By far the most important move in our leading indicators this week was in the Euro as well as in 10 year rates. Both are leading assets, and they are able to drive global markets. They did, and it resulted in strong moves in several segments in global markets. One thing is clear to us: particularly the move in the Euro this week will have lasting effects on commodities in 2020 and beyond, this is why.

We wrote about a major breakout in the Euro two weeks ago: Leading Indicator Euro About To Make A Hugely Important Decision

This is what we wrote:

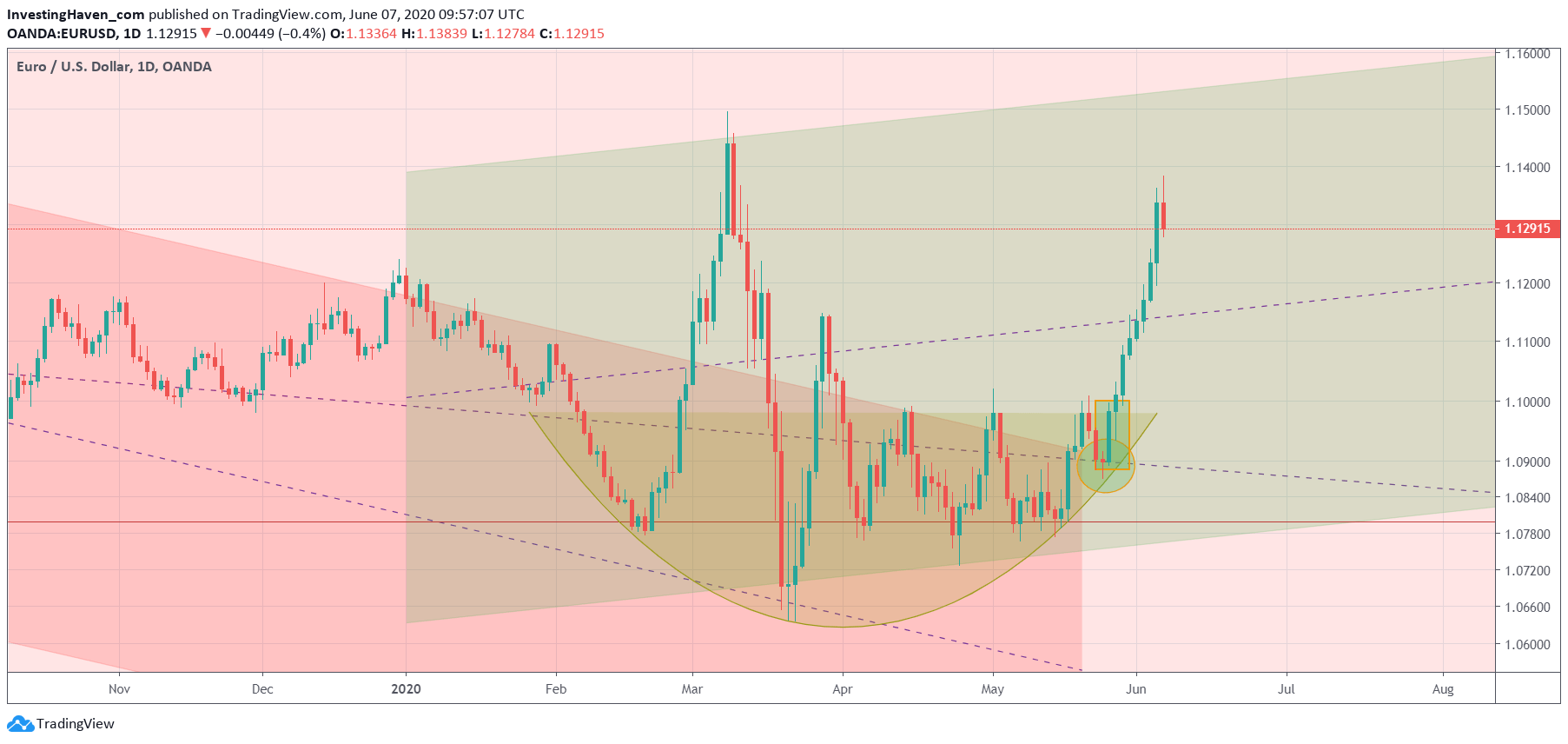

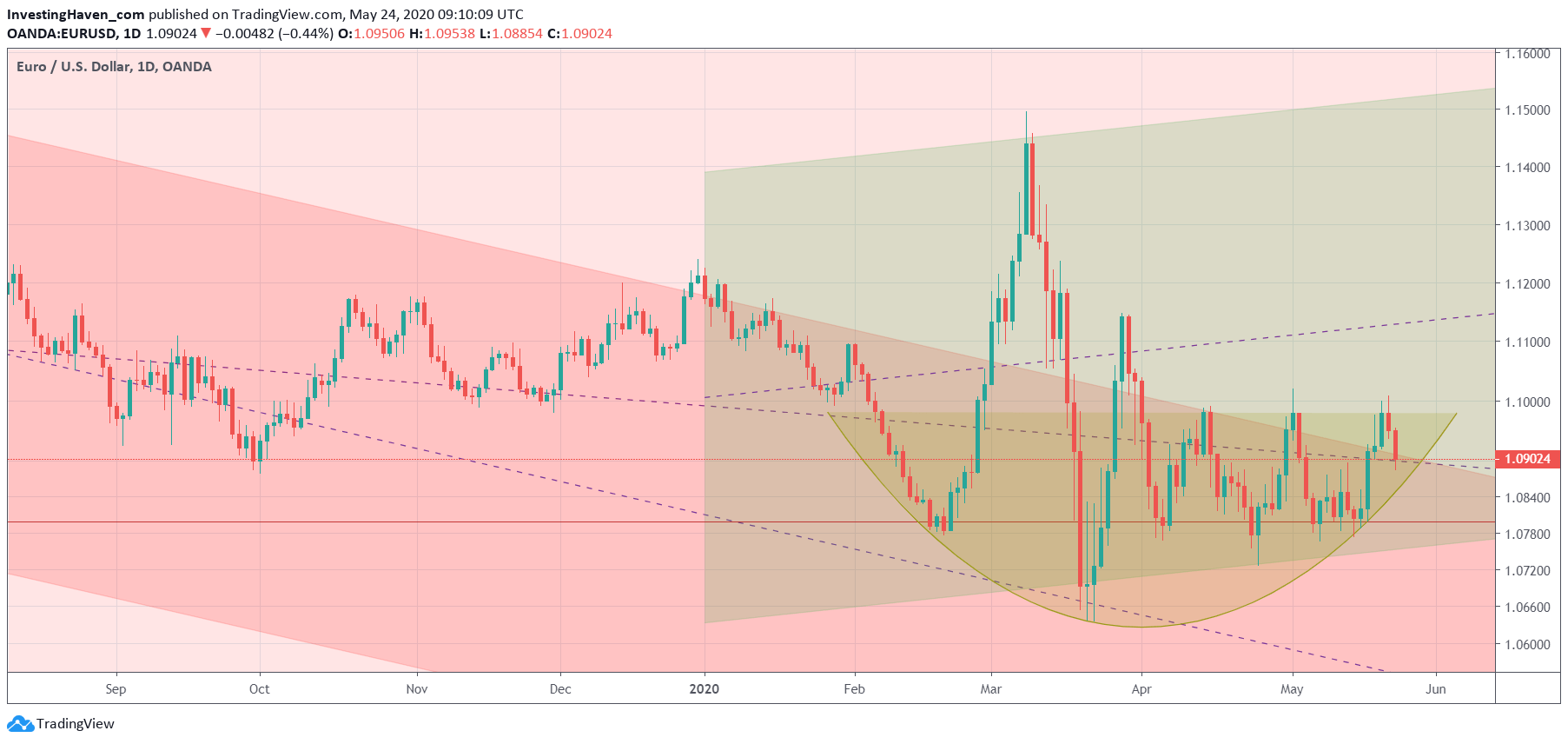

The reversal that started in February of this year, which we indicated in yellow (rounded pattern). This is an equally important pattern as the one explained in the previous point, and is really decisive. Note that the reversal pattern may be close to completion now, and that the last daily candles are all above the 2018/2019 downtrend.

First, let’s review the Euro chart we sent 2 weeks ago. This is the one where we said: decision time, and major impact on global markets particularly risk assets like stocks.

This is the same chart, 2 weeks later.

This is the same chart, 2 weeks later.

In the meantime stocks went up strongly. Any coincidence? No!

