When it comes to energy investments, two heavyweight contenders, crude oil and uranium, tend to be somehow correlated lately. Beyond their apparent differences, both hold the key to global energy dynamics. Today, we dissect the charts, unraveling the numbers to guide you on the better prospects for 2024‘s energy stocks. We try to answer the question “which energy stocks to buy in 2024,” and compare crude oil with uranium stocks.

We will focus on leading indicators in our analysis. We don’t use but we highlight findings from the crude oil stocks charts and uranium stocks charts. In doing so, we will highlight differences in order to conclude which energy stocks to buy in 2024.

The conclusion is very simple: acknowledging that markets will print new all-time highs in 2024, uranium may be preparing to outperform markets early on in 2024. Pending validation, it’s not a forecast.

As usual, in the public domain we will keep it high level. In our premium service Momentum Investing, we look at the details, primarily of the uranium stocks charts, and provide much more detailed guidance than in our public blogs.

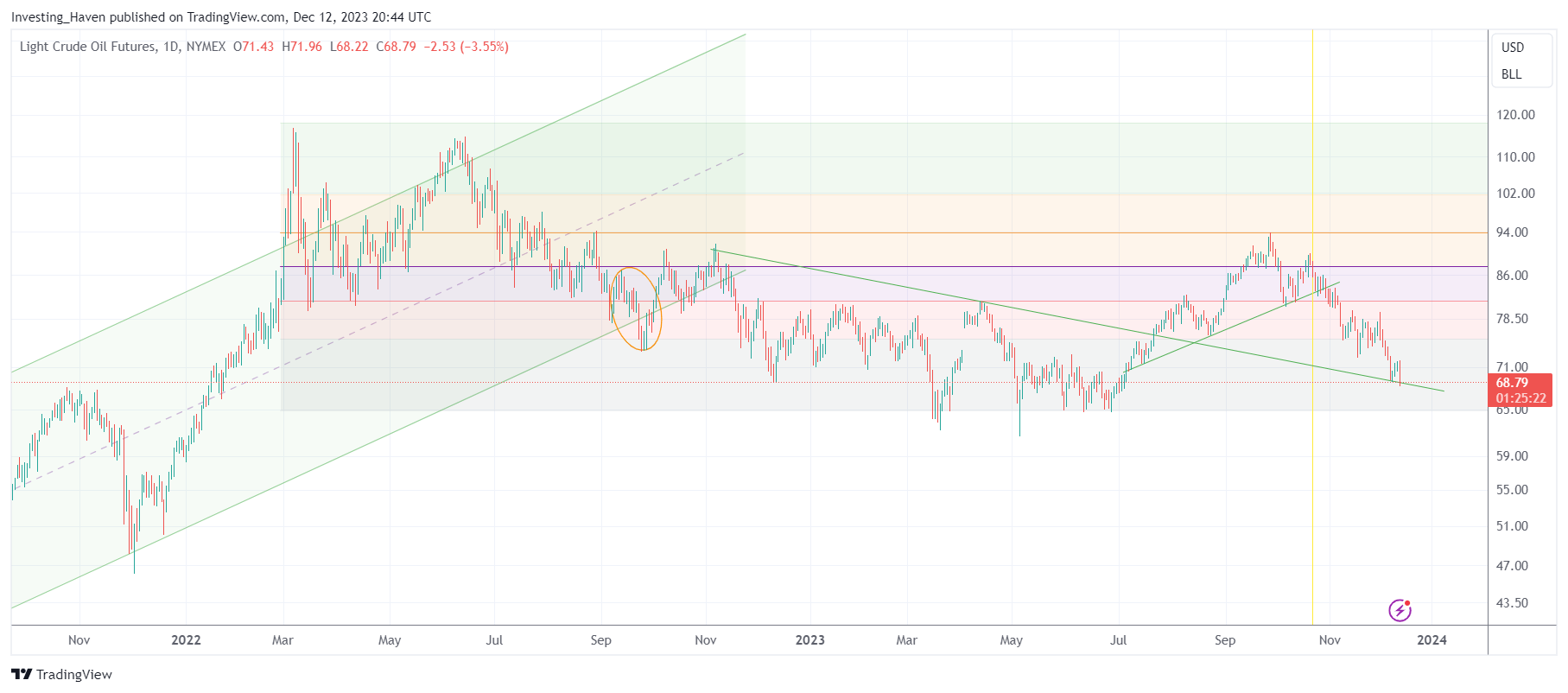

Crude Oil Chart Analysis: It’s a Consolidation

In the realm of crude oil, a 16-month-long consolidation has been unfolding, navigating within a tight range of 65 to 94 USD per barrel. This chart raises questions about its direction, leaving analysts wondering if it’s gearing up for a bullish or bearish turn. The pivotal test is the 92 USD per barrel mark, aligning with the 50% retracement level in the 2022-2023 range (65 to 120 USD per barrel). Presently, signs suggest a potential for a bullish consolidation, but a prudent approach calls for more time and space for the market to reveal its intentions. Notably, energy stocks are closely mirroring the trajectory of crude oil.

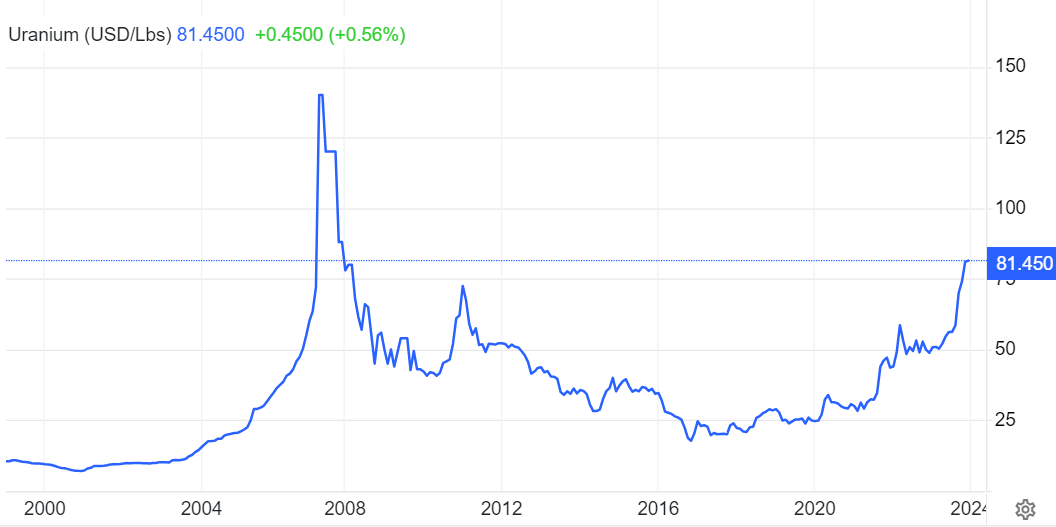

Spot Uranium Chart Analysis: The Unleashed Potential

