It was a year ago that we published our piece Emerald Health Therapeutics Stock Forecast 2019. We identified a very bullish price target for Emerald Health Therapeutics (EMH.V). Just a bit later we came with our Cannabis Stocks Forecast 2019. Fast forward to today, we see relentless selling pressure especially in the last 4 months. This article takes a very close look at the sector, this stock, decisions by their management. We conclude with one key conclusion: the verdict will be determined in August 2019. We also outline a few scenarios and obvious decision points that might help understand future direction.

Note that we calculated in great detail, last week, how massive the inflow of capital is into gold and silver stocks. Most likely the capital flows partially from cannabis stocks into gold and silver stocks: How Long Will Bearish Momentum Continue In Cannabis Stocks?

Does this mean that gold and silver are the reasons why cannabis stocks and EMH.V is selling off? Not really, because if cannabis stocks would be more prudent towards shareholders, their shareholders would be more inclined to hold them. However, any investors that sees an opportunity will first sell the positions that he/she is doubting about.

So gold and silver simply accelerated a trend in the cannabis market. The fact that the precious metals inflow is some 15x bigger than the outflow out of cannabis shows how tiny but also how fragile the cannabis market is.

Cannabis companies better understand this, otherwise they will evolve from market darlings to market victims faster than they expect!

Detailed analysis on EMH.V

Let’s start with a detailed analysis of critical data points we have found for EMH.V:

- Volume of new shares, options and warrants that is creating shareholder dilution.

- Recent at-the-market offering.

- Use of proceeds of capital.

- Cash burn rate.

We will then answer 3 crucial questions:

- How much still left to fund for the different facilities?

- What’s the expected value created by their 4 facilities?

- How much will they be able to decrease cash burn in Q2 2019 by cutting operating costs and improving revenue?

This is a pretty loaded, and data heavy article, before coming to conclusions!

Data point 1: Volume of new shares, options and warrants that is creating shareholder dilution.

When it comes to the calendar year 2018, we got detailed insights in the annual report some 2 towards the end of May of this year.

- During the year ended December 31, 2018 the number of shares outstanding increased by from 88.4M to 141.4M basic and diluted shares outstanding.

- During the year ended December 31, 2018, the Company granted 2,811,000 stock options to employees and consultants. The stock options granted had exercise prices between $2.49 and $6.68, have expiry dates of five years and vest over three years. The weighted average fair value of the stock options granted was $2.77.

- At year end December 31, 2018, the number of oustanding options (vested + unvested) were 9,894,211 exercisable into 9,894,211 Common Shares, with a weighted average exercise price of $1.71 per share.

- Throughout 2018 EMH granted 10,000,000 warrants, and none in Jan-April 2019

Moreover, more recent data include:

- Between January 1, 2019 and April 30, 2019, a further 5,383,000 Options have been granted with expiry in 2024 and exercise price between $3 and $4.

- The ATM equity program that started on March 27th, 2019 resulted in new shares created by the company. Details available in the next section, but the total number is 4,166,800 new shares between end of March and end of June 2019.

Some take-aways:

- The number of shares that EMH.V is creating is not sustainable. The number was very high in 2018, and is slowing down in 2019. However, the market conditions in the cannabis market start deteriorating in recent weeks as said in Aurora Cannabis Officially Breaks Down as well as in Cannabis Market Breaks Down As High Beta Conditions Improve.

- The options created in the last 12 to 18 months have average exercise prices in the 1.7 to 6.5 range, approx. The average expiry is in 2 to 5 years. This might mean that downward pressure on the stock price because of the high number of options might be spread over time. However, in case the cannabis really breaks down, we might see an accelerated number of options being exercised. So it can go both directions.

Data point 2: Recent at-the-market offering.

The recently announced At The Market (ATM) equity program (March 27th, 2019) is an extension of previous efforts to raise capital through market operations. This specific prospectus looks for an aggregate gross sales price of up to $39M to the public ‘from time to time at the Company’s discretion, at prevailing market prices’. This program runs April 2021.

