Palladium (PALLADIUM) was in an amazing shape early this year. Our palladium forecast for 2019 was ultra-bullish, and we were looking at a price target of $2500 at the end of this year. However, in March of 2019, palladium broke down, and it violated a critical support level. We flashed a sell alert of palladium at the end of March. Now, 3 months later, we are convinced it was the right thing to do. It is clear that palladium is NOT one of the top 3 opportunities of 2019, and we can focus on other markets for profitable trades.

We want to come back to palladium, not because we believe it is a market worth entering, but just to follow up on our sell alert. We want to ensure we continuously do the right thing, and get the maximum learnings out of each market call.

Moreover, as per our investing tips for long term investors, it is the exit decision that is the toughest call. Entering a market is simple. Exiting a market with optimal returns is much more challenging.

Exiting a market because the outlook is not great is even more important. That’s because if your assessment is not right you will get emotional, and chase prices higher. It becomes a very, very risky thing.

Continuously following up to maximize learnings is the one and only way to gradually move to a maximum of accurate investing decisions.

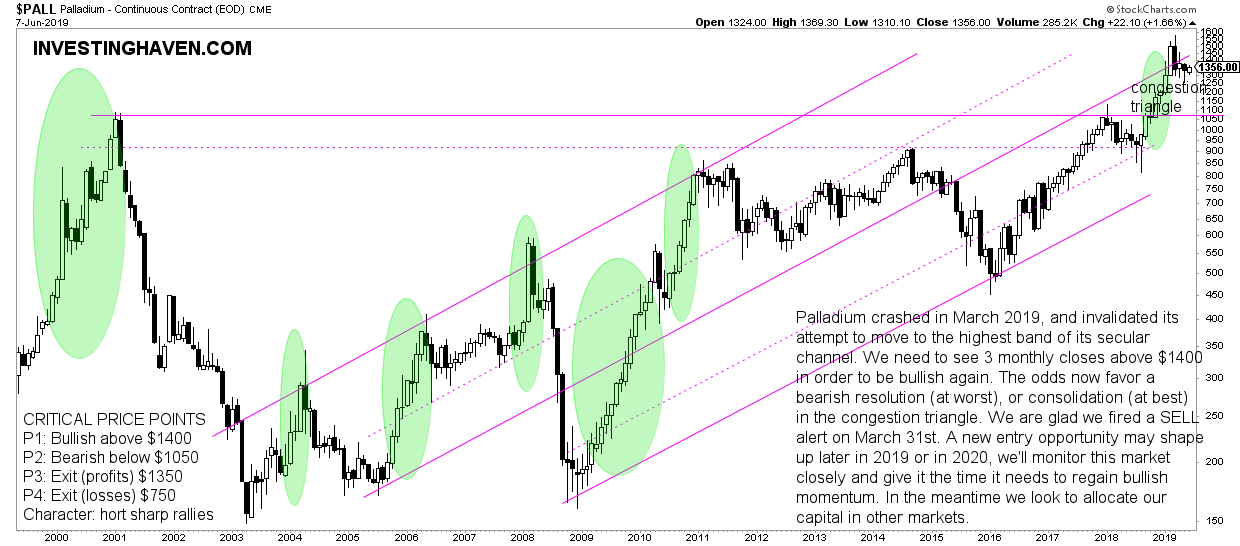

Our ‘exit thesis’ was the violation of the critical support level of the higher band of the rising channel as shown below. Now, after 3 months, we see that palladium’s price indeed intended to get back to the lower rising channel, into the ‘congestion triangle’ indicated on the chart.

This suggests that palladium will be mildly bearish or neutral in the next months, until proven otherwise. The area between $1100 and $1400 is the most likely area in which palladium will trade.

Again, our ‘exit thesis’ seemed to be accurate. We do not undertake any action in the palladium market until there is a sign of life. We might consider an entry at the lower side of the triangle, but it will also depend on how other markets behave and trade. In other words, we will be only interested if the relative opportunity looks good.