As 2024 kicks off, a seismic shift is occurring in the uranium sector. This should not come as a surprise to InvestingHaven readers because our bullish uranium outlook was published a long time ago.

The indicators for a substantial breakout in 2024 are not just promising; they are unmistakable. This post delves into two pivotal indicators – spot uranium prices and the URA ETF representing uranium stocks – to unravel the bullish narrative that is currently unfolding.

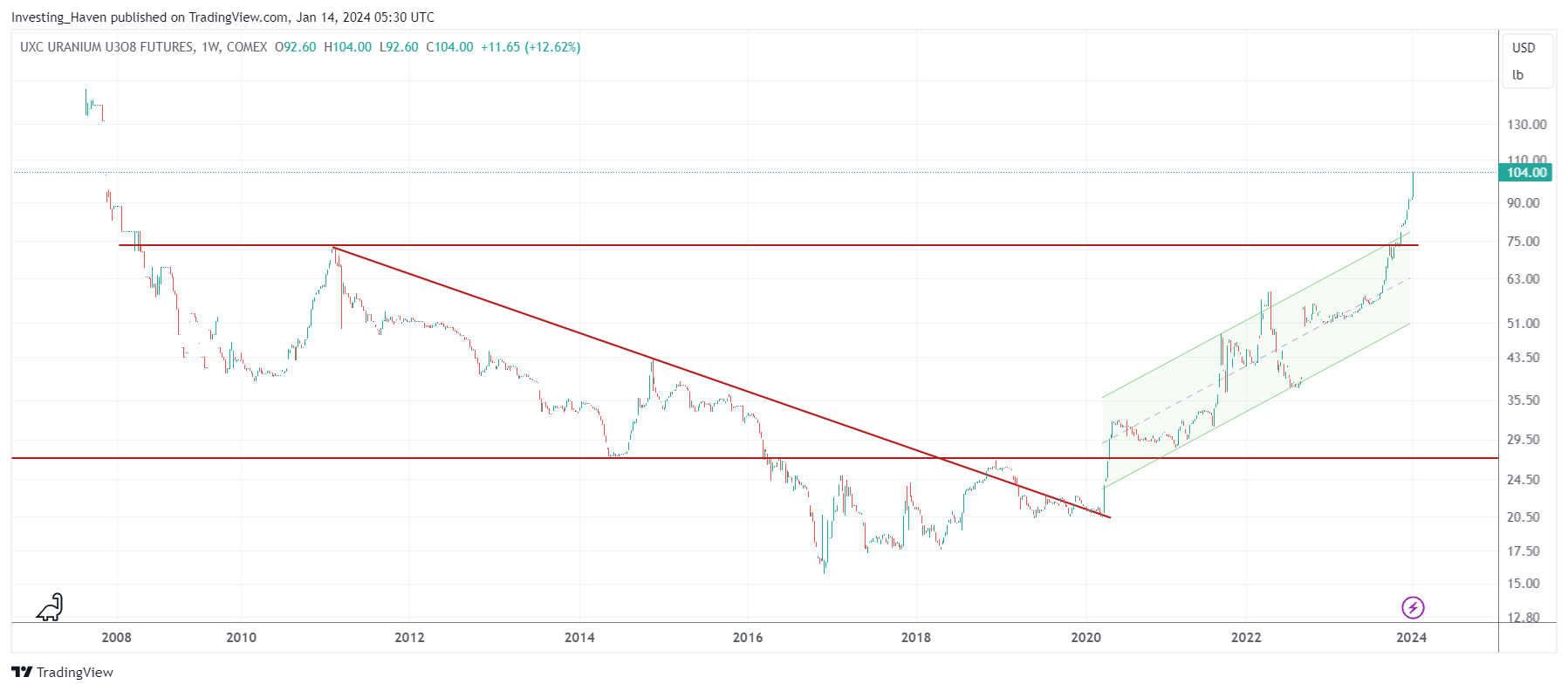

Uranium Market Breakout Leading Indicator #1: Spot Uranium

The first indicator, spot uranium, laid the groundwork for this breakout in the latter part of 2023. Around October and November, spot uranium prices breached significant levels, surpassing the critical thresholds of 60 USD/Lbs and subsequently 74 USD/Lbs. This marked a crucial turning point, hinting at the underlying strength and potential of the uranium market.

The journey of spot uranium to its breakout is a proof of the strong supply and demand dynamics in the uranium market. In recent years, the uranium industry has witnessed a resurgence of interest, driven by a growing recognition of nuclear energy’s role in a carbon-neutral future. Spot uranium, as a leading indicator, captures not just the immediate market sentiments but also reflects the broader trends shaping the energy landscape.