The detailed number of new shares that were created in recent months is listed below. This information is released at the start of each new month, so these are very recent data points:

- March 2019

43,500 Aggregate Number of Shares Distributed during the Month

$4.0176 Average Sale Price of Shares Distributed during the Month

$170,396.46 Net Proceeds Realized from Sales of Shares during the Month - April 2019

1,019,600 Aggregate Number of Shares Distributed during the Month

$4.2418 Average Sale Price of Shares Distributed during the Month

$4,233,065 Net Proceeds Realized from Sales of Shares during the Month - May 2019

1,502,000 Aggregate Number of Shares Distributed during the Month

$3.6655 Average Sale Price of Shares Distributed during the Month

$5,389,126 Net Proceeds Realized from Sales of Shares during the Month - June 2019

1,601,700 Aggregate Number of Shares Distributed during the Month

$2.9712 Average Sale Price of Shares Distributed during the Month

$4,588,305 Net Proceeds Realized from Sales of Shares during the Month

Some take-aways:

- The company raised already $14,380,892 in some 3 months, until June 30th, 2019. That’s almost half of their target.

- Most likely, this is one of the 2 reasons why the chart breakout in April of 2019 got stopped cold. Th other reason is the massive influx in the precious metals stock market.

- We don’t get insights about the evolution (trend) in which new shares are created until the first week of each new month. This results in some level of unpredictability, pretty tough for investors.

Data point 3: Use of proceeds of capital.

The capital that EMH.V sucks out of the market goes to their balance sheet, largely.

Total assets doubled in one year from $123M (Q1/2018) to $240M (Q1/2019).

This is how they report out on the proceeds of the capital they have been rising in the last 18 months:

- $2.3 million for development of Richmond facility; $4 million equity investments in Pure Sunfarms; $2.75 million to increase ownership of Avalite from 53% to 65%; $5 million for loans subsequently made to Pure Sunfarms to fund development of its production facility; balance for working capital.

- $8 million in loans to Pure Sunfarms to fund development of its production facility; $2 million to increase ownership of Avalite from 65% to 100%; $2 million for development of the Richmond facility; and $6 million for the acquisition cost of Verdélite.

- $10.8 million to substantially complete Richmond and Verdélite facilities.

- $10M in March-May of 2019 from the ATM equity program: The funds are being used to fund completion of the Richmond and Verdélite facilities, and Delta 2 expansion.

Some take-aways:

- There is significant advancements in their plan to establish 4 fully owned facilities, with the exception of Sun Purefarms which is partially owned. Largely the capital looks to be used for expansion and first mover advantages to deliver massive amounts of cannabis in a legal and qualitative way.

- The million dollar question is when their capital operation ends. We have an answer to this question, scroll down to question 1! The summary: early July 2019 all facilities should be up and running and should not require additional capital expenditures. The only expenditures left are for the expansion to the 2nd 1.03 million square feet facility, so anyways no pressing need for continued aggressive shareholder dilution.

- It is not clear how much of the capital is used to feed into the cash burn, see next point. It should become clear in the quarterly earnings report on August 30th, 2019.

Data point 4: Cash burn rate.

In the last 4 quarters EMH.V operated at a cash burn per quarter between $13M and $15M.

In the last 4 quarters cash declined from $55M to $11M on March 31st 2019.

- 09/30/2018

$52.9M cash

136,850,193 common shares outstanding

8,411,764 warrants outstanding - 12/31/2018

$36M cash

141,443,116 basic and diluted shares outstanding - 04/30/2019

143,932,730 shares outstanding of which 4,955,947 held in escrow until May 1, 2019

Cash provided by financing activities for the year ended December 31, 2018 was $83.1M, compared to cash provided of $68.1M in the prior period. Cash generated in 2018 included $60.6M from net proceeds of the prospectus offerings completed in January, February, May and December 2018, $21.9M received from warrant exercises, and $1.2M from stock option exercises.

Some take-aways:

- It will become clear on August 30th, 2019, during the next earnings report, to which extent this company is becoming self sufficient in terms of operating its business. It is one thing to raise capital for initial infrastructure setup, it is another thing to run a business in an economically viable way.

- The company MUST be able to show accelerated revenue and control costs in a way they can stop the cash burn. Is this realistically possible? Yes, but it requires disciplined management and cost control, which is something the company has to prove. More details in question #3 below.

Question 1: How much still left to fund for the 4 facilities?

Good news here, potentially at least. All facilities should be setup and running by now, with no expenditures required for getting the 4 existing facilities to full production.

The only exception for which EMH.V can require additional capital is to fund their 2nd 1.03 million square feet facility (Delta 2) at the same location as the current Pure Sunfarms (PSF) facility (Delta 3).

- PSF Delta 2 Facility => another $60M required in expenses (after spent $1.7M)

- Richmond => $5M expected to complete the facility by end of June 2019 which most likely happened with the $14,3M they raised between April and June of 2019.