In stark contrast to oil, the spot uranium chart displays a notably bullish trajectory. A massive reversal on the longest timeframe marked the beginning of a giant breakout as it cleared the 72-74 USD per pound threshold. What’s remarkable here is the absence of immediate resistance, signaling the potential for a 50% surge from the current levels. The caveat is a swift invalidation if spot uranium retreats below 72-74 USD per pound in the next three weeks. The conclusion is clear: uranium is poised for substantial gains. Interestingly, uranium stocks, usually in tandem with spot uranium, show a significant divergence – lagging behind the breakout. One hypothesis suggests they await the broader energy momentum, likely tied to a resurgence in crude oil. Another theory proposes that uranium stocks are gearing up for a grand breakout, patiently biding their time, possibly aligning with the bullish 3-month cycle in early January.

Comparative Analysis: Which Energy Stocks to Buy in 2024?

In this duel between crude oil and uranium, the charts narrate distinct stories. Crude oil hesitates within a consolidation, demanding more evidence of its intent, while uranium stands out with a clear bullish bias and the potential for substantial gains. Energy stocks, traditionally following crude oil’s lead, stand at a crossroads – continue to mimic oil’s tentative dance or catch up to uranium’s bullish sprint.

Conclusion: Navigating Energy Stocks in 2024

As we stand on the cusp of 2024, the energy investment landscape offers a choice. Crude oil whispers promises of a bullish future but requests more time for affirmation. On the other hand, uranium boldly declares its potential, its breakout reverberating through charts. Investors face a decision – tread cautiously with oil or ride the waves of uranium’s ascendancy. The next moves in the energy sector will likely shape the trajectory of portfolios in the coming year.

Note, Momentum Investing members receive detailed guidance on the uranium market, with price and timeline analysis, as well as a top uranium stock selection.