Anyone who believes that the Turkey stock market crash of 2018 is a serious thing should revise its thinking. InvestingHaven’s research team points out that the 22% correction in recent 9 months may be significant, but it is far from a crash. The stock market chart of Turkey until 2018 shows that the real crash will start if current (support) levels give away. This is the make-or-break moment for Turkey. Will Turkey be able to avoid its stock market crash in 2018?

Mr. Erdogan may be committed to continue to heat up the ongoing Turkey crisis as seen in great detail here. However, we truly hope for Mr. Erdogan that he has a great chart analyst in his team of advisors.

Turkey stock market crash of 2018 coming?

The point is that Turkey’s stock market is on the verge of a mega-breakdown which, if it materializes, will result in a mega Turkey stock market crash in 2018.

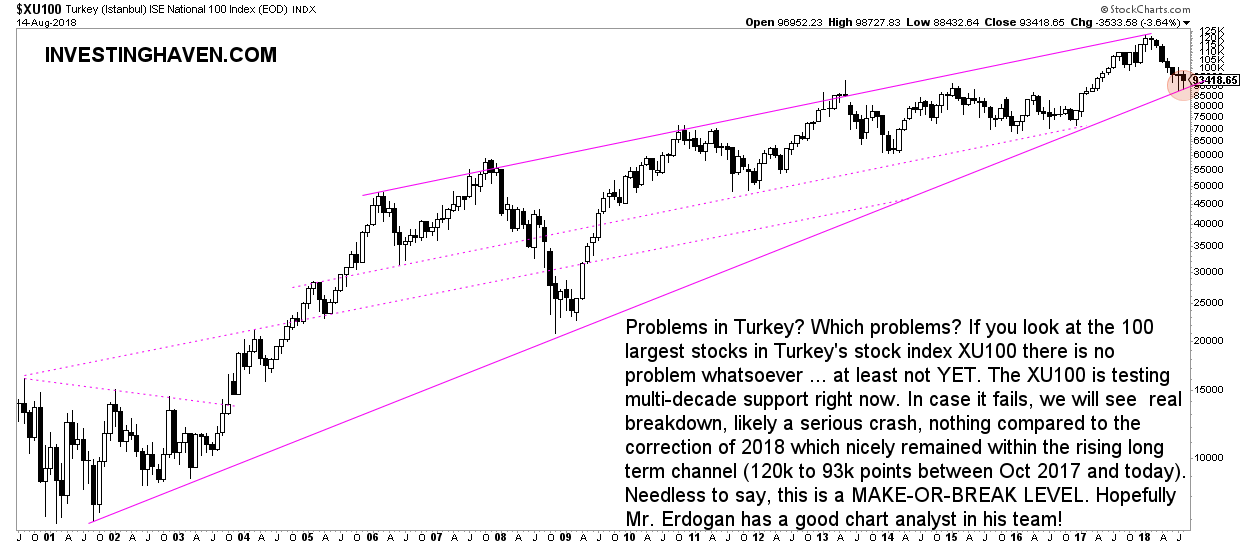

Chart analysis 101 shows that Turkey’ stock market index XU100 representing the top 100 stocks in Turkey has corrected 22% since October 2017. However, it now arrived at a crucial level. As seen on the long term chart below this is multi-decade support.

If this price level gives away we will see a real Turkey stock market crash in 2018, the type of 2009 and worse. Someone in Mr. Erdogan’s team should have noticed it … or are we the only ones looking at this?

Is this crash coming? We cannot know at this point in time. We can only identify that the 90k level is the breakdown point on the XU100 chart. Any monthly close (end of month close) below 90k will be forecasting an important crash.

