Inflation expectations is what we care most about, more than the real inflation/deflation readings. Why do we consider inflation expectations to be so important? Because it is a leading indicator, and it carries predictive information for other markets. That’s why it is an essential part of our investing methodology. Interestingly, our inflation expectations indicator is flat, but looking at this very carefully we see a strong bullish bias. This is important, as we can use this information to read other markets and establish an investing thesis to hit the next trend(s).

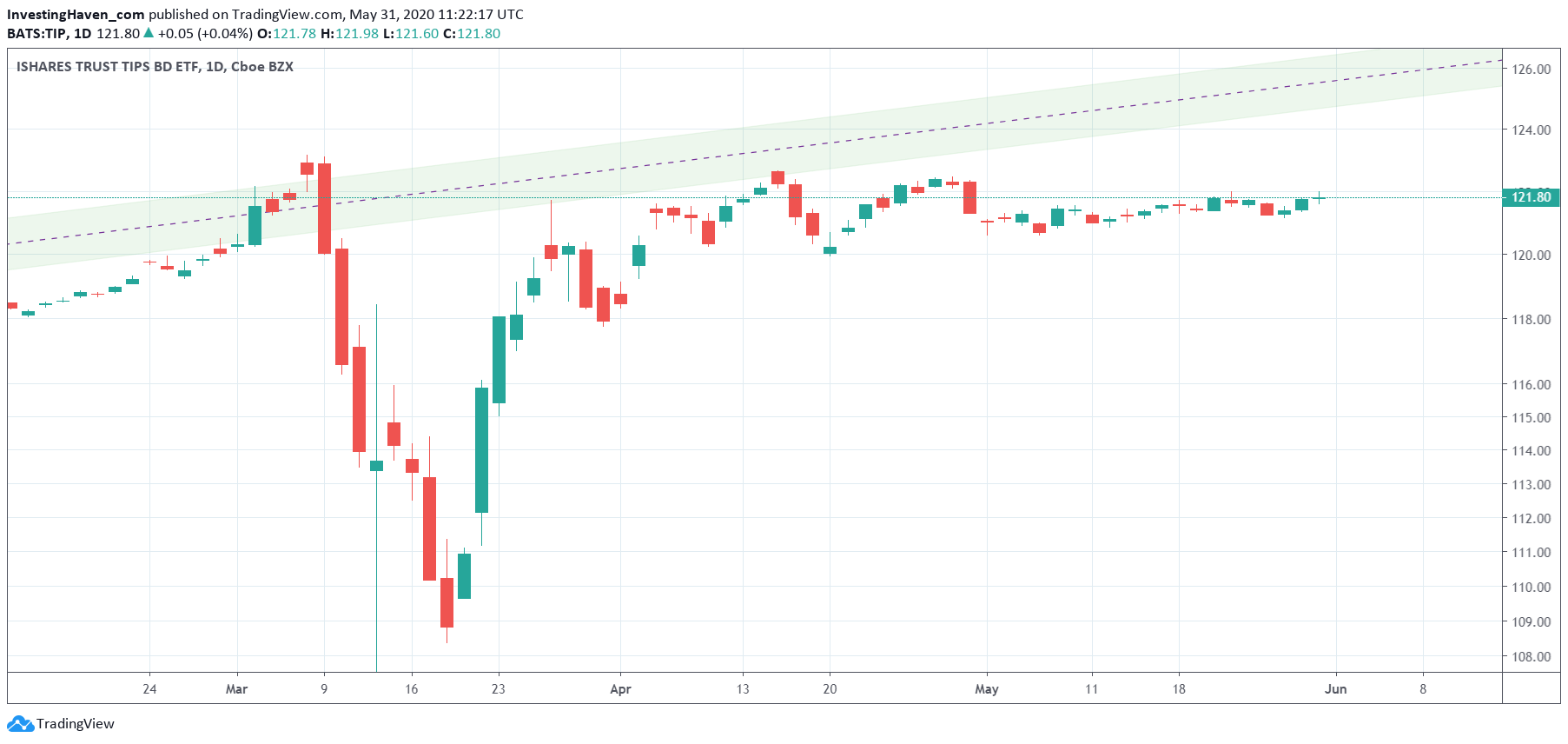

The inflation expectations indicator we use is TIP ETF. Its daily chart is embedded in this article.

In terms of reading charts nowadays it has become pretty challenging with those giant sell off formations in March of 2020 (we would call them the ‘Corona crash patterns’).

Still, if we try to break through this clutter (by adjusting chart patterns) we can get some clarity.

Our inflation expectations chart has what we call a bullish bias. Since mid-April it has set a series of higher lows. More importantly, there is a bullish rounding formation visible in May. Both characteristics are bullish in nature, for sure when combined.

What does this mean, and how can this help us?

Very simple, commodities and crypto markets are the place to be in the short to medium term. Both markets are inflation sensitive. It is a matter of picking the right entry point, as well as the right markets in both the commodities complex as well as the cryptocurrencies complex.