The Nasdaq index is in a great shape. However, it’s the index that is in great shape, not all tech stocks, big difference. At this very point in time, the strong performance of the Nasdaq index is driven by 5 stocks approx. This creates a false perception, investors that feel FOMO’ed need to revise whether it’s justified or not. At the same time, bullish momentum in 5 stocks may be able to create broader based momentum, where the single most important question is WHEN EXACTLY.

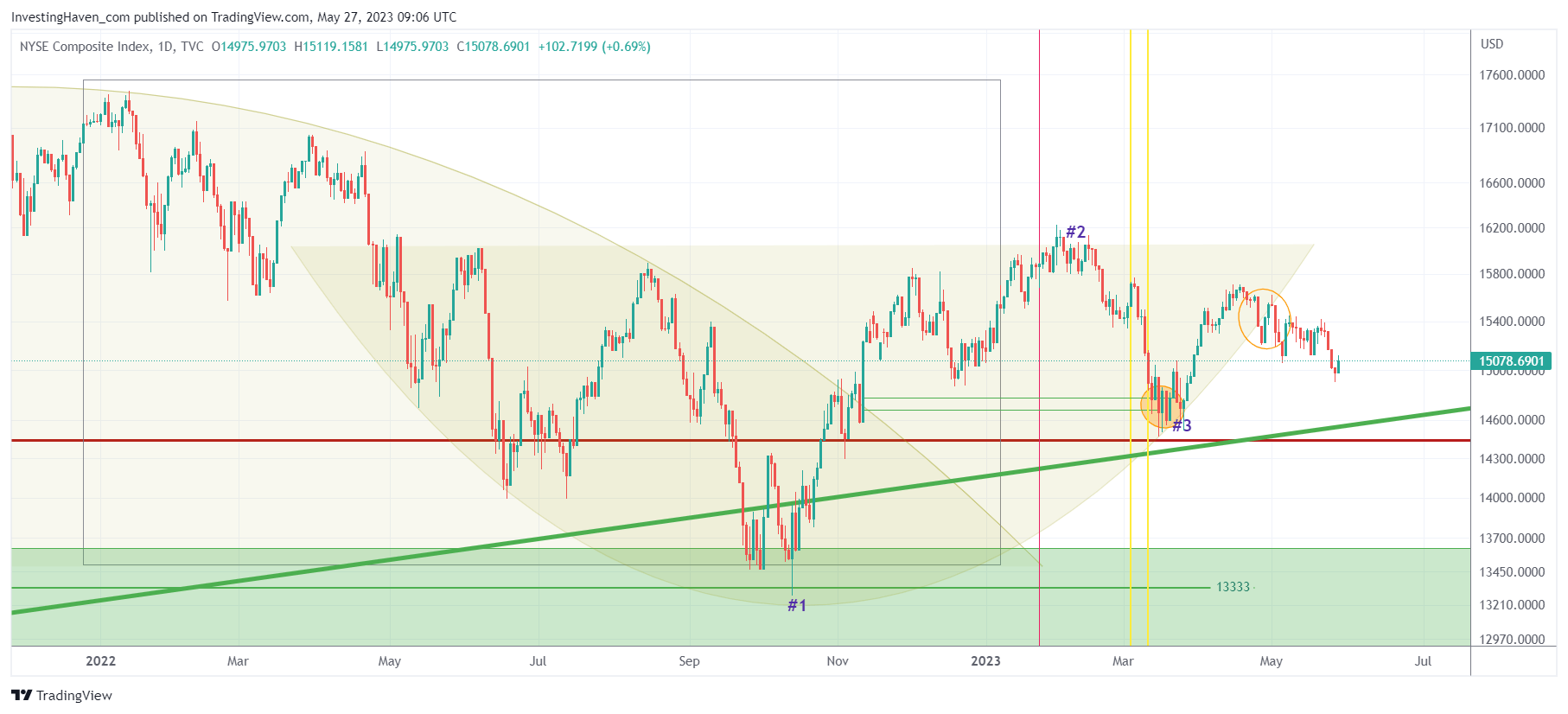

We shared the NYSE Composite Index multiple times in recent months. Last week, we said that Value Stocks In La-La-Land, Vulnerable As We Head Into June 2023 which means they won’t feel a lot of joy to the upside but might be hit hard when volatility will spike in June (expected, for sure, in the 2nd half of June).

The chart below has not improved in recent months, it did deteriorate.

That said, the question is whether investors should feel FOMO’ed or not.

Our viewpoint is that FOMO is not justified at this very point in time, for 2 reasons:

- The market will come down again.

- The number of stocks that are driving the Nasdaq (to a much less degree also the S&P 500) is just a few of them.

This implies that we firmly believe that prices will come down in the 2nd half of June, a period which will most likely come with good entry prices.

Stated differently, the first days of June are meant to observe what has / has no momentum, the last days of June will be to enter those stocks. First the selection, wait / no action, then action around June 30th, 2023.

Don’t feel FOMO’ed, it’s not justified. This current ‘pop’ is solid and bodes well for the 2nd half of 2023, in line with our expectations, but this is not a runaway market, for sure not, not yet at least.