- Verdélite => final funding on May 27, 2019, another $1.6M expenses required

- Avalite => funding completed, 100% owner, since August 2018

- PSF Delta 3 Facility => complete

Question 2: What’s the expected value created by their 4 facilities?

This is the million dollar question. How much value, and revenue, will their 4 facilities create? Will this be sufficient to fund the operations of their business, stop the cash burn rate, and slow down significantly the shareholder dilution which is ongoing?

- Pure Sunfarms (Delta 3): sales reach $14.4M in Q1 (Emerald’s 50% share is $7.2M), and the company confirmed it has reached annualized production run-rate of 75,000 kg on July 11th, 2019.

- Verdélite: 88,000 square feet indoor grow facility in Quebec is expected to be in full production by mid-2019 (over 5,000 kg annually).

- Avalite: a 3,742 square foot facility that was already in full production.

- Victoria: EMH.V leases 16,000 square feet of mixed-use space with approx. 500 square feet of cultivation area (there are also laboratory and packaging activities in that facility, as well as the national call center).

- Richmond: constructing 156,000 square foot facility, commenced in May 2017, expected to be complete by June 30, 2019.

- Metro Vancouver, BC: this is a new organic cannabis operation with 12-acre outdoor grow area costing $80,000 per quarter (leasing). The license is effective July 12, 2019, EMH.V believes this facility will deliver one harvest and a portion of the expected full production volume in 2019.

Take-aways:

- Compared to Q1 2019 sales we expect a major boost in Q2 2019 revenues as well as Q3 2019. That’s because in Q1 Pure Sunfarms (by far the largest facility) was not running at full production capacity, nor the smaller Verdélite and Richmond. Also the new Metro Vancouver large facility will start delivering as of now.

- This, by the way, is the potential we saw in EMH.V when we wrote our bullish forecast last year!

- The moment of truth will be there on August 30th, 2019, when EMH.V will publish their earnings report. The increased revenue, combined with cost control, should make this company economically viable.

Question 3: How much will they be able to decrease cash burn in Q2 2019 by cutting operating costs and improving revenue?

They need to grow with a minimum of $4M in Q2/2019 coming from revenue of owned facilities combined with Pure Sunfarms share of income (joint venture).

Is this realistically possible? It is, see the take-aways and details in the previous point!

Only IF the company succeeds in keeping their operating and general costs under control will they be able to stop their cash burn. This should and MUST happen in Q2/2019, that’s why this is such a pivotal moment in the history of this company. What comes out of this obviously translates into shareholder value (or dilution).