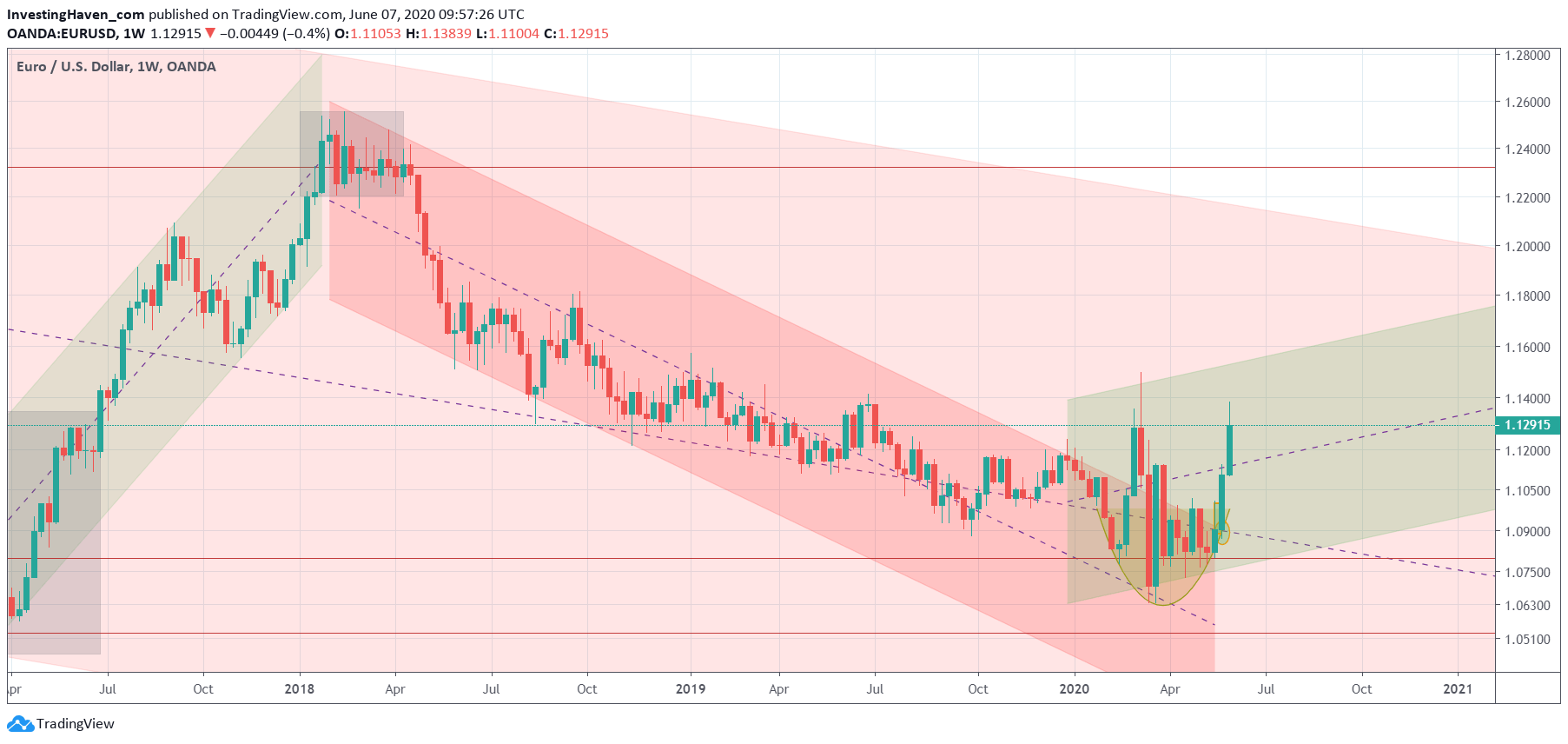

The weekly chart morphed into a strongly bullish chart.

Particularly the last chart, the weekly on 3 years, is the one that is leading for our medium term investments. We stick to our viewpoint we wrote 2 weeks ago:

The most likely path of global markets is that the Euro is going to introduce a new RISK on wave, once the Corona crash aftermath effects start fading. The daily chart confirms this. We need Euro readings above 1.09 to know for sure.

And we add this conclusion:

This bullish Euro trend is happening in the context of a secular downtrend. As long as the Euro remains below 1.20 it remains in a (very) long term downtrend. This means that RISK ON cycles don’t last very long (not more than 1.5 years).

Do you like our analysis?