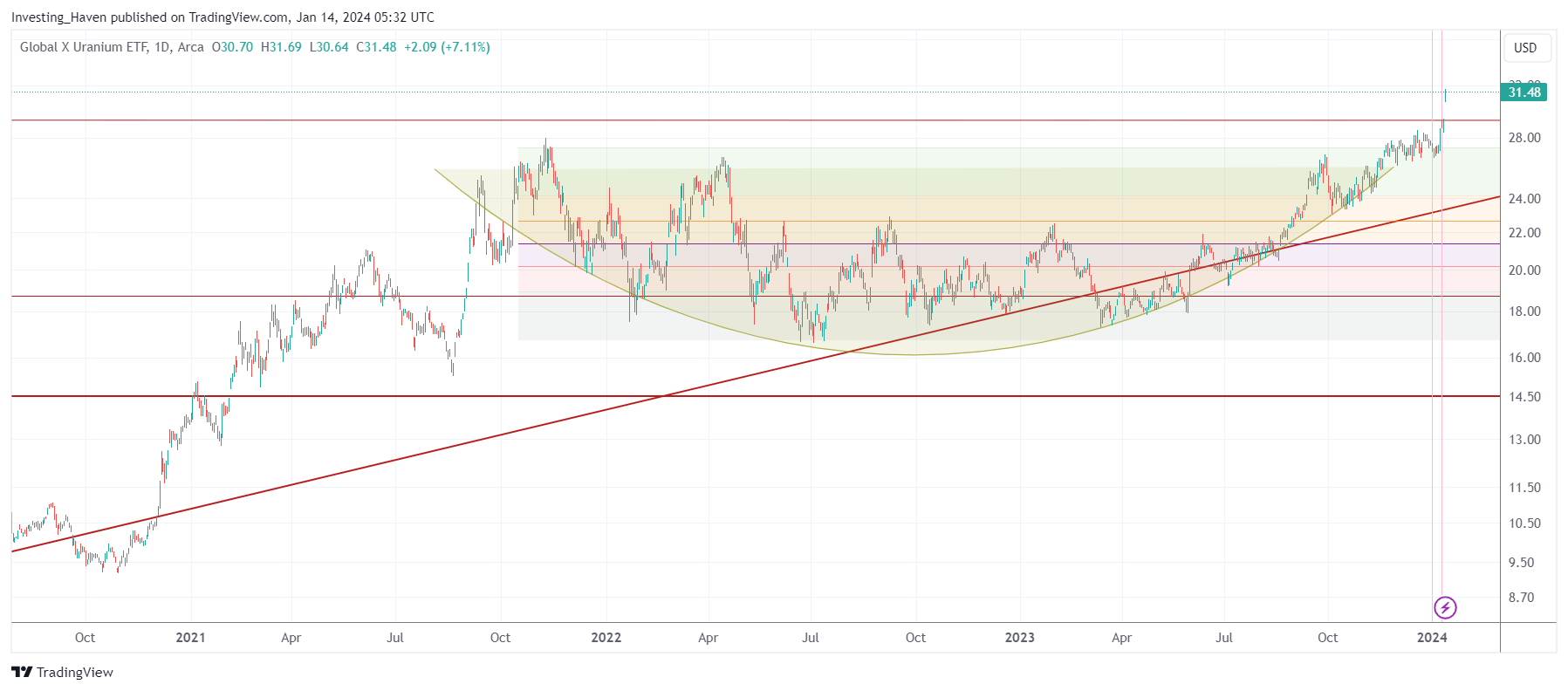

Uranium Market Breakout Leading Indicator #2 – URA ETF and Uranium Stocks

While spot uranium paved the way, uranium stocks, as represented by the URA ETF, initially lagged in reflecting this bullish sentiment. The consolidation phase persisted until a watershed moment on Wednesday, January 10th, 2024, when the breakout finally commenced. This synchronicity of spot uranium and uranium stocks is a powerful signal, indicating a unified bullish trajectory for the uranium market.

The weekly URA ETF chart is insanely bullish, and confirms tremendous upside potential:

Understanding the dynamics of the URA ETF and uranium stocks is pivotal for investors seeking exposure to the uranium market. The URA ETF provides a diversified approach, comprising various uranium-related companies. Analyzing the components of this ETF can offer insights into the specific segments of the market that are poised for growth. Individual uranium stocks, on the other hand, present an opportunity for more targeted investments, allowing investors to align their portfolios with specific companies that exhibit strong fundamentals and growth potential.

Understanding the dynamics of the URA ETF and uranium stocks is pivotal for investors seeking exposure to the uranium market. The URA ETF provides a diversified approach, comprising various uranium-related companies. Analyzing the components of this ETF can offer insights into the specific segments of the market that are poised for growth. Individual uranium stocks, on the other hand, present an opportunity for more targeted investments, allowing investors to align their portfolios with specific companies that exhibit strong fundamentals and growth potential.

Uranium Market Outlook 2024 – A Wildly Bullish Year Unfolding

As the breakout gains momentum, the outlook for the uranium market in 2024 appears extraordinarily bullish. What we witness now is not merely a momentary surge but the inception of a more sustained and robust uptrend. Factors such as increasing demand for clean energy sources, geopolitical considerations, and a broader shift toward nuclear power contribute to the favorable conditions for uranium.

The surge in uranium prices reflects a structural change in the energy landscape. Governments and industries globally are reevaluating their energy strategies, with nuclear power emerging as a crucial component in the quest for sustainable and low-carbon energy solutions. The ongoing global commitment to reduce carbon emissions further amplifies the significance of uranium as a key player in achieving these environmental goals.

Uranium Stocks – Selection of Top Stocks

For those keen on participating in the uranium market boom, a well-considered selection of stocks is crucial. Our premium service, Momentum Investing, has been ahead of the curve, sharing a curated list of five top uranium stocks since the summer of 2023. These stocks are positioned to leverage the upward momentum in the uranium sector, offering investors a strategic entry into this exciting market.

Investors navigating the world of uranium stocks should consider various factors, including the financial health of the companies, their exposure to different stages of the uranium production cycle, and their strategic positioning in the evolving energy landscape. Diversification remains a key principle in constructing a resilient portfolio, and our recommended stocks aim to provide a balanced exposure to the potential upside in the uranium market.

In conclusion, the uranium market is undergoing a major breakout in 2024, backed by strong indicators and favorable market dynamics. Investors looking to capitalize on this trend should keep a close eye on both spot uranium prices and uranium stocks, ensuring a well-informed and strategic approach to navigate the promising journey ahead. As we traverse this era of renewed interest in nuclear energy, the uranium market stands as a beacon of opportunity for investors seeking not just financial gains but also a stake in shaping the future of sustainable and clean energy.