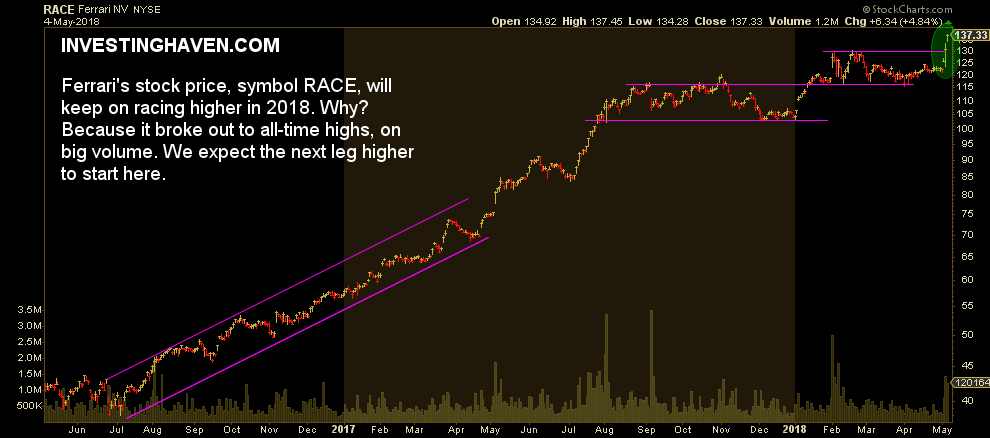

Ferrari’s stock price rose 11 pct this week on earnings. Investors would intuitively look to read news in order to understand whether Ferrari’s stock is a buy in 2018. However, at InvestingHaven, we reverse our approach: first the chart, then the news and only the 1% of the news that really matters. As Ferrari’s chart shows a breakout on big trading volume we believe Ferrari’s stock is a buy in 2018, and it will continue its race higher.

Note that we wrote about Ferrari a year ago when we observed that Ferrari’s Stock Price Doubled In 12 Months. Is the stock about to do the same?

As said, the chart is the first thing to check. The chart of Ferrari, symbol RACE, looks gorgeous. A breakout on big volume after a 9 month consolidation is the ideal setup for higher prices.

Only if the chart looks good do we continue to look for the news that matters. Financial results posted earlier this week were great (see here):

- Q1 profits rose by 19 percent to a record 149 million euros ($178 million).

- Shipments were up 6.2 percent to 2,128 units, with Europe and the Middle East the largest single market with 1,103 units followed by the Americas with 569 units — both showing single-digit improvement.

- Sales in greater China were up 14 percent to 183 units.

- Net revenues grew by just 1 percent, to 831 million euros.

- 2018 forecasts of net revenues of 3.4 billion euros and shipments of above 9,000 units were confirmed by the company.

Ferrari’s cars look gorgeous, its chart and finacials are as gorgeous. A buy in 2018.