The uranium market is quite exciting for investors at this point in time. We covered this market extensively in recent weeks. InvestingHaven’s research team was among the first to signal a very bullish sign in uranium miners. Last week, it was clear that uranium miners were breaking out.

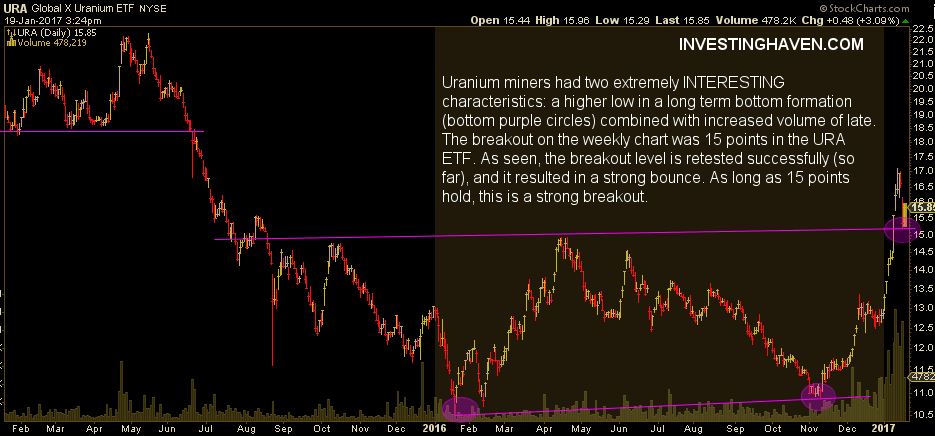

Things can go very fast in the uranium market as it is characterized by a very high level of volatility. Just one week after the breakout in uranium miners, a retest of the breakout level was took place today. In particular, the uranium mining ETF URA retraced till the 15.25 level, which coincides with the former resistance points (see purple horizontal line at 15 points on below chart).

According to InvestingHaven’s research team, investors should watch closely what happens around 15 points. If URA ETF remains above that level in the coming days, lots of buying interest will enter the uranium market.

Investors have already shown buying interest as evidenced by the significant trading volume in the past six weeks. Watch on the chart how trading volume went up sharply (dark green bars above the time axis).

Year-to-date, the URA ETF is up 10 percent. It peaked last week at 17 points, which was almost 20 percent higher compared to the start of the year.

2017 could bring much higher prices in the uranium mining segment only if current price levels stand firm, and if buying interest remains strong.