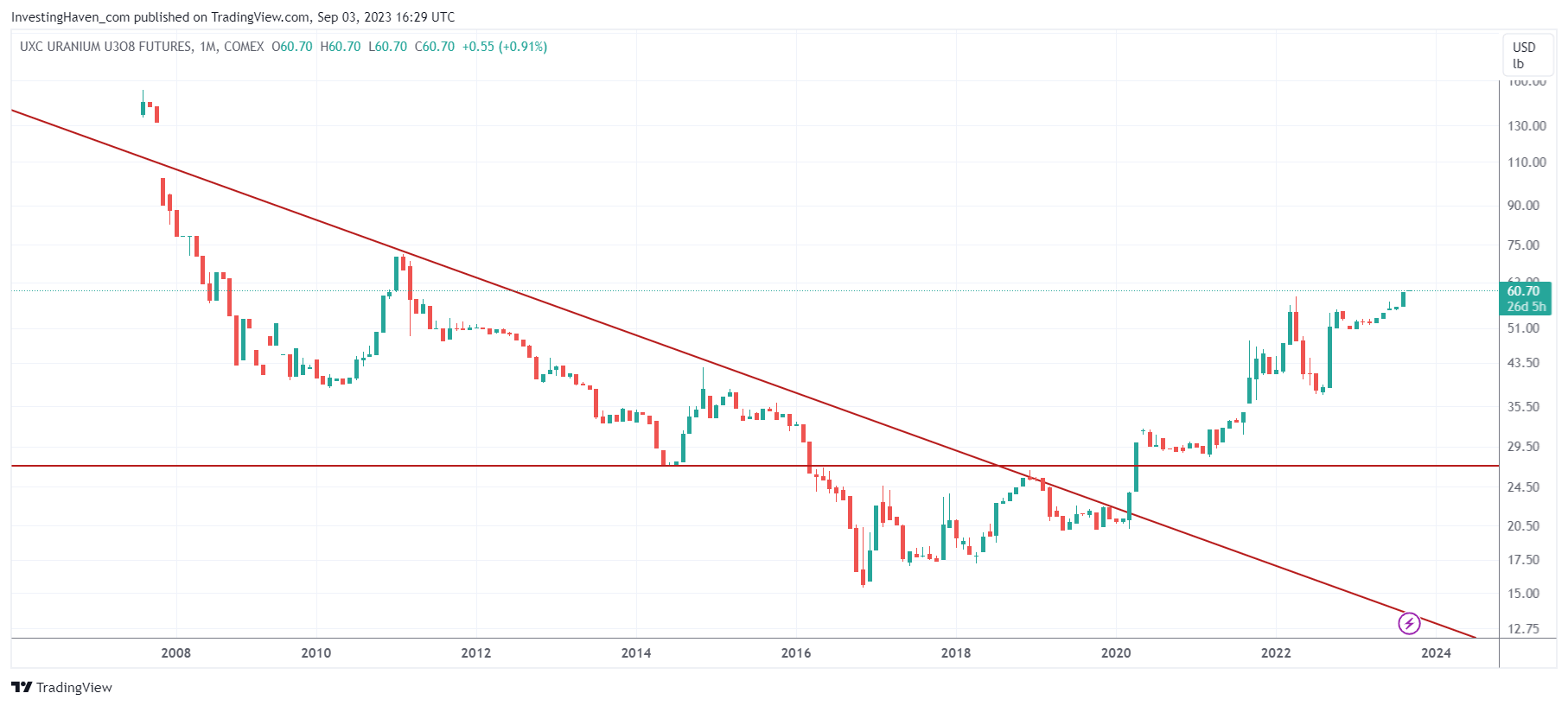

In our recent analysis of the uranium market Uranium Market Outlook 2023 & 2024, we identified two critical data points that could shape the future of this vital energy commodity: the spot uranium price reaching $60 and the URA ETF flirting with the $24 mark. These levels have been the focus of uranium investors and industry experts alike, and now, as the market tests these crucial thresholds, there’s a sense of anticipation in the air.

Interestingly, the uranium market is now testing these breakout levels. The charts suggest that this breakout is for real, even though a small pullback might occur in September. We believe that, ultimately, short or medium term, the uranium market will break out in 2023.

Spot Uranium at $60: A Significant Milestone

Spot uranium prices have been on the rise, steadily inching closer to the $60 mark. This level is more than just a number; it’s a psychological threshold that holds immense significance for the uranium market. Historically, this price point has acted as a key resistance level, preventing uranium from surging higher.

However, recent market dynamics suggest that the tide may be turning. As spot uranium flirts with the $60 range, investors are closely watching for a decisive breakout. If uranium can breach this resistance level and establish a foothold above $60, it could signal a new era for the industry. This would not only reflect growing confidence in nuclear energy but also indicate increasing demand for uranium as countries worldwide shift towards alternative energy sources.

URA ETF Testing $24

The URA ETF, a widely watched indicator for uranium market sentiment, has also been making notable moves. As it approaches the $24 range, it’s a clear sign that investors are gaining confidence in the uranium sector. ETFs like URA provide a convenient way for investors to gain exposure to uranium-related assets, making them a reliable gauge of market sentiment.

A breakout above $24 for the URA ETF could signify that institutional and retail investors alike are positioning themselves for a uranium market rally. It suggests that the broader investment community is recognizing the potential of nuclear energy and the critical role uranium plays in powering the world’s clean energy future.

As a reference, below is another uranium ETF, one with a longer history: Uranium Nuclear Energy ETF.

In conclusion, the uranium market is at a pivotal juncture. The spot uranium price nearing $60 and the URA ETF’s approach to $24 are strong indications of the growing momentum behind uranium. While we can’t predict the future with certainty, these data points suggest that the market might be ready to stage a breakout. As investors, staying informed and vigilant during these critical moments is key to making well-informed decisions in the dynamic world of commodities.

Top uranium stocks

As the uranium market shows signs of potential breakout, the spotlight is firmly on this essential energy commodity. For those looking to dive deeper into this promising sector and explore the top 5 uranium stocks that we believe have tremendous potential, we invite you to join our premium research service Momentum Investing. This weekend alert, due to be published on Sunday, September 3d, 2023, will feature our uranium top stock selection.

Our premium members gain exclusive access to in-depth research, analysis, and insights into these uranium stocks, along with many other investment opportunities across various sectors. We understand the importance of respecting our premium members, which is why we reserve our most valuable research for them.

If you’re eager to uncover the potential of these top 5 uranium stocks and stay ahead of market trends, consider becoming a premium member today. We look forward to having you on board as we navigate the dynamic world of commodities and investments together.