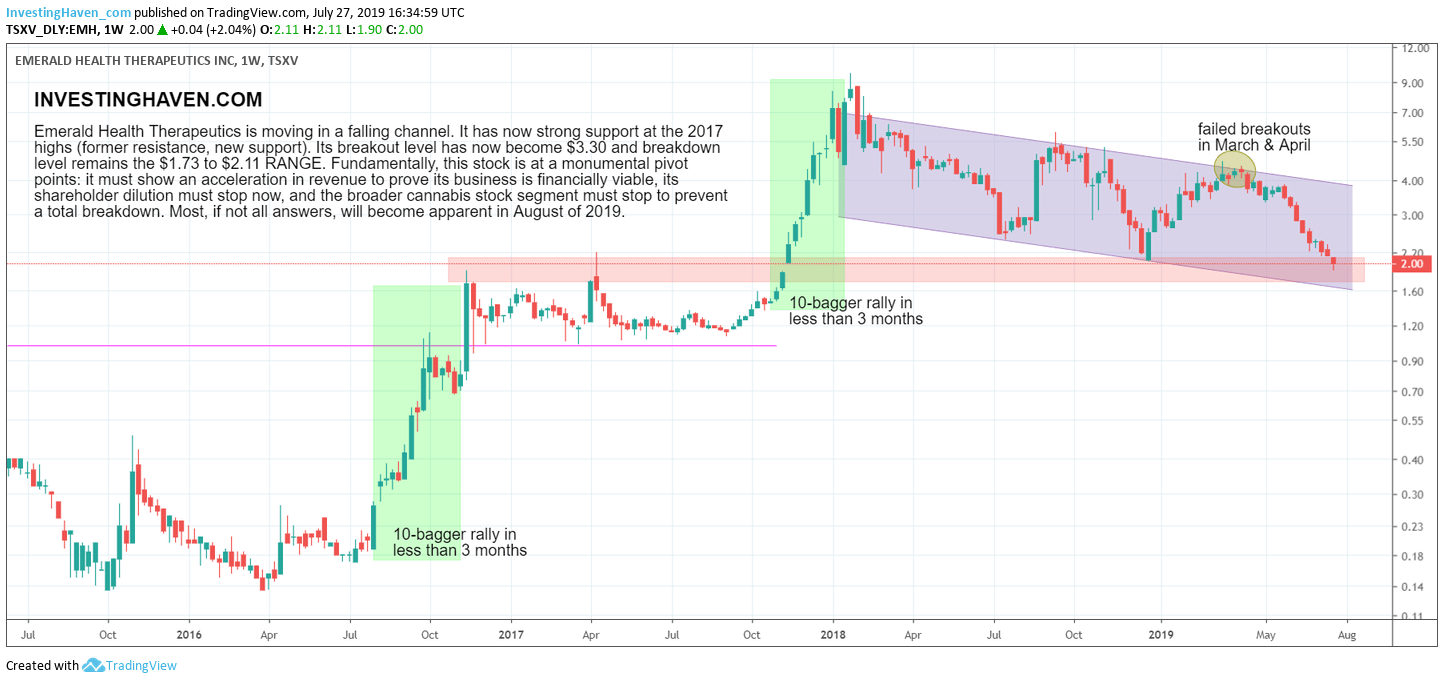

EMH.V Long Term Chart

Emerald Health Therapeutics is moving in a falling channel. It has now strong support at the 2017 highs (former resistance, new support). Its breakout level has now become $3.30 and breakdown level remains the $1.73 to $2.11 RANGE. Fundamentally, this stock is at a monumental pivot points: it must show an acceleration in revenue to prove its business is financially viable, its shareholder dilution must stop now, and the broader cannabis stock segment must stop to prevent a total breakdown. Most, if not all answers, will become apparent in August of 2019.

Conclusions on EMH.V and its attractiveness for investors

Let’s summarize what we see, and we want to see in order to remain bullish on EMH.V. We take a top down approach:

- Broad markets are supportive of high beta stocks as our research suggests we are entering a new ‘risk on’ cycle.

- Cannabis stock market segment got hit for 3 reasons: first capital rotation into precious metals (which is 15x larger than the cannabis sector), second continued shareholder dilution, third disappointing news by some larger cannabis companies.

- EMH.V went far in shareholder dilution but at the same time the data suggest it was a required capital operation because they have now (July 2019) fully funded their 4 facilities. Whatever is left to fund is for a new facility, essentially even more expansion. Their management should understand they MUST slow down now. Moreover, August 30th, 2019 will be a crucial day as we will say how viable their business is: accelerated revenue combined with cost control is the ideal answer we want to read in the data! The potential is there from a revenue perspective, but cost control is something only the company’s management controls!

- Existing institutional shareholders hold lots of shares and options from the different capital raising rounds. Are they long term holders? If yes, they should be supportive for a continuation in the bull market, medium to long term.

So, broad markets are supportive, the outflow to precious metals should stabilize going forward, and the bad news in the sector can be easily avoided by disciplined management decisions (collectively).

In sum we believe management of these companies, in particular EMH.V, hold the key to turn this bearish momentum in cannabis stocks back into a bullish trend.

How this plays out is something that we can impossibly predict. How can we know, upfront, if collective management of these companies will do the right thing? Impossible, we can only monitor how things are going, month-on-month, and interpret the market data against the question whether they are (finally) decelerating shareholder dilution.

In the meantime the long term picture of this sector remains outrageously bullish. In case the sector will collectively continue to decline there will be large investors who will see the undervaluation and get in.

So we are not concerned for the long term.

Short to medium term, in case there is more downside, it may be prudent to get some shares off the table and keep the capital to enter again in case lower price points would present themselves. In case we are near a major bottom you can get in later as well, and sleep well in the meantime.

Is it realistic to expect that EMH.V will reach our ultimate bullish price target of +$30? Obviously, the lower this stock falls the lower the likelihood. We forecasted an improving broad market environment with ‘risk on’. Every time this happened in the past, especially summer 2016 and fall 2017, EMH.V went up 10-fold in less than 3 months. This still is the potential we see, however the whole space must become bullish again and the downtrend must stop. We can only confirm or invalidate a ten-bagger potential in the next few months, depending on how the points outlined above play out!