Turkey stock market ETF at 2009 crash levels

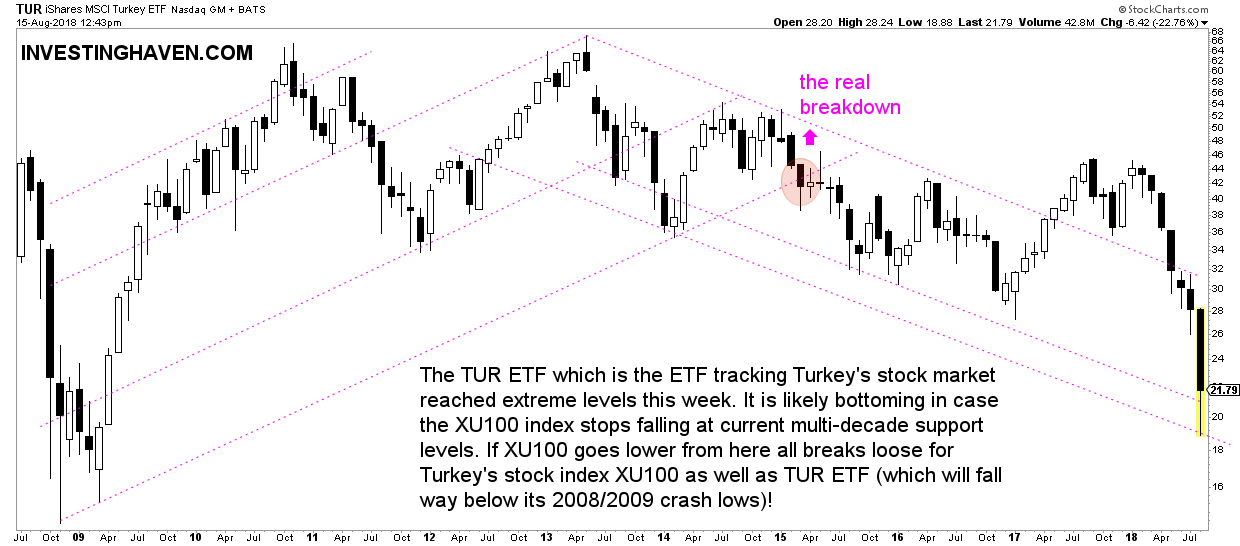

The stock market index of Turkey may not have started the crash in 2018 yet … the Turkey ETF is already at 2009 crash levels.

TUR is Turkey’s stock market ETF. Its long term chart how March 2015 was a decisive moment. Obviously, ‘nobody’ noticed it, as it was a regular decline at that point in time.

However, from a chart perspective, applying our 1/99 Investing Principles, it would have been clear that it was the real breakdown point.

Since then, things have become worse.

As the TUR ETF chart shows there was an attempt at the end of last year to recover but that was a very short lived attempt. Since January of 2018 downhill it went, and very fast and steep.

TUR ETF not only tracks Turkey’s stock market, it also incorporates the US Dollar effect.

Note that TUR EFT got very close to 2008/2009 crash levels this week. A breakdown in Turkey’s stock market index XU100 will result in a ‘real crash’ in TUR ETF. If XU100 holds up, then we may see a strong recovery in TUR ETF which will bring this instrument to 31 points.

Turkey’s lira crash of 2018

The really important underlying issue of course is the crash of Turkey’s currency: the Lira. That issue seems not be taken care of by Turkey’s central bank. Ultimately, it may result in the real Turkey stock market crash, if there is no strong intervention to stop the hyper-devaluation of Turkey’s Lira.

As per the Economist:

“Mr Erdogan referred to the currency crisis as a coup against him and his government. He also refused to endorse any decisive action by the central bank, which has not raised lending rates over the past two months (and which is assumed to be unable to do so without the president’s approval). Interest rates are a “tool of exploitation”, Mr Erdogan said. The lira responded by posting new record lows on August 13th. The currency has now lost over 40% of its value since the start of the year and about 25% since the US imposed sanctions against two Turkish ministers two weeks ago.”

And here is another important quote:

“The crisis has been largely of Turkey’s own making. By forcing banks to keep lending rates low, increasing government spending and encouraging companies, especially in the construction sector, to rack up billions of dollars in debt, Mr Erdogan has allowed inflation to get close to 16% and exposed the economy to external shocks.”

Tourists may like the hyper-devaluation of the Lira, as they can buy increasingly cheaper products in Turkey. However, this side-effect really does not compare to the hyper-damage that a potential Turkey stock market crash can have as effect.