Uranium Energy Corp (UEC) is one of the most leveraged ways to play the uranium market. The company does not have great revenue streams but that’s because they tend to store uranium until prices rise, pretty smart but also to some extent risky! Even though we said last week that Uranium Market May See The Invisible Start Of A New Bull Market we also see the start of a giant breakdown on UEC’s price chart this week. Note that this is happening on the highest timeframe, so this really is not a joke, and may become very bad for UEC. However, very often it results in a ‘failed breakdown’ which may be the case for UEC as well. So the next 3 weeks will be crucial for UEC. No bottom fishing allowed until a ‘failed breakdown’ is confirmed.

Earlier this month UEC released a press release in which they comment on a coming decision by the Trump Administration: “The Trump Administration is to be commended for elevating the topic of U.S. uranium mining to the top of our national security and energy security agenda. At a time when we have bi-partisan support for the clean, baseload energy that nuclear power provides, it is crucial that the domestic supply chain is available for over 50% of our nation’s carbon free electricity generation. We will certainly make ourselves available to assist the newly formed U.S. Nuclear Fuel Working Group in any way possible.”

The President and CEO of UEC, Amir Adnani stated: “The White House released the complete, much-anticipated decision late Friday evening. We are very pleased with President Trump’s decision in establishing the U.S. Nuclear Fuel Working Group, co-chaired by White House National Security Advisor John Bolton and National Economic Policy Advisor Larry Kudlow . The President has instructed the Working Group to develop recommendations for reviving and expanding domestic nuclear fuel production, including uranium mining, and to submit their findings within 90 days. Ultimately, we remain even more positive and excited about the improving fundamentals in the uranium market, with a growing global deficit between primary production and reactor requirements. We fully expect demand to continue to grow with the world’s need for the highly reliable, carbon-free, safe energy that nuclear power provides.“

One way or another this is not really reflected in the company’s stock price, on the contrary. A sharp sell off started in July which brought this stock from resistance to breakdown in just 2 weeks time.

The UEC Price Chart: Scary in July, Decision Time in August of 2019

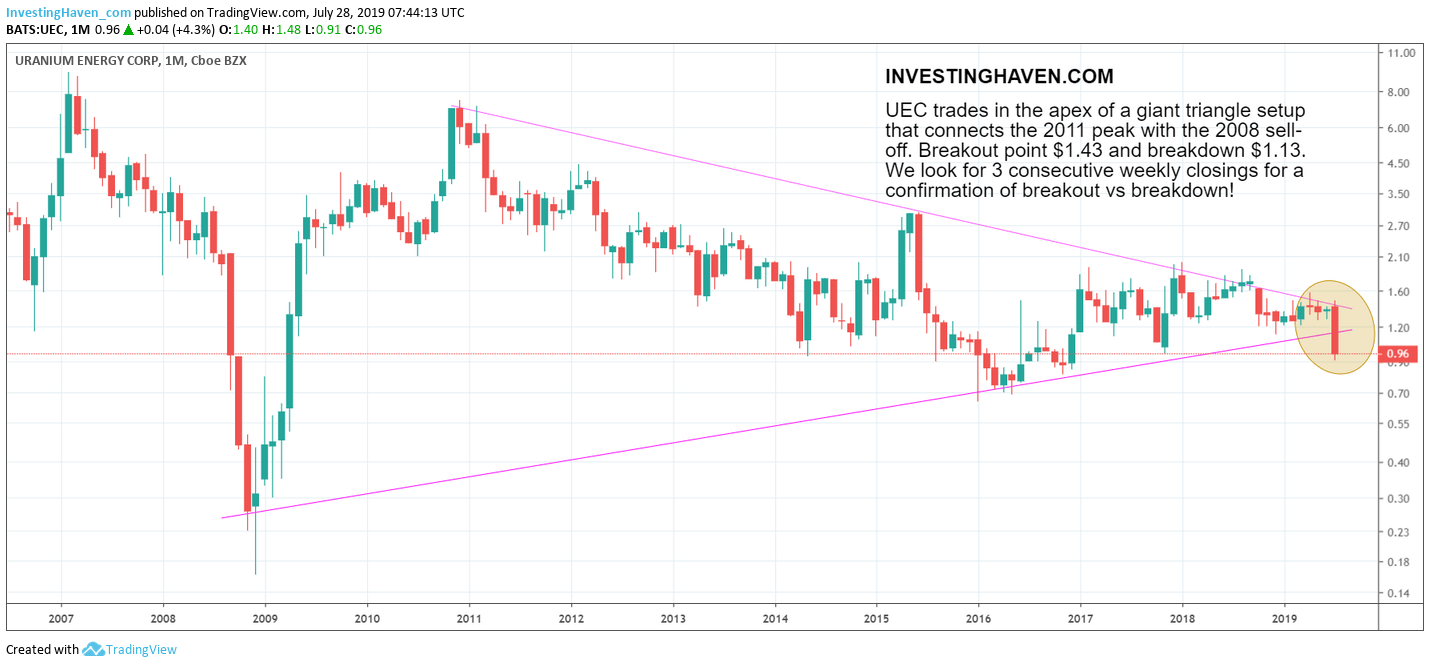

The monthly chart timeframe makes our point. Note this giant triangle on the monthly, and the start of the breakdown in July 2019.

As seen on below UEC price chart trades in the apex of a giant triangle setup that connects the 2011 peak with the 2008 sell-off.

Breakout point $1.43 and breakdown $1.13.

We look for 3 consecutive weekly closings for a confirmation of breakout vs breakdown!

As long as there is no confirmation we do not think bottom fishing is a good idea. Yes there may be a great outcome out of the Trump Administration, and UEC may become the next star and market darling. Between now and then, things may get deteroriate or improve, or both. In the scenario of a bullish outcome we also are interested in picking up shares at lower prices in case UEC will continue to fall (which is very likely by the way).