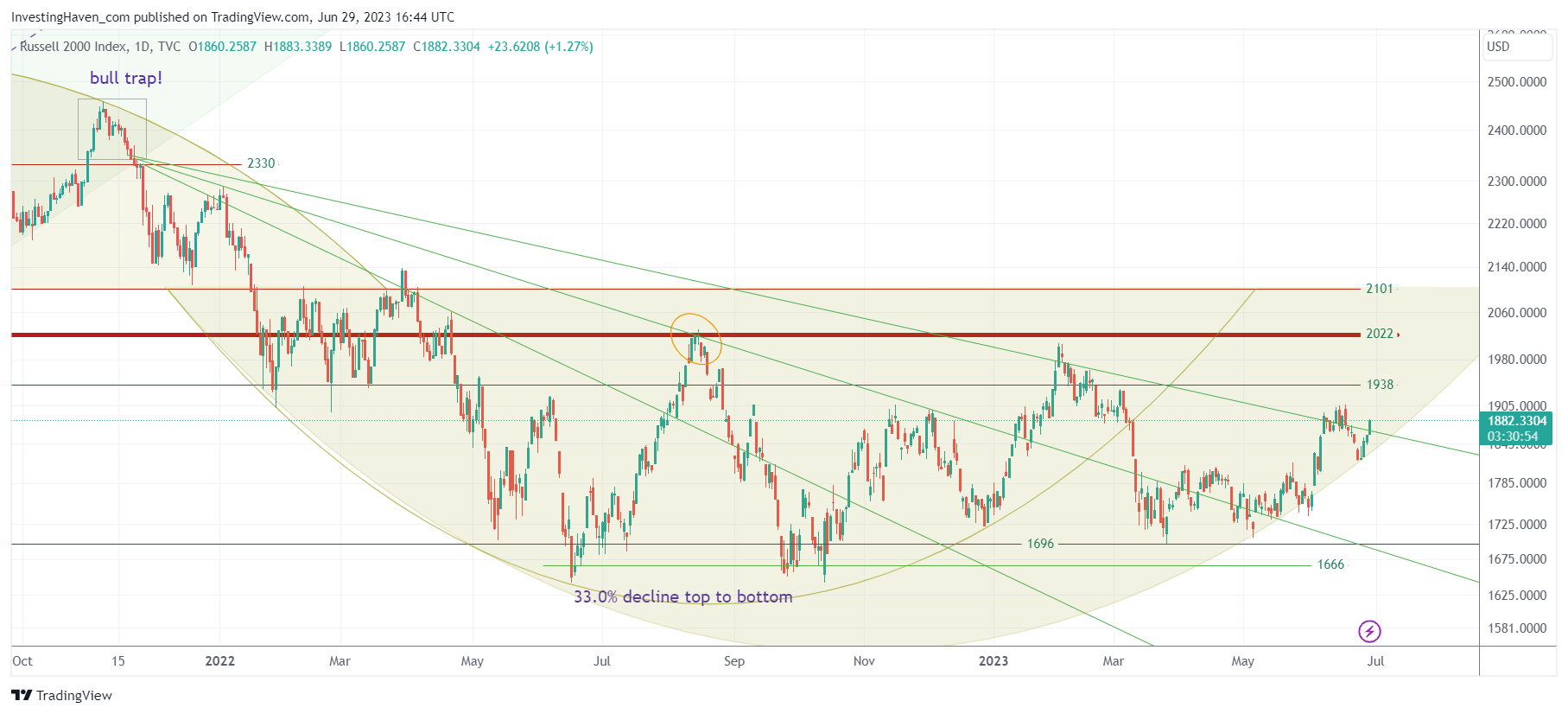

Upon analyzing the chart, several observations can be made. Firstly, the long-term reversal pattern in small cap stocks appears highly bullish. Over the past 12 months, the index has consistently set higher lows, indicating a positive upward trend. This pattern suggests that small cap stocks have been gradually gaining strength and resilience, which bodes well for their performance in the near future.

Furthermore, the chart reveals that the 3-day falling trendline, which previously provided resistance two weeks ago, is now being tested once again. This current setup appears to be increasingly constructive, hinting at a potential breakout in the near term. If the resistance of the trendline is successfully breached, it could signal the start of a new bullish momentum for small cap stocks.

Before continuing, we want to point out what we wrote about a month ago: Enjoy The Party But Watch Out June Won’t Come With A ‘Happy End’. What we call a ‘volatility window’ did hit value stocks and small cap stocks, however not as bad as expected. The volatility window respected the long-term bullish reversal pattern, represented by the rounded pattern on the chart. This suggests that the market sentiment remains positive, with investors exhibiting confidence in small cap stocks. The soft volatility in this period further supports the notion of a promising summer for these stocks.

However, it is essential to be aware of the ongoing sector rotation taking place in the market. While small cap stocks may exhibit bullish momentum, it does not guarantee a rise in all sectors. Identifying which sectors will move in tandem with the Russell 2000 index will be crucial for investors to capitalize on potential opportunities. Conducting thorough sector analysis and staying informed about market dynamics will aid in making informed investment decisions.

In conclusion, the chart analysis of small cap stocks, as represented by the Russell 2000 index, suggests a promising summer ahead. The bullish long-term reversal pattern, along with the constructive setup and positive market sentiment, indicate potential opportunities for investors. However, it is important to navigate the market’s sector rotation carefully and identify the sectors that will move in sync with small cap